NFLX Trading Predictions

1 Day Prediction

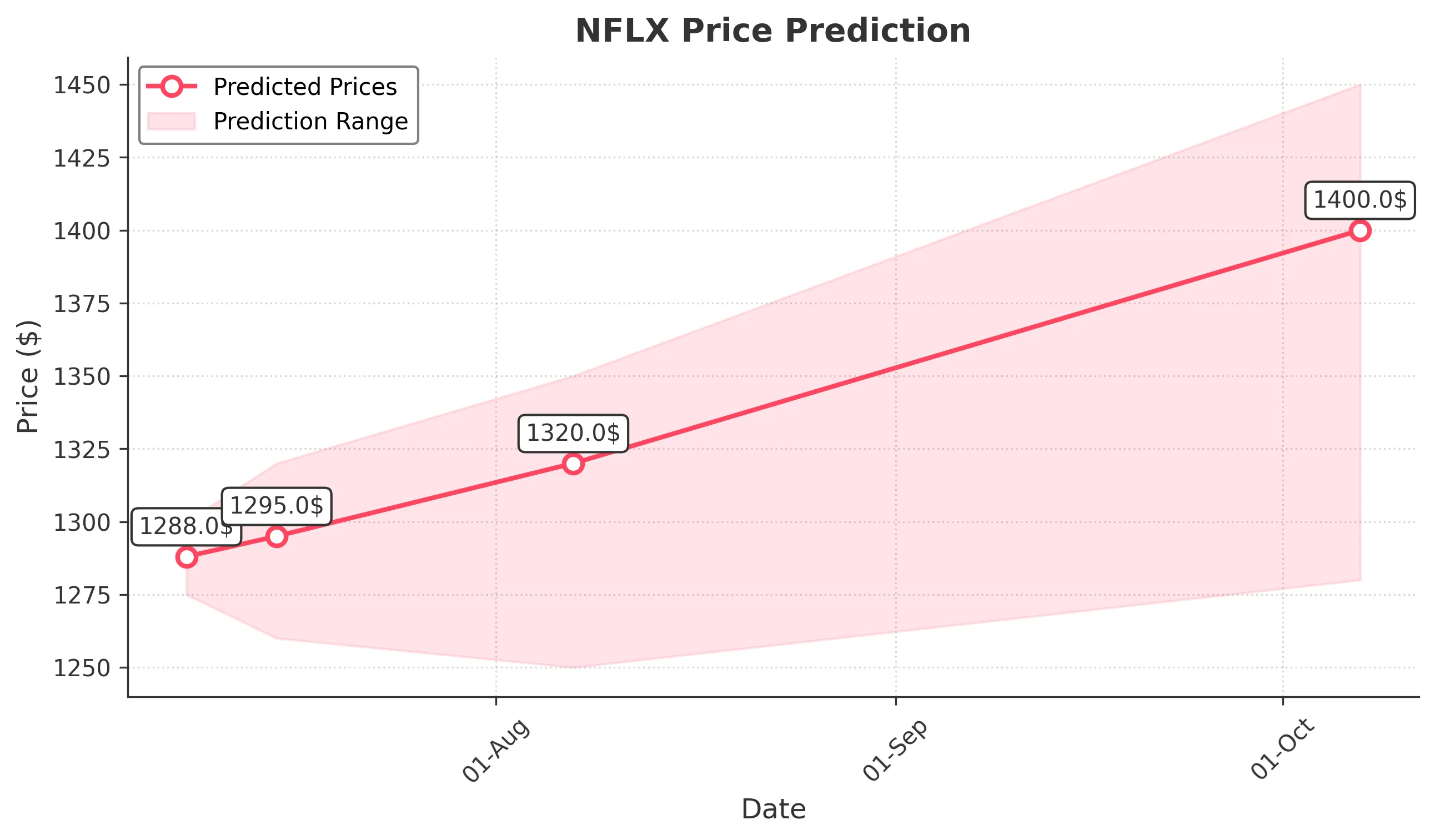

Target: July 8, 2025$1288

$1285

$1300

$1275

Description

The stock shows a slight bullish trend with a potential for a small rebound after recent declines. RSI indicates oversold conditions, while MACD is showing a bullish crossover. However, volatility remains high, suggesting caution.

Analysis

Over the past 3 months, NFLX has shown a bullish trend with significant upward movements, reaching highs above 1300. Key support is around 1275, while resistance is near 1330. Recent volume spikes indicate strong interest, but recent price action suggests potential consolidation.

Confidence Level

Potential Risks

Market sentiment could shift quickly due to external news or earnings reports, which may impact the stock's performance.

1 Week Prediction

Target: July 15, 2025$1295

$1288

$1320

$1260

Description

Expect a slight recovery as the stock may bounce off support levels. The Bollinger Bands indicate potential for upward movement, but the overall market sentiment remains cautious, which could limit gains.

Analysis

NFLX has experienced fluctuations with a recent bearish phase. The stock is currently testing support levels, and while there are bullish signals from technical indicators, the overall market sentiment remains mixed, indicating potential for both upward and downward movements.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings surprises could lead to increased volatility and affect the stock's trajectory.

1 Month Prediction

Target: August 7, 2025$1320

$1295

$1350

$1250

Description

A gradual recovery is anticipated as the stock stabilizes. The MACD shows potential for upward momentum, and RSI is moving towards neutral territory. However, resistance at 1350 may pose challenges.

Analysis

The past three months have shown a volatile pattern for NFLX, with significant highs and lows. The stock is currently at a critical juncture, with support around 1250 and resistance at 1350. Technical indicators suggest a potential recovery, but caution is warranted.

Confidence Level

Potential Risks

Market volatility and external factors could still impact the stock's performance, especially if earnings reports do not meet expectations.

3 Months Prediction

Target: October 7, 2025$1400

$1320

$1450

$1280

Description

Long-term bullish sentiment is expected as the stock may break through resistance levels. Positive earnings and market conditions could drive the price higher, but watch for potential pullbacks.

Analysis

NFLX has shown strong performance over the last three months, with a bullish trend and increasing volume. Key resistance levels are being tested, and if broken, the stock could see further gains. However, external economic factors could introduce volatility.

Confidence Level

Potential Risks

Economic downturns or negative news could reverse the bullish trend, impacting investor sentiment significantly.