NFLX Trading Predictions

1 Day Prediction

Target: July 14, 2025$1240

$1245

$1250

$1230

Description

The stock shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 1240.

Analysis

Over the past 3 months, NFLX has shown a bullish trend with significant price increases. Key resistance at 1300 and support around 1200. Recent candlestick patterns indicate potential reversal signals. Volume has been inconsistent, suggesting uncertainty.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish sentiment could lead to higher prices.

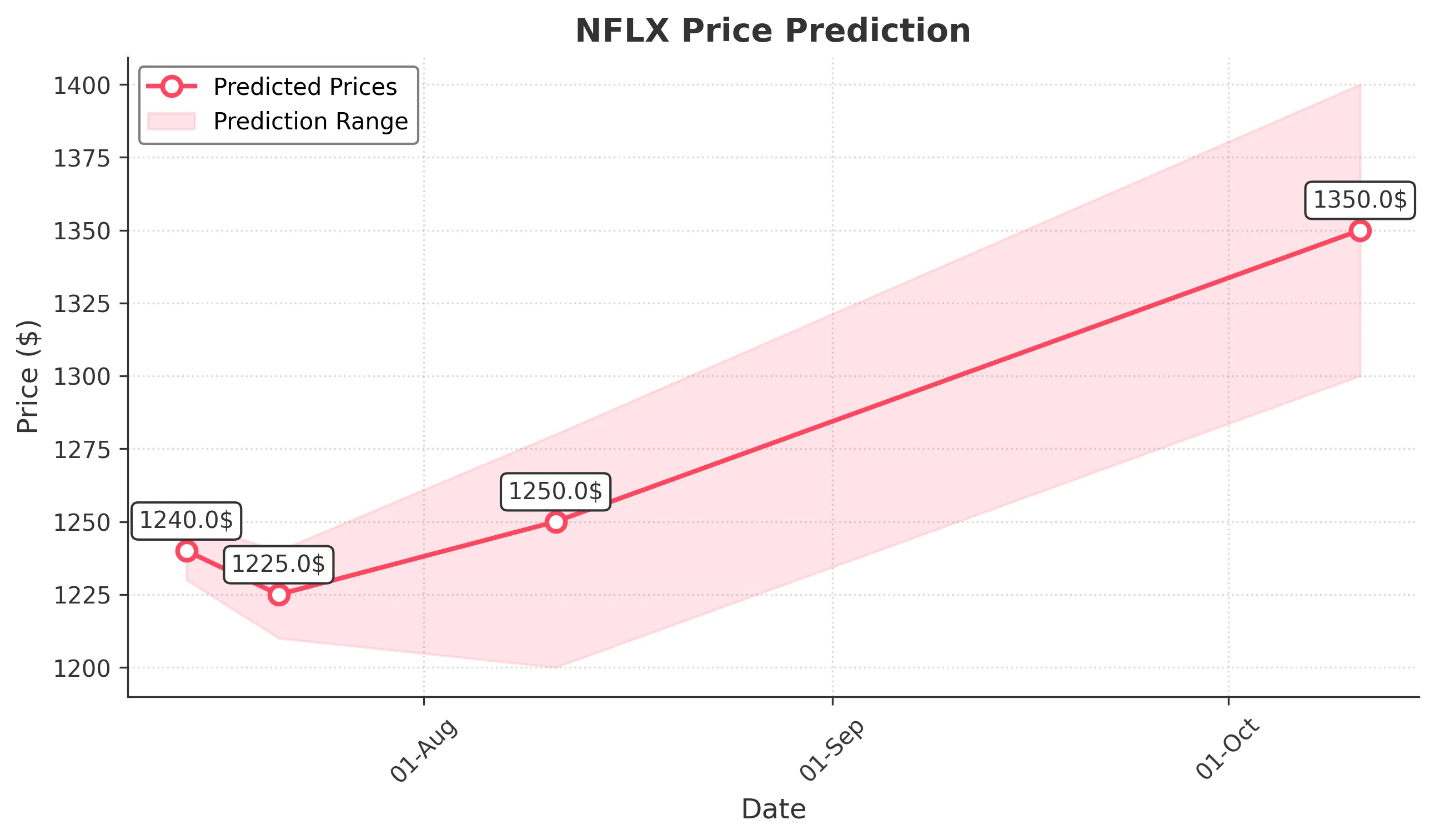

1 Week Prediction

Target: July 21, 2025$1225

$1230

$1240

$1210

Description

Expect a continued bearish trend as the stock faces resistance at 1250. The MACD shows a bearish crossover, and the RSI is approaching oversold territory, indicating potential for a bounce back. Close around 1225.

Analysis

The stock has been in a corrective phase after reaching highs above 1300. Key support at 1200 is critical. Technical indicators suggest a potential consolidation phase. Volume patterns indicate a lack of strong buying interest.

Confidence Level

Potential Risks

Unforeseen market events or earnings reports could lead to volatility. A strong bullish reversal could change the outlook.

1 Month Prediction

Target: August 11, 2025$1250

$1245

$1280

$1200

Description

A potential recovery is expected as the stock approaches key support levels. If it holds above 1200, a rally towards 1280 is possible. Watch for bullish candlestick patterns for confirmation. Close around 1250.

Analysis

NFLX has shown volatility with significant price swings. The overall trend remains bullish, but recent corrections have raised concerns. Key support at 1200 and resistance at 1300. Technical indicators suggest a potential rebound if support holds.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors like economic data releases could impact the stock's performance.

3 Months Prediction

Target: October 11, 2025$1350

$1340

$1400

$1300

Description

If the bullish trend resumes, expect a gradual increase towards 1350. Positive earnings reports and market sentiment could drive prices higher. Watch for breakout patterns above 1300 for confirmation.

Analysis

The stock has shown resilience with a strong upward trend over the past months. Key resistance at 1400 and support at 1300. Technical indicators suggest potential for further gains if bullish momentum continues. Volume patterns indicate healthy interest.

Confidence Level

Potential Risks

Economic conditions and competitive pressures in the streaming industry could affect growth. A downturn in market sentiment could lead to price declines.