NFLX Trading Predictions

1 Day Prediction

Target: July 25, 2025$1165

$1160

$1175

$1155

Description

The stock shows bearish momentum with a recent drop. RSI indicates oversold conditions, but a potential bounce could occur. Watch for support around 1155. Volume is expected to be moderate as traders react to recent price action.

Analysis

NFLX has shown a bearish trend recently, with significant selling pressure. Key support is around 1155, while resistance is at 1180. The RSI is nearing oversold levels, suggesting a potential short-term bounce, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A reversal is possible if bullish sentiment returns.

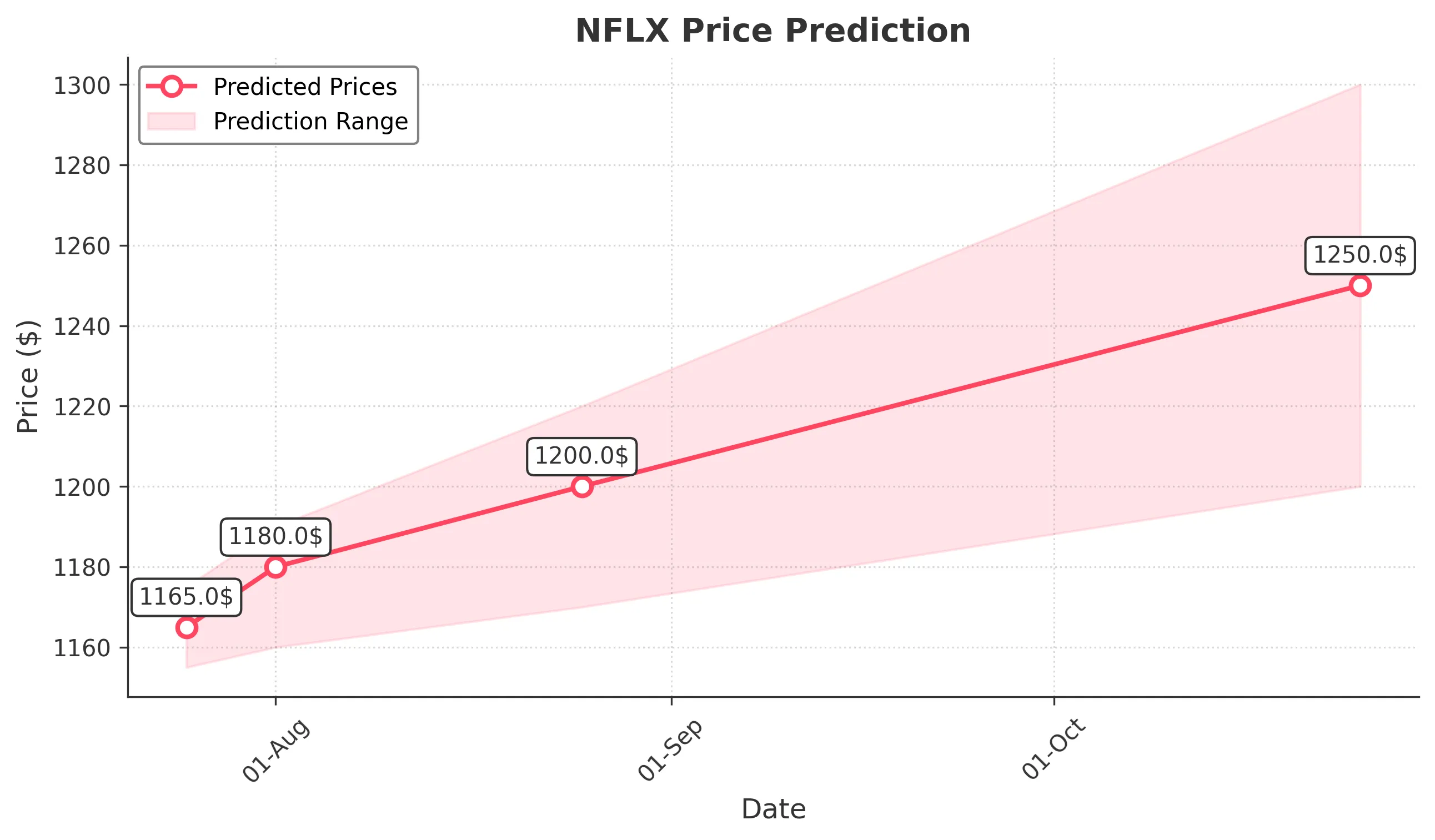

1 Week Prediction

Target: August 1, 2025$1180

$1170

$1190

$1160

Description

Expect a slight recovery as the stock approaches a critical support level. The MACD shows signs of a potential bullish crossover, indicating a possible upward movement. Volume may increase as traders react to earnings reports.

Analysis

The stock has been in a downtrend, but recent price action suggests a potential reversal. Key support at 1155 is critical. The MACD is showing bullish divergence, while volume patterns indicate increased interest. However, external factors could influence the outcome.

Confidence Level

Potential Risks

Earnings reports and macroeconomic factors could lead to unexpected volatility. A failure to hold support could lead to further declines.

1 Month Prediction

Target: August 25, 2025$1200

$1190

$1220

$1170

Description

A gradual recovery is anticipated as the stock stabilizes. The 50-day moving average is approaching the current price, which may act as support. Market sentiment could improve if earnings exceed expectations.

Analysis

NFLX has been under pressure but shows signs of stabilization. The 50-day moving average is a key level to watch. Volume has been increasing, indicating renewed interest. However, external factors and earnings results will be crucial in determining the stock's direction.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and any negative news could derail the recovery. Watch for resistance at 1220.

3 Months Prediction

Target: October 25, 2025$1250

$1230

$1300

$1200

Description

Long-term bullish sentiment is expected as the stock recovers from recent lows. If the company performs well in upcoming quarters, it could drive prices higher. Watch for key resistance at 1300.

Analysis

Over the past three months, NFLX has experienced significant volatility. The stock is currently in a recovery phase, with key support at 1155 and resistance at 1300. Technical indicators suggest potential for upward movement, but external factors must be monitored closely.

Confidence Level

Potential Risks

Macroeconomic conditions and competitive pressures could impact growth. A failure to meet earnings expectations could lead to a downturn.