NFLX Trading Predictions

1 Day Prediction

Target: April 18, 2025$960

$958

$970

$950

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is around 55, suggesting room for upward movement. However, MACD is flattening, indicating potential resistance ahead.

Analysis

Over the past 3 months, NFLX has shown a bullish trend with significant resistance around 970. Recent volume spikes indicate strong interest, but the stock has faced pullbacks. Technical indicators suggest a potential consolidation phase.

Confidence Level

Potential Risks

Market volatility and external news could impact the price. A sudden downturn in sentiment could lead to a drop.

1 Week Prediction

Target: April 25, 2025$965

$960

$975

$940

Description

The stock is expected to consolidate around current levels with potential upward movement. The Bollinger Bands are tightening, indicating reduced volatility. However, a bearish divergence in MACD could signal a reversal.

Analysis

NFLX has been trading in a range with key support at 940 and resistance at 970. The RSI is neutral, indicating a lack of strong momentum. Volume patterns suggest cautious trading, with potential for both upward and downward moves.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to volatility. The market sentiment remains mixed.

1 Month Prediction

Target: May 25, 2025$950

$965

$980

$920

Description

Expect a slight decline as the stock approaches resistance levels. The Fibonacci retracement suggests a pullback to 950. The RSI is nearing overbought territory, indicating potential selling pressure.

Analysis

The stock has shown a bullish trend but is facing resistance. Key support at 920 is critical. Technical indicators suggest a potential pullback, while volume analysis indicates a cautious approach from investors.

Confidence Level

Potential Risks

Market sentiment could shift rapidly, and earnings reports may influence the stock's direction significantly.

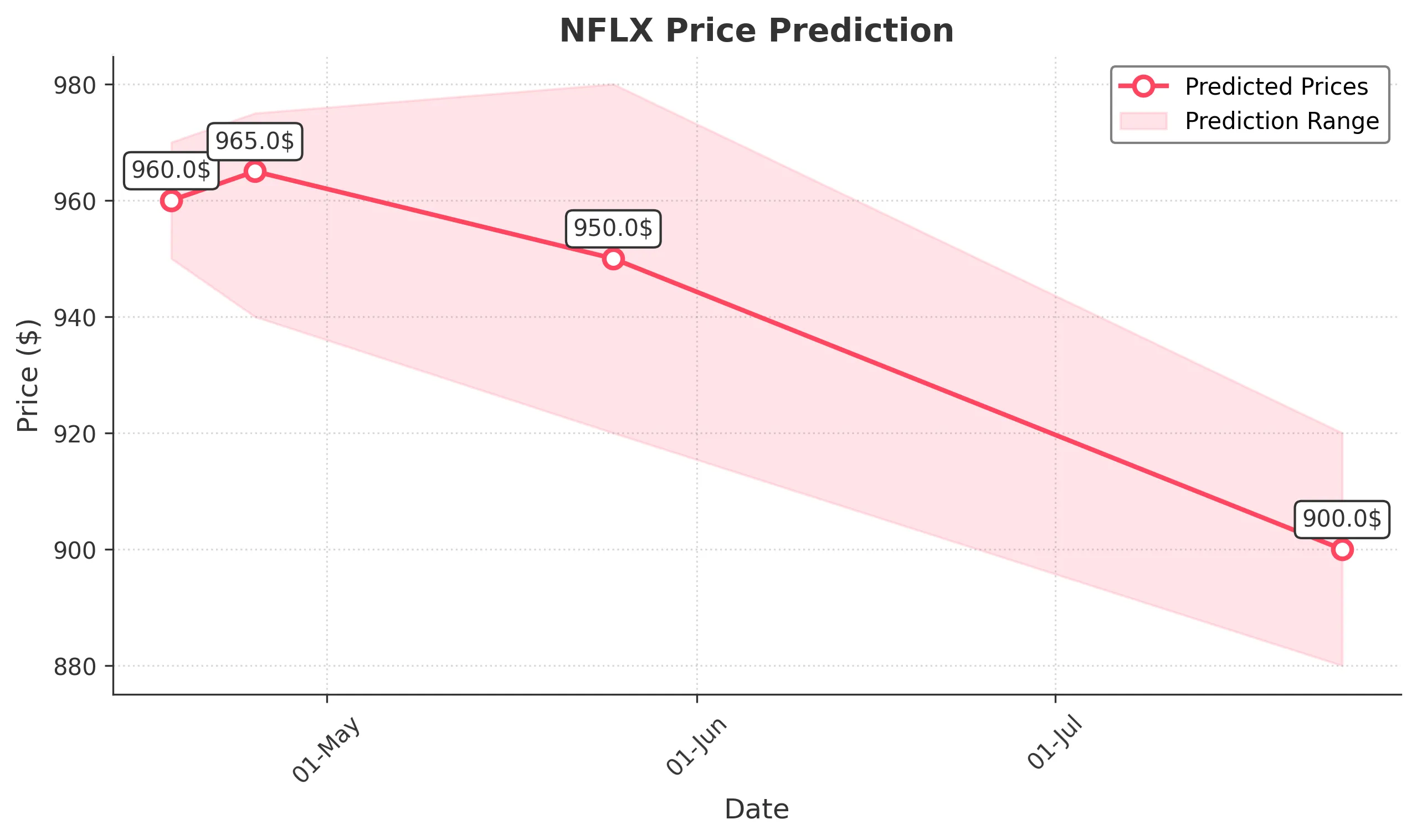

3 Months Prediction

Target: July 25, 2025$900

$910

$920

$880

Description

A bearish outlook is anticipated as the stock may face significant resistance. The MACD shows a bearish crossover, and the RSI indicates overbought conditions. A correction towards 900 is likely.

Analysis

NFLX has experienced fluctuations with a recent bearish trend. Key support at 880 is crucial. The stock's performance is influenced by broader market conditions and competitive landscape, leading to uncertainty in future price movements.

Confidence Level

Potential Risks

Economic conditions and competitive pressures could lead to further declines. Market sentiment is volatile, and external factors may heavily influence the stock.