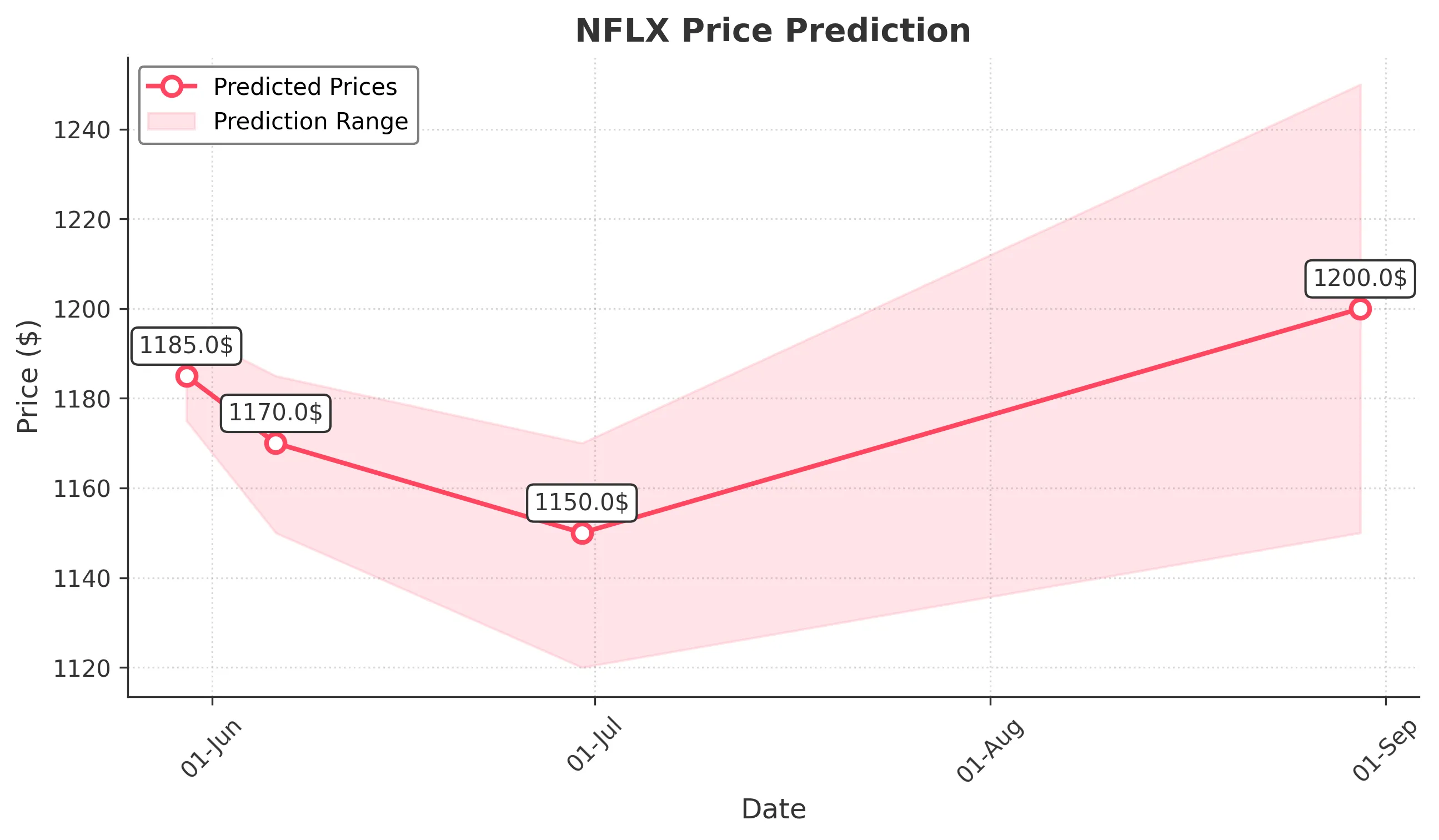

NFLX Trading Predictions

1 Day Prediction

Target: May 30, 2025$1185

$1180

$1195

$1175

Description

The stock shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 1185.

Analysis

NFLX has shown a bullish trend over the past three months, reaching highs above 1200. However, recent price action indicates a potential reversal with lower highs and increased volatility. Key support at 1175 and resistance at 1200.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to external news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: June 6, 2025$1170

$1175

$1185

$1150

Description

Expect continued bearish pressure as the stock approaches key support levels. The MACD shows a bearish crossover, and the ATR indicates increasing volatility. A close around 1170 is likely.

Analysis

The stock has been in a consolidation phase, with significant resistance at 1200. Recent candlestick patterns suggest indecision, and volume trends indicate a lack of strong buying interest. Watch for support at 1150.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings surprises could lead to significant price fluctuations.

1 Month Prediction

Target: June 30, 2025$1150

$1160

$1170

$1120

Description

The bearish trend may continue as the stock approaches critical support levels. RSI indicates oversold conditions, but a rebound is possible. Expect a close around 1150.

Analysis

NFLX has faced selling pressure, with key support at 1150. The stock's performance has been influenced by broader market trends and sentiment. Watch for potential rebounds if support holds.

Confidence Level

Potential Risks

Market volatility and external factors could lead to unexpected price movements.

3 Months Prediction

Target: August 30, 2025$1200

$1180

$1250

$1150

Description

If the stock can hold above key support levels, a recovery towards 1200 is possible. Positive earnings or market sentiment could drive prices higher. Expect volatility.

Analysis

The stock has shown resilience, with potential for recovery if it can break above resistance levels. Key support at 1150 and resistance at 1250 will be crucial in determining the future trend.

Confidence Level

Potential Risks

Long-term predictions are subject to market changes and economic conditions that could impact performance.