NFLX Trading Predictions

1 Day Prediction

Target: July 18, 2025$1248.5

$1250

$1260

$1240

Description

The stock shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 1248.50.

Analysis

NFLX has shown a bearish trend recently, with significant resistance around 1260. Key support is at 1240. Technical indicators like RSI are high, suggesting a potential correction. Volume patterns indicate reduced buying interest.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction.

1 Week Prediction

Target: July 25, 2025$1235

$1245

$1250

$1220

Description

Expect continued bearish pressure as the stock approaches key support levels. MACD shows a bearish crossover, and volume remains low, indicating lack of buying interest. Close around 1235.00 is likely.

Analysis

The stock has been in a bearish phase, with resistance at 1260 and support at 1220. Technical indicators suggest weakening momentum. Volume patterns show a decline, indicating reduced investor confidence.

Confidence Level

Potential Risks

Potential for unexpected market news or earnings reports could alter the trend.

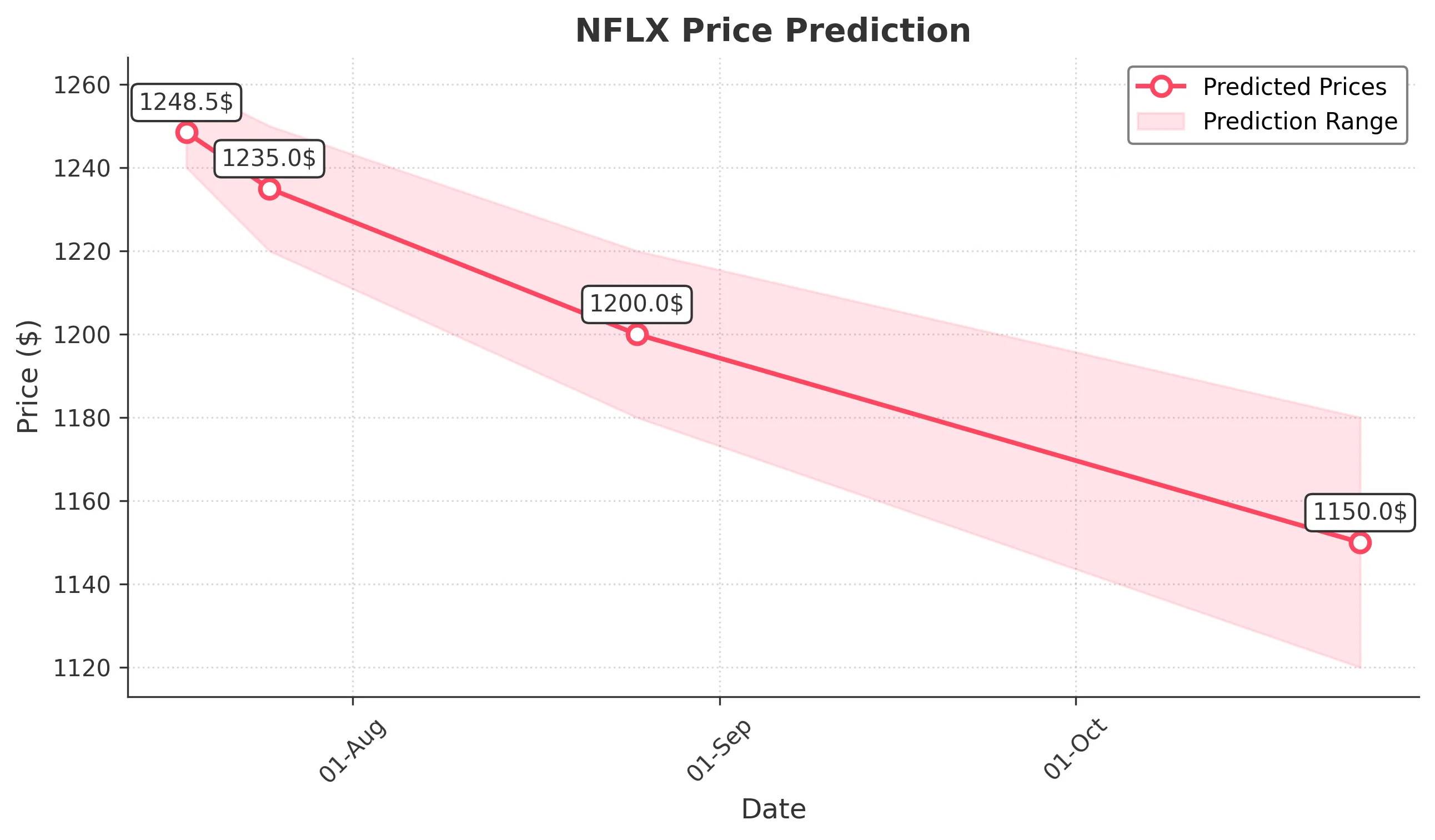

1 Month Prediction

Target: August 25, 2025$1200

$1210

$1220

$1180

Description

The bearish trend is expected to continue, with potential for further declines as the stock approaches critical support levels. Market sentiment is cautious, and external factors may weigh on performance.

Analysis

NFLX has been trending downwards, with key support at 1200. Technical indicators suggest a continuation of this trend. Volume analysis shows a lack of strong buying interest, indicating potential for further declines.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings surprises could significantly impact the stock.

3 Months Prediction

Target: October 25, 2025$1150

$1160

$1180

$1120

Description

Long-term bearish sentiment may persist, with the stock potentially testing lower support levels. Market conditions and investor sentiment will play a crucial role in determining the trajectory.

Analysis

Over the past three months, NFLX has shown a bearish trend with significant resistance at 1260. Key support levels are being tested. Technical indicators suggest a continuation of this trend, with volume patterns indicating reduced interest.

Confidence Level

Potential Risks

Market volatility and changes in investor sentiment could lead to unexpected price movements.