NFLX Trading Predictions

1 Day Prediction

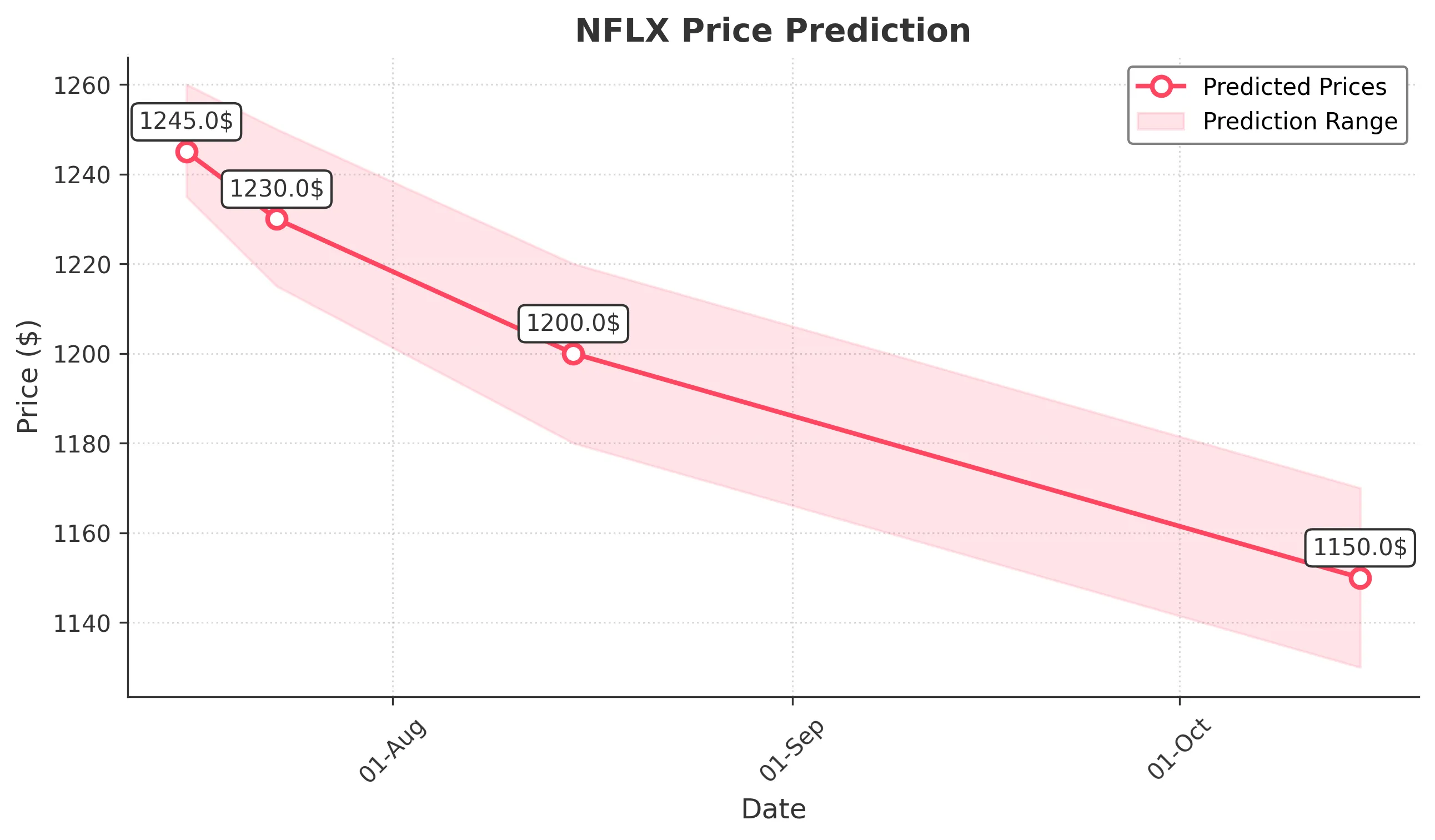

Target: July 16, 2025$1245

$1245

$1260

$1235

Description

The stock shows a slight bearish trend with recent lower highs and lower lows. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 1245.

Analysis

Over the past 3 months, NFLX has shown a bullish trend with significant price increases, reaching a peak of 1339.13. However, recent price action indicates a potential reversal with lower highs. Key support at 1240 and resistance at 1300. Volume patterns suggest decreasing interest.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish sentiment could lead to higher prices.

1 Week Prediction

Target: July 23, 2025$1230

$1235

$1250

$1215

Description

The bearish trend may continue as the stock faces resistance around 1250. The MACD shows a bearish crossover, and the RSI is approaching oversold territory. Expect a close around 1230 as selling pressure persists.

Analysis

NFLX has experienced a significant pullback from its highs, with recent trading showing lower volume and bearish candlestick patterns. Support at 1215 is critical, while resistance remains at 1250. The overall sentiment is cautious.

Confidence Level

Potential Risks

Unforeseen market events or earnings reports could lead to volatility. A bullish reversal is possible if sentiment shifts.

1 Month Prediction

Target: August 15, 2025$1200

$1210

$1220

$1180

Description

The stock may continue to decline as bearish momentum builds. The Bollinger Bands indicate potential for further downside, and the ATR suggests increasing volatility. Expect a close around 1200 as the market digests recent highs.

Analysis

In the last three months, NFLX has shown a strong bullish trend but is now facing resistance. The recent downturn indicates a potential shift in market sentiment. Key support at 1180 is crucial for maintaining upward momentum.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and any positive news could reverse the trend. Earnings reports may also impact the stock significantly.

3 Months Prediction

Target: October 15, 2025$1150

$1160

$1170

$1130

Description

Longer-term bearish sentiment may prevail as the stock struggles to regain upward momentum. The Fibonacci retracement levels suggest potential support at 1150. Expect a close around 1150 as the market stabilizes.

Analysis

NFLX's performance over the past three months has been characterized by volatility and a recent downturn. The stock is currently testing key support levels, and external factors such as competition and market conditions could influence future performance.

Confidence Level

Potential Risks

Economic conditions and competitive pressures could further impact the stock. A bullish reversal is possible if market sentiment improves.