NFLX Trading Predictions

1 Day Prediction

Target: July 17, 2025$1265

$1260

$1275

$1255

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, suggesting potential for upward movement. However, the MACD is flattening, indicating possible consolidation. Volume is expected to be moderate.

Analysis

Over the past 3 months, NFLX has shown a bullish trend with significant upward movement, reaching a peak of 1339.13. Key support is at 1250, while resistance is around 1300. The RSI indicates overbought conditions, and recent volume spikes suggest profit-taking could occur.

Confidence Level

Potential Risks

Market volatility and external news could impact the price. A bearish reversal is possible if the support level at 1255 breaks.

1 Week Prediction

Target: July 24, 2025$1270

$1265

$1285

$1245

Description

The stock is expected to consolidate around current levels. The Bollinger Bands are tightening, indicating reduced volatility. The MACD shows a bearish crossover, suggesting potential downward pressure. Volume may increase as traders react to earnings reports.

Analysis

NFLX has experienced a strong rally but is now facing resistance. The recent price action shows signs of exhaustion, with the RSI nearing overbought territory. Volume has been mixed, indicating uncertainty among investors. Key support at 1250 remains critical.

Confidence Level

Potential Risks

Earnings announcements or macroeconomic data releases could lead to unexpected volatility. A break below 1245 could signal a bearish trend.

1 Month Prediction

Target: August 17, 2025$1250

$1270

$1280

$1220

Description

Expect a pullback as the stock approaches key resistance levels. The RSI indicates overbought conditions, and profit-taking may occur. The MACD divergence suggests weakening momentum. Volume is likely to increase as traders react to market sentiment.

Analysis

The stock has shown a strong upward trend but is now facing resistance. The recent price action indicates potential for a correction. Key support at 1220 is crucial, and if broken, further declines could occur. Market sentiment remains mixed.

Confidence Level

Potential Risks

Unforeseen market events or changes in investor sentiment could lead to significant price fluctuations. A strong earnings report could reverse the bearish sentiment.

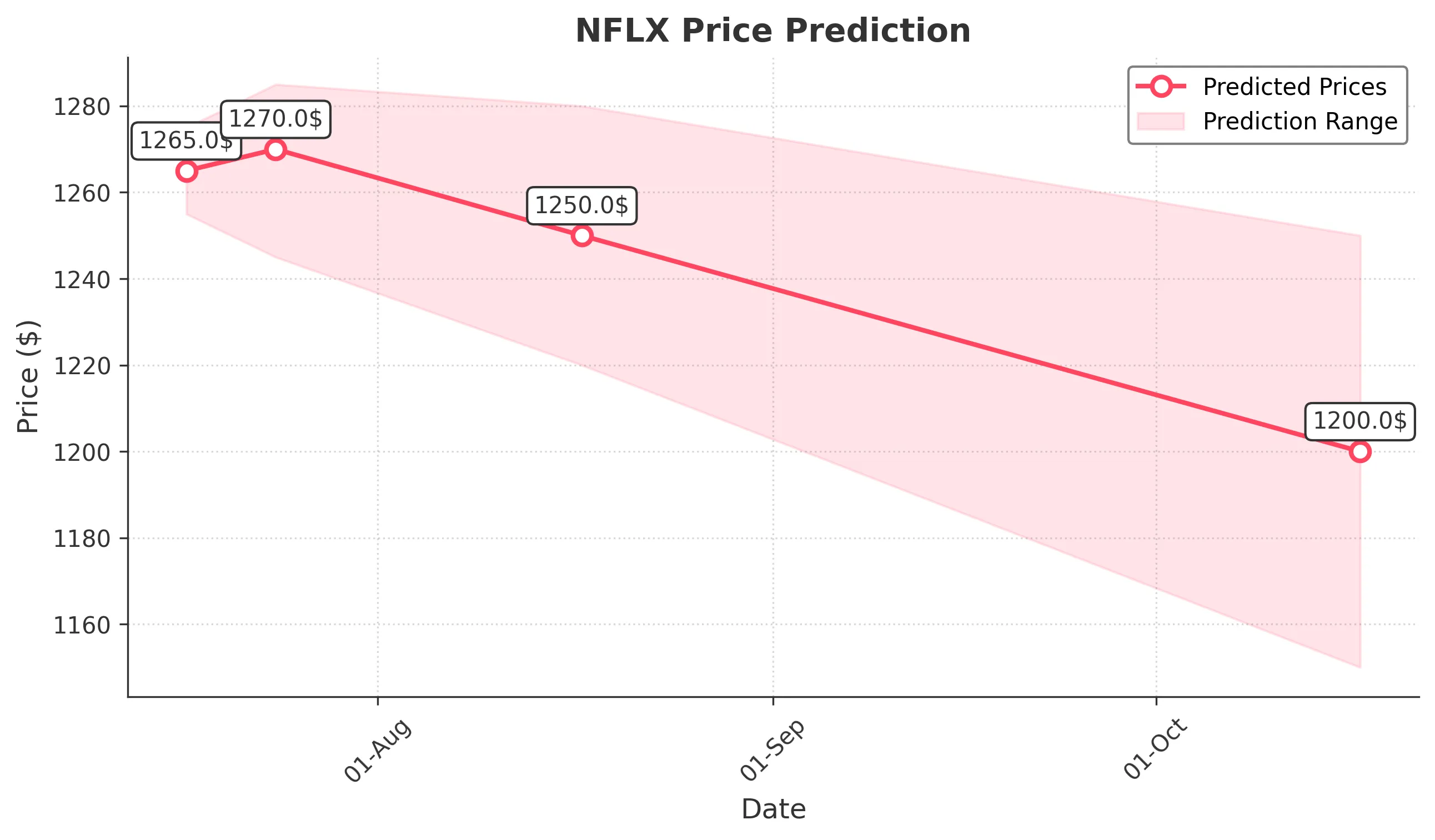

3 Months Prediction

Target: October 17, 2025$1200

$1230

$1250

$1150

Description

Long-term outlook suggests a bearish trend as the stock may face continued selling pressure. The MACD indicates a bearish trend, and the RSI is likely to remain low. Volume may increase as investors react to broader market conditions.

Analysis

Over the past three months, NFLX has shown volatility with significant price swings. The stock is currently in a correction phase, and key support levels are being tested. Market sentiment is cautious, and external factors could heavily influence future performance.

Confidence Level

Potential Risks

Economic downturns or negative news could exacerbate declines. A failure to maintain support at 1150 could lead to further losses.