NFLX Trading Predictions

1 Day Prediction

Target: May 2, 2025$1125

$1120

$1135

$1110

Description

The stock shows bullish momentum with a recent upward trend. The RSI is nearing overbought levels, indicating potential for a pullback. However, strong support at 1110 suggests limited downside. Expect a slight increase in price.

Analysis

NFLX has shown a strong bullish trend over the past three months, with significant upward movements. Key support is at 1100, while resistance is around 1135. Volume has been increasing, indicating strong buying interest.

Confidence Level

Potential Risks

Potential market volatility and profit-taking could impact the price.

1 Week Prediction

Target: May 9, 2025$1130

$1125

$1140

$1105

Description

The bullish trend is expected to continue, supported by strong earnings sentiment. However, the RSI indicates overbought conditions, suggesting a possible pullback. Watch for resistance at 1140.

Analysis

The stock has been on a bullish run, with recent highs indicating strong investor confidence. Key resistance levels are at 1140, while support remains at 1105. Volume trends suggest sustained interest.

Confidence Level

Potential Risks

Market corrections or negative news could lead to a price drop.

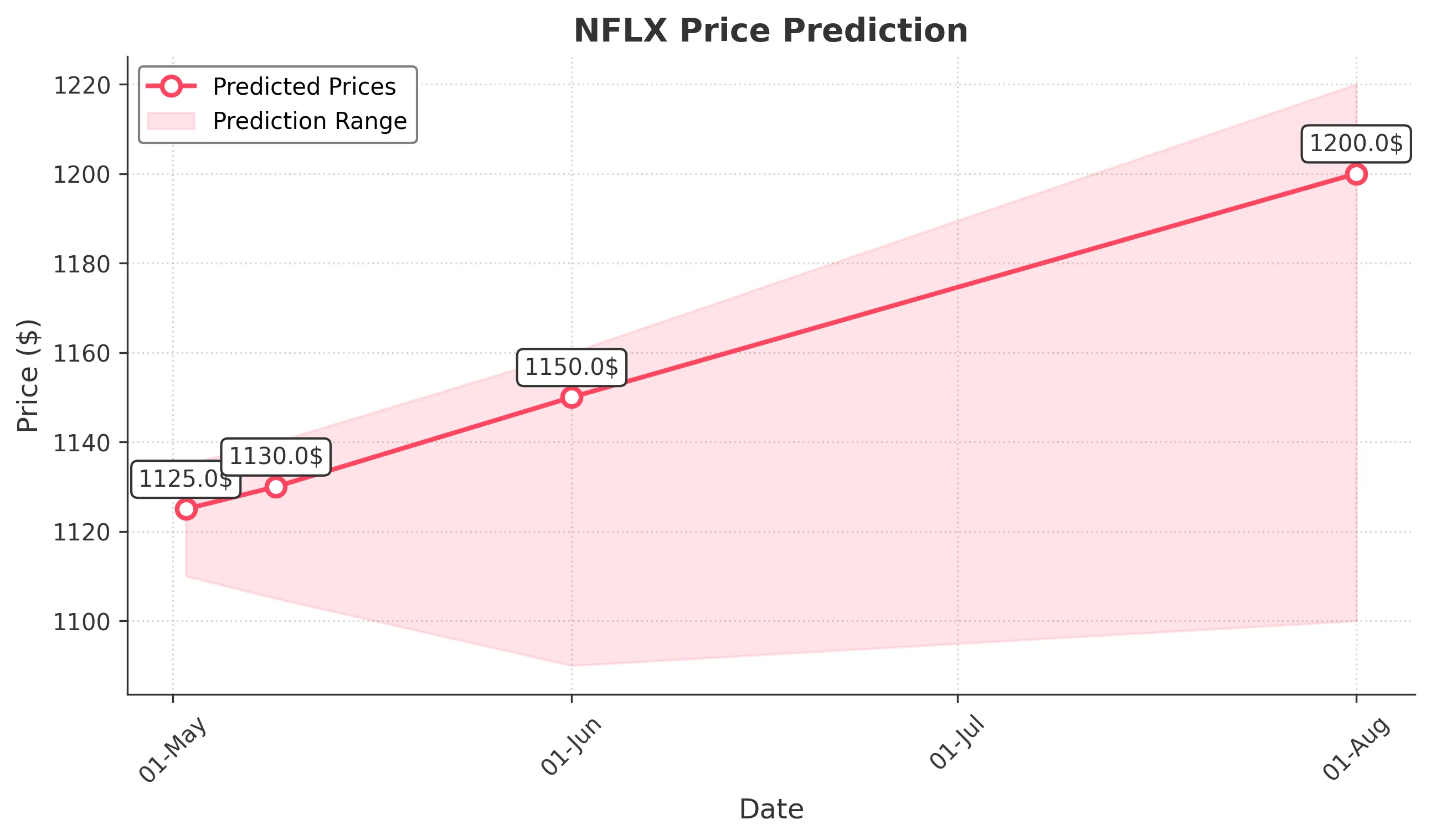

1 Month Prediction

Target: June 1, 2025$1150

$1135

$1160

$1090

Description

Expect continued bullish momentum driven by positive market sentiment and strong earnings. However, the stock may face resistance at 1160. A pullback could occur if the RSI remains overbought.

Analysis

NFLX has shown a strong upward trend, with significant support at 1100. The stock's performance is bolstered by positive market sentiment, but overbought conditions could lead to volatility.

Confidence Level

Potential Risks

Economic factors or earnings misses could negatively impact the stock.

3 Months Prediction

Target: August 1, 2025$1200

$1150

$1220

$1100

Description

Long-term bullish outlook supported by strong fundamentals and market trends. However, potential economic downturns or competitive pressures could impact growth. Watch for key resistance at 1220.

Analysis

Over the past three months, NFLX has shown a strong bullish trend, with key support at 1100 and resistance at 1220. While the outlook remains positive, external economic factors could introduce volatility.

Confidence Level

Potential Risks

Market corrections or changes in consumer behavior could lead to price declines.