NFLX Trading Predictions

1 Day Prediction

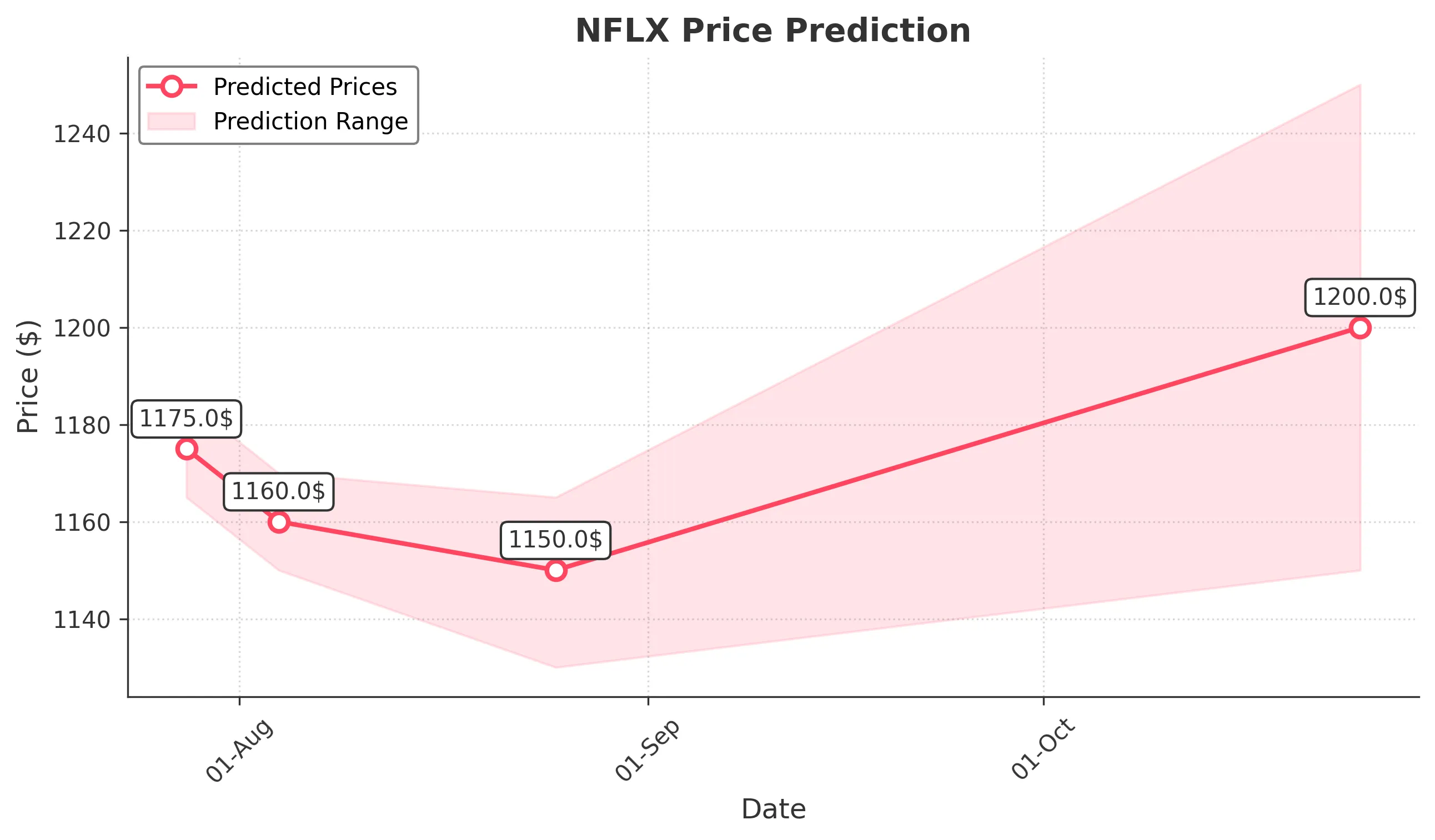

Target: July 28, 2025$1175

$1170

$1185

$1165

Description

The stock shows a bearish trend with recent lower highs and lower lows. RSI indicates oversold conditions, suggesting a potential bounce. However, the recent volume spike on July 18 indicates selling pressure, which may continue to weigh on prices.

Analysis

Over the past 3 months, NFLX has experienced significant volatility, with a peak around $1339 and a recent drop to $1177. Key support is at $1170, while resistance is at $1200. The MACD shows bearish momentum, and the ATR indicates increased volatility.

Confidence Level

Potential Risks

Market volatility and potential news could impact the stock's performance. A reversal pattern could emerge if bullish sentiment returns.

1 Week Prediction

Target: August 4, 2025$1160

$1165

$1170

$1150

Description

The bearish trend is expected to persist as the stock struggles to regain upward momentum. The recent candlestick patterns suggest continued selling pressure, and the RSI remains in a neutral zone, indicating indecision among traders.

Analysis

NFLX has shown a bearish trend with significant selling pressure. The stock has tested support levels around $1170 multiple times. The MACD is bearish, and volume has been inconsistent, indicating uncertainty in market sentiment.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to sudden price movements. A bullish reversal is possible if sentiment shifts.

1 Month Prediction

Target: August 25, 2025$1150

$1155

$1165

$1130

Description

The stock is likely to continue its downward trajectory as bearish sentiment prevails. The Bollinger Bands indicate a squeeze, suggesting potential volatility, but the overall trend remains negative.

Analysis

In the last three months, NFLX has faced significant resistance at higher levels. The stock's performance has been characterized by high volatility and bearish momentum, with key support at $1130. The RSI indicates potential oversold conditions, but the overall trend remains bearish.

Confidence Level

Potential Risks

Market sentiment can change rapidly, and any positive news could lead to a reversal. The potential for a bullish divergence exists if buying pressure increases.

3 Months Prediction

Target: October 25, 2025$1200

$1180

$1250

$1150

Description

A potential recovery could occur as the stock approaches key support levels. If bullish sentiment returns, we may see a reversal. However, the overall trend remains uncertain, and external factors could influence price movements.

Analysis

NFLX's performance over the past three months has been marked by volatility and bearish trends. The stock has tested key support levels, and while there is potential for recovery, the overall market sentiment remains cautious. The MACD and RSI suggest a need for careful monitoring.

Confidence Level

Potential Risks

Economic conditions and company performance will heavily influence the stock's trajectory. A lack of positive catalysts could hinder recovery.