NFLX Trading Predictions

1 Day Prediction

Target: May 6, 2025$1120

$1115

$1135

$1105

Description

The stock shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 1120.

Analysis

NFLX has shown a bullish trend over the past three months, reaching highs above 1100. However, recent price action indicates a potential reversal with lower highs and increased volatility. Key support at 1100 and resistance at 1150.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish sentiment could push prices higher.

1 Week Prediction

Target: May 13, 2025$1110

$1115

$1130

$1090

Description

Expect a slight decline as the stock faces resistance around 1130. The MACD shows bearish divergence, and the ATR indicates increasing volatility. A close around 1110 is likely.

Analysis

The stock has been in a consolidation phase, with key support at 1100. Technical indicators suggest a potential pullback, but overall sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to significant price changes.

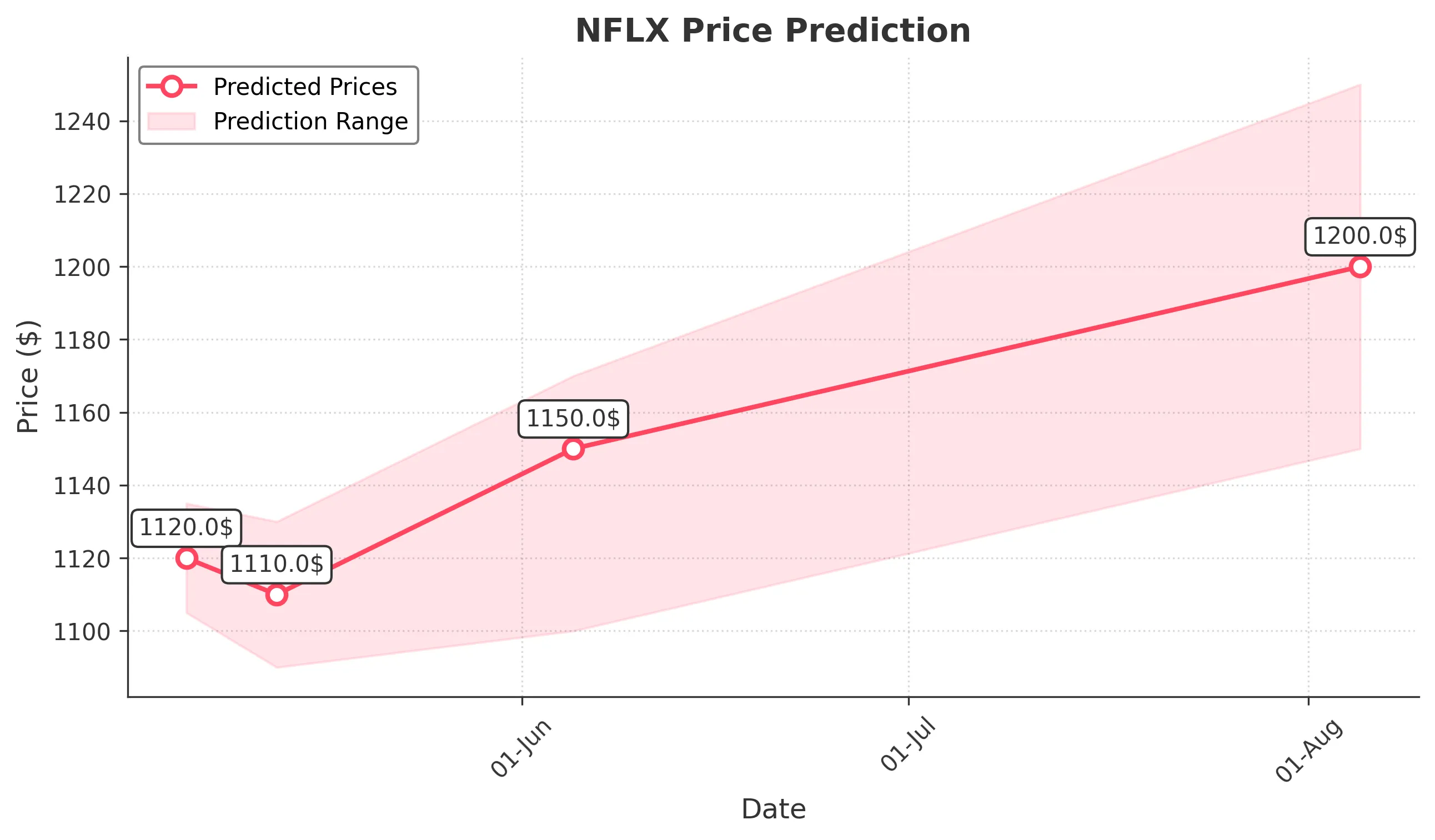

1 Month Prediction

Target: June 5, 2025$1150

$1120

$1170

$1100

Description

A recovery is anticipated as the stock may find support at 1100. Positive earnings reports could drive prices higher, with a target close of 1150. Watch for bullish candlestick patterns.

Analysis

NFLX has shown resilience with a strong upward trend. Key support at 1100 and resistance at 1170. The RSI is approaching neutral, indicating potential for upward movement.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and any negative news could derail the bullish outlook.

3 Months Prediction

Target: August 5, 2025$1200

$1180

$1250

$1150

Description

Long-term bullish sentiment supported by strong fundamentals and market recovery. Anticipate a close around 1200, with potential for higher highs if momentum continues.

Analysis

The stock has been on a bullish trajectory, with significant support at 1150. Technical indicators suggest continued upward momentum, but external factors could introduce volatility.

Confidence Level

Potential Risks

Economic conditions and competitive pressures could impact growth. Watch for changes in subscriber growth metrics.