NFLX Trading Predictions

1 Day Prediction

Target: July 11, 2025$1287

$1285

$1295

$1275

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, recent volatility may lead to fluctuations.

Analysis

Over the past 3 months, NFLX has shown a bullish trend with significant upward movement, reaching a peak of 1339.13. Key support is around 1275, while resistance is near 1340. Volume has been relatively stable, but recent spikes indicate increased interest. Technical indicators suggest potential for further gains, but caution is warranted due to market volatility.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, which may impact the stock's performance.

1 Week Prediction

Target: July 18, 2025$1295

$1287

$1305

$1265

Description

The stock is expected to consolidate around current levels with potential for slight upward movement. The Bollinger Bands are tightening, indicating reduced volatility. A potential breakout could occur if the price holds above 1290.

Analysis

NFLX has experienced a strong rally, but recent price action suggests a possible consolidation phase. The RSI is approaching overbought territory, indicating a potential pullback. Key support at 1275 and resistance at 1340 remain critical levels to watch.

Confidence Level

Potential Risks

Market reactions to earnings or macroeconomic data could lead to unexpected price movements.

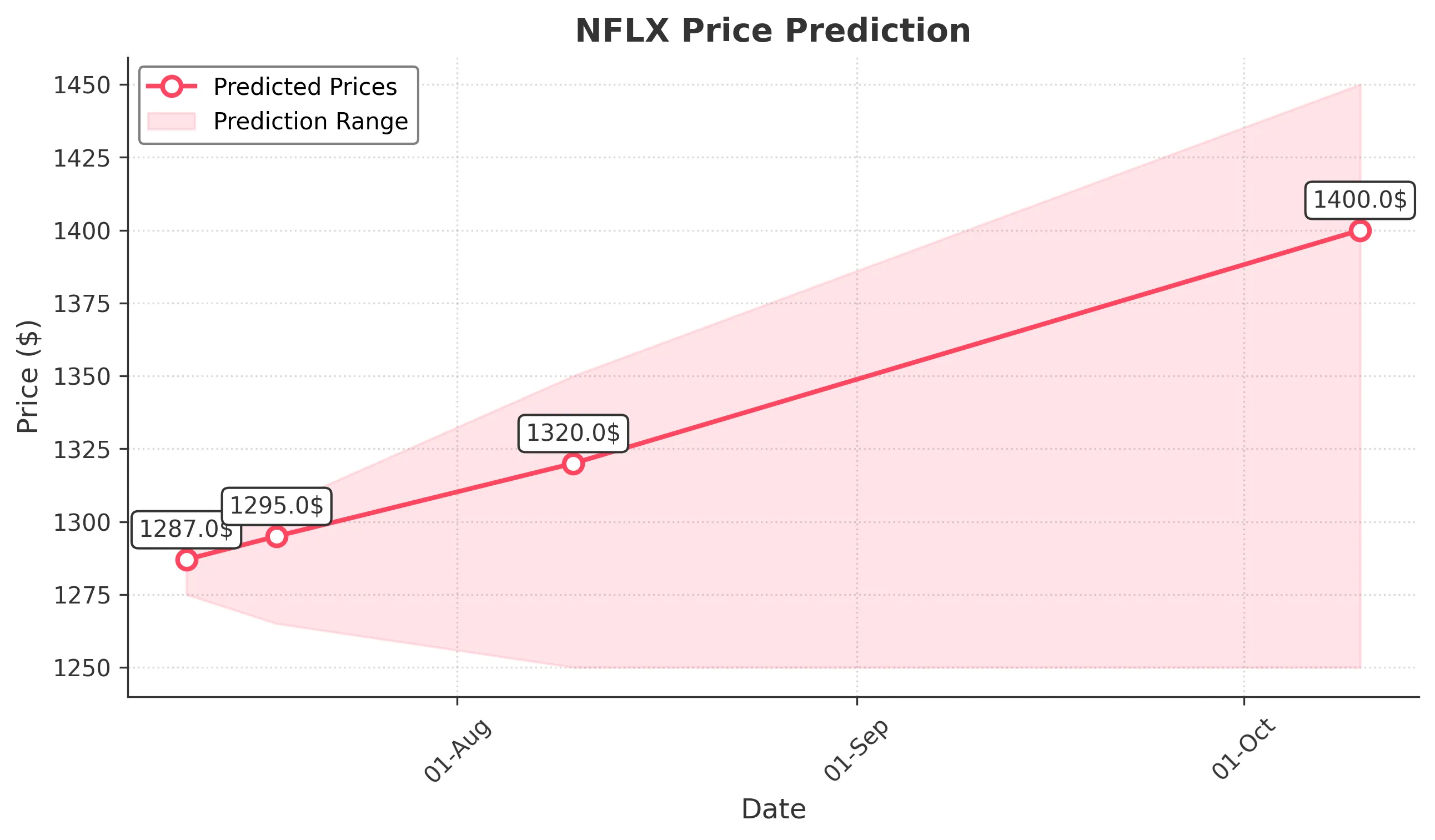

1 Month Prediction

Target: August 10, 2025$1320

$1295

$1350

$1250

Description

Expect a gradual increase in price as bullish sentiment may return. The MACD is showing signs of a bullish crossover, and if the stock can maintain above 1300, it may attract more buyers.

Analysis

The stock has shown resilience with a strong upward trend. Key technical indicators support a bullish outlook, but the RSI indicates potential overbought conditions. Volume patterns suggest sustained interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Any negative news or earnings surprises could reverse the trend, leading to a decline.

3 Months Prediction

Target: October 10, 2025$1400

$1320

$1450

$1250

Description

Long-term bullish outlook as the stock may break through resistance levels. Positive earnings reports and market sentiment could drive prices higher, but caution is advised due to potential market corrections.

Analysis

NFLX has shown a strong upward trajectory, with significant support at 1250 and resistance at 1450. The overall market sentiment is bullish, but external economic factors could introduce risks. Technical indicators suggest potential for continued growth, but caution is warranted.

Confidence Level

Potential Risks

Macroeconomic factors and competitive pressures could impact growth, leading to volatility.