NFLX Trading Predictions

1 Day Prediction

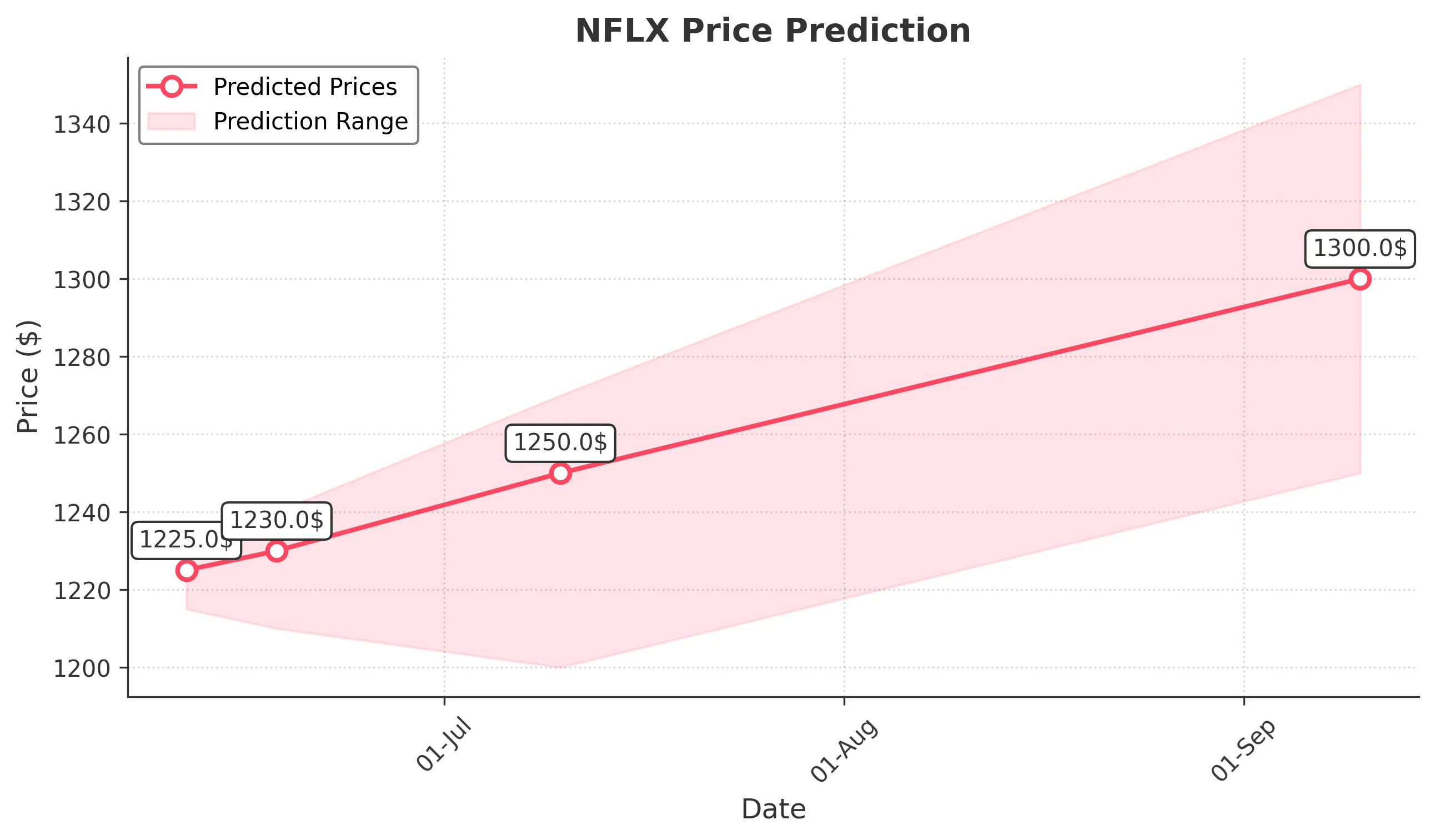

Target: June 11, 2025$1225

$1224

$1235

$1215

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, volatility remains a concern.

Analysis

Over the past 3 months, NFLX has shown a bullish trend, reaching new highs. Key support is around 1200, while resistance is near 1250. The RSI indicates overbought conditions, and volume has been decreasing, suggesting potential consolidation.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the stock's performance.

1 Week Prediction

Target: June 18, 2025$1230

$1225

$1240

$1210

Description

The stock is expected to consolidate around current levels with minor fluctuations. The Bollinger Bands are tightening, indicating reduced volatility. A potential pullback could occur if the RSI remains high, suggesting overbought conditions.

Analysis

NFLX has been on an upward trajectory, but recent price action shows signs of exhaustion. The MACD is flattening, and volume patterns indicate a potential slowdown. Key support at 1200 remains critical for maintaining the bullish trend.

Confidence Level

Potential Risks

External factors such as economic data releases or competitor performance could lead to unexpected price movements.

1 Month Prediction

Target: July 10, 2025$1250

$1230

$1270

$1200

Description

Expect a gradual increase in price as the stock breaks through resistance levels. The Fibonacci retracement levels suggest a target near 1250. However, the RSI indicates potential overbought conditions, which could lead to a pullback.

Analysis

The stock has shown strong performance, with significant upward movement. Key resistance at 1250 is crucial, and a break above could lead to further gains. However, the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Market volatility and external economic factors could impact the stock's ability to maintain upward momentum.

3 Months Prediction

Target: September 10, 2025$1300

$1260

$1350

$1250

Description

Long-term bullish sentiment is expected as the stock continues to gain traction. The MACD indicates a strong upward trend, and the overall market sentiment remains positive. However, watch for potential corrections as the stock approaches higher levels.

Analysis

NFLX has maintained a bullish trend over the past three months, with significant price increases. Key support at 1250 and resistance at 1350 are critical levels to monitor. The overall market sentiment remains positive, but caution is advised due to potential overbought conditions.

Confidence Level

Potential Risks

Unforeseen market events or changes in consumer behavior could lead to volatility and affect the stock's performance.