NFLX Trading Predictions

1 Day Prediction

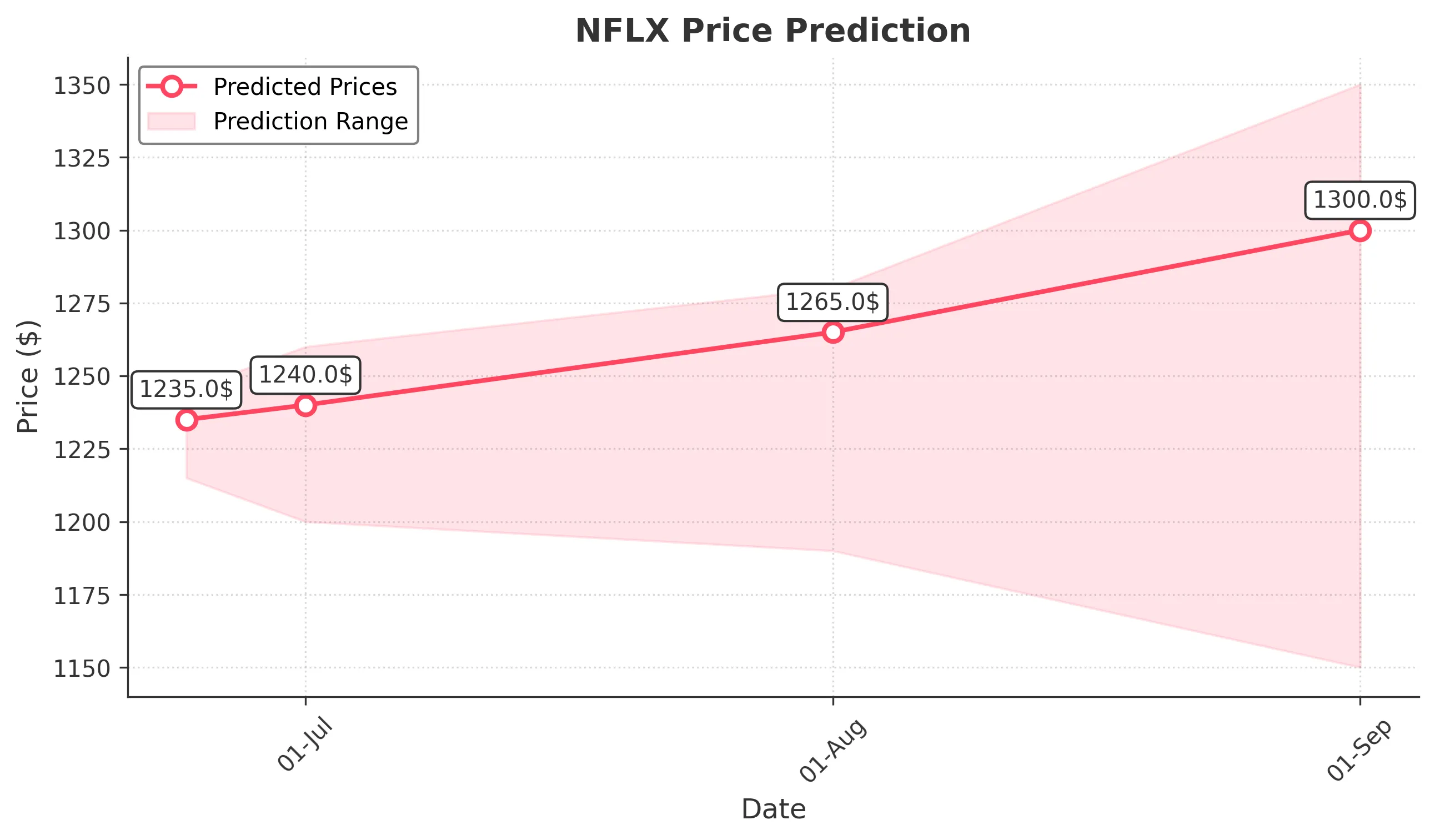

Target: June 24, 2025$1235

$1230

$1245

$1215

Description

The stock shows a bullish trend with a recent close above the 20-day moving average. RSI indicates overbought conditions, suggesting a potential pullback. However, strong support at 1215 may hold, leading to a slight upward movement.

Analysis

NFLX has shown a bullish trend over the past three months, with significant resistance at 1245. The recent price action indicates a consolidation phase, with volume patterns suggesting increased interest. The RSI is nearing overbought territory, indicating caution.

Confidence Level

Potential Risks

Potential volatility due to market sentiment and external news could impact the prediction.

1 Week Prediction

Target: July 1, 2025$1240

$1235

$1260

$1200

Description

The stock is expected to maintain its upward trajectory, supported by strong buying volume. However, the MACD shows signs of divergence, indicating potential weakness. A pullback to the 1215 support level is possible before further gains.

Analysis

Over the past three months, NFLX has experienced a bullish trend, with key support at 1215. The MACD is showing signs of potential reversal, while the Bollinger Bands indicate tightening, suggesting a possible breakout or breakdown.

Confidence Level

Potential Risks

Market volatility and macroeconomic factors could lead to unexpected price movements.

1 Month Prediction

Target: August 1, 2025$1265

$1240

$1280

$1190

Description

The stock is likely to continue its upward trend, driven by positive market sentiment and strong earnings reports. However, the RSI indicates overbought conditions, suggesting a potential correction before reaching new highs.

Analysis

NFLX has shown consistent bullish momentum, with significant resistance at 1280. The volume has been increasing, indicating strong interest. The RSI is approaching overbought levels, which may lead to a short-term pullback before further gains.

Confidence Level

Potential Risks

Earnings surprises or negative news could lead to significant price adjustments.

3 Months Prediction

Target: September 1, 2025$1300

$1265

$1350

$1150

Description

The stock is expected to reach new highs, supported by strong fundamentals and market trends. However, potential macroeconomic headwinds could create volatility. A correction to the 1150 support level is possible before the rally resumes.

Analysis

NFLX has maintained a bullish trend, with key support at 1150. The stock's performance has been strong, but external factors such as economic conditions and competition could pose risks. The overall sentiment remains positive, but caution is warranted.

Confidence Level

Potential Risks

Economic downturns or changes in consumer behavior could negatively impact performance.