NFLX Trading Predictions

1 Day Prediction

Target: June 1, 2025$1205

$1200

$1215

$1190

Description

The stock shows bullish momentum with a recent upward trend. The RSI is nearing overbought levels, indicating potential for a pullback. However, strong support at $1190 and resistance at $1215 suggest a stable close around $1205.

Analysis

NFLX has shown a bullish trend over the past three months, with significant support at $1190 and resistance at $1215. The recent price action indicates strong buying interest, but the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Potential market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: June 8, 2025$1210

$1205

$1220

$1185

Description

The stock is expected to maintain its bullish trend, with a slight pullback possible. The MACD indicates upward momentum, while the Bollinger Bands suggest a potential breakout. Watch for volume spikes for confirmation.

Analysis

Over the past three months, NFLX has experienced a strong upward trend, with key support at $1190. The MACD and moving averages indicate bullish momentum, but caution is warranted as the stock approaches resistance levels.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and any negative news could reverse the trend.

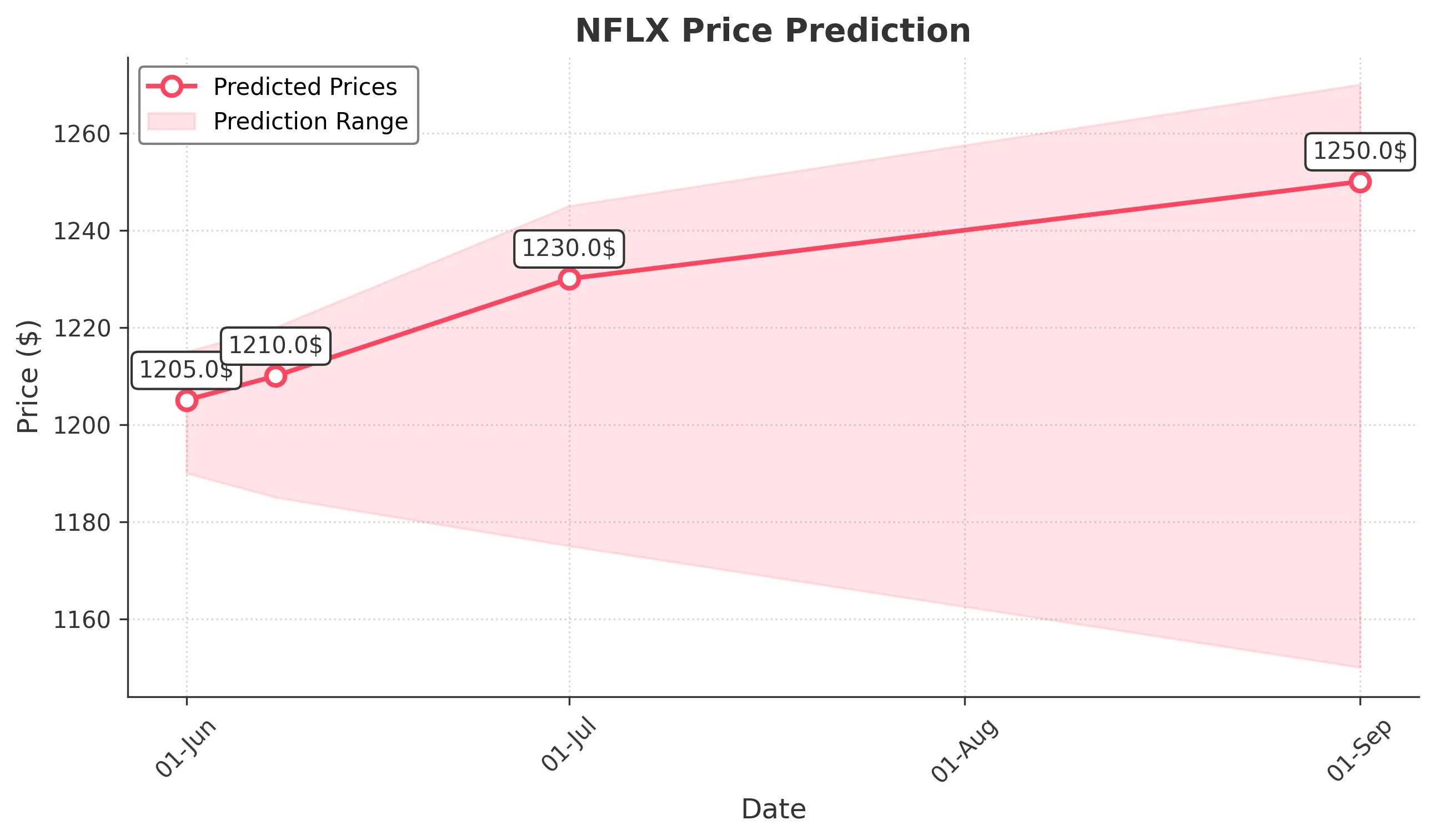

1 Month Prediction

Target: July 1, 2025$1230

$1210

$1245

$1175

Description

Expect continued bullish momentum, with potential for a breakout above $1220. The Fibonacci retracement levels support this upward movement, but watch for any bearish divergence in the RSI.

Analysis

NFLX has shown a strong bullish trend, with significant support at $1190. The stock is approaching key Fibonacci levels, indicating potential for further gains. However, external economic factors could impact performance.

Confidence Level

Potential Risks

Economic indicators and earnings reports could introduce volatility.

3 Months Prediction

Target: September 1, 2025$1250

$1230

$1270

$1150

Description

Long-term bullish outlook with potential for price consolidation. The stock may face resistance around $1270, but strong fundamentals and market sentiment support growth. Monitor for any signs of reversal.

Analysis

Over the last three months, NFLX has shown a strong upward trend, but potential resistance at $1270 could lead to consolidation. The stock's performance will depend on broader market conditions and company fundamentals.

Confidence Level

Potential Risks

Market conditions and competitive pressures could affect growth prospects.