NFLX Trading Predictions

1 Day Prediction

Target: April 17, 2025$970

$972

$980

$960

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near 50, suggesting a potential upward move. However, MACD is flattening, indicating possible resistance ahead.

Analysis

Over the past 3 months, NFLX has shown a bearish trend with significant fluctuations. Key support is around 855, while resistance is near 980. Volume spikes were noted during price drops, indicating selling pressure. The overall sentiment is cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the price. A bearish reversal is possible if the price fails to break above recent highs.

1 Week Prediction

Target: April 24, 2025$965

$970

$975

$950

Description

The stock is expected to consolidate around current levels. The Bollinger Bands are tightening, indicating reduced volatility. A bearish divergence in RSI suggests potential downward pressure.

Analysis

NFLX has experienced a volatile period with a recent drop from highs. Support at 950 is critical, while resistance at 980 remains strong. The overall trend is bearish, with potential for sideways movement in the coming week.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to significant price changes. The market sentiment remains mixed.

1 Month Prediction

Target: May 16, 2025$940

$950

$955

$925

Description

Expect a continued bearish trend as the stock approaches key support levels. The MACD indicates a bearish crossover, and the RSI is trending downwards, suggesting further declines.

Analysis

The past three months have shown a bearish trend with significant selling pressure. Key support at 925 is critical, while resistance remains at 980. Volume analysis indicates increased selling activity, suggesting caution.

Confidence Level

Potential Risks

Market sentiment could shift with new developments, and earnings reports may lead to unexpected volatility. The potential for a bounce off support exists.

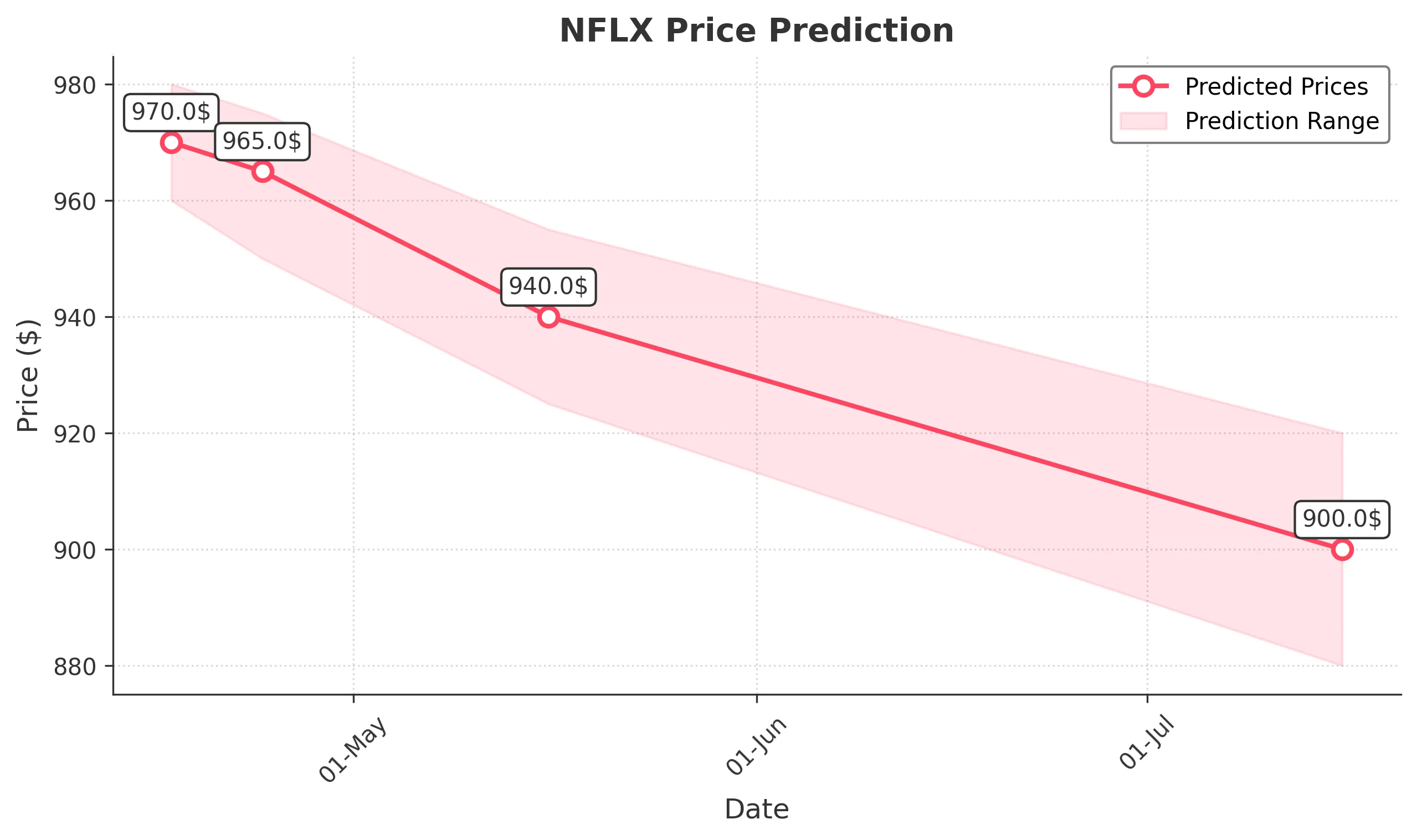

3 Months Prediction

Target: July 16, 2025$900

$910

$920

$880

Description

Long-term bearish sentiment persists, with potential for further declines as macroeconomic factors weigh on the stock. The ATR indicates increasing volatility, suggesting larger price swings.

Analysis

NFLX has faced significant challenges over the past three months, with a clear bearish trend. Key support at 880 is crucial, while resistance at 950 remains. The overall market sentiment is cautious, with potential for further declines.

Confidence Level

Potential Risks

Economic conditions and competitive pressures could lead to unexpected price movements. A recovery is possible if the stock finds support at lower levels.