NFLX Trading Predictions

1 Day Prediction

Target: July 19, 2025$1210

$1215

$1220

$1200

Description

The stock shows bearish momentum with a recent drop. RSI indicates oversold conditions, suggesting a potential bounce. However, the MACD is bearish, and volume has decreased, indicating caution. Expect a slight recovery but overall weakness.

Analysis

Over the past 3 months, NFLX has shown a bullish trend until recent weeks, where it faced resistance around 1300. The stock has retraced significantly, with support around 1200. Technical indicators show mixed signals, with bearish MACD and RSI suggesting potential oversold conditions.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A strong reversal is possible if bullish sentiment returns.

1 Week Prediction

Target: July 26, 2025$1230

$1215

$1245

$1210

Description

Expect a slight recovery as the stock may find support at 1200. The RSI is improving, indicating potential upward momentum. However, the overall trend remains bearish, and caution is advised.

Analysis

The stock has faced significant selling pressure recently, with key support at 1200. Technical indicators show a bearish trend, but a potential bounce is possible if buying interest returns. Volume patterns indicate reduced activity, suggesting indecision in the market.

Confidence Level

Potential Risks

Unforeseen market events or earnings reports could lead to volatility. The bearish trend may continue if selling pressure persists.

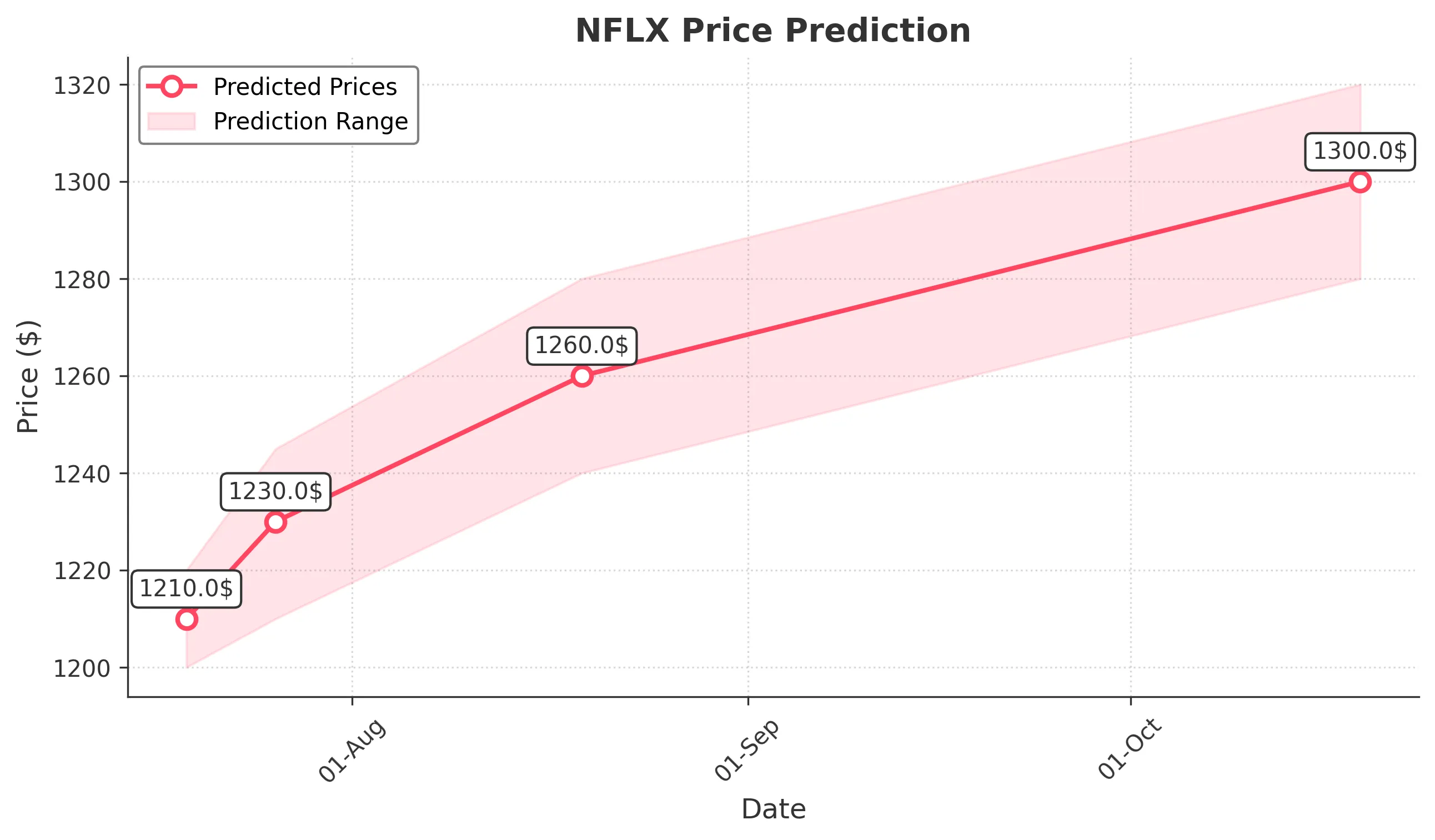

1 Month Prediction

Target: August 19, 2025$1260

$1250

$1280

$1240

Description

A gradual recovery is anticipated as the stock stabilizes around 1250. The RSI may return to neutral levels, and if bullish sentiment returns, a test of resistance at 1300 could occur.

Analysis

NFLX has shown volatility with a recent bearish trend. Key support at 1200 is critical, and a recovery towards 1300 is possible if buying interest increases. Technical indicators suggest potential stabilization, but caution is warranted due to recent price action.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors may influence the stock's performance. A failure to break resistance could lead to further declines.

3 Months Prediction

Target: October 19, 2025$1300

$1290

$1320

$1280

Description

If the stock can maintain support and recover, a return to 1300 is feasible. The market may react positively to earnings or macroeconomic factors, but risks remain due to potential market corrections.

Analysis

The stock has experienced significant fluctuations, with a recent bearish trend. Key resistance at 1300 and support at 1200 are critical levels. Technical indicators suggest potential for recovery, but external factors could influence the overall market sentiment.

Confidence Level

Potential Risks

Macroeconomic conditions and competitive pressures could impact performance. A failure to maintain upward momentum could lead to further declines.