NFLX Trading Predictions

1 Day Prediction

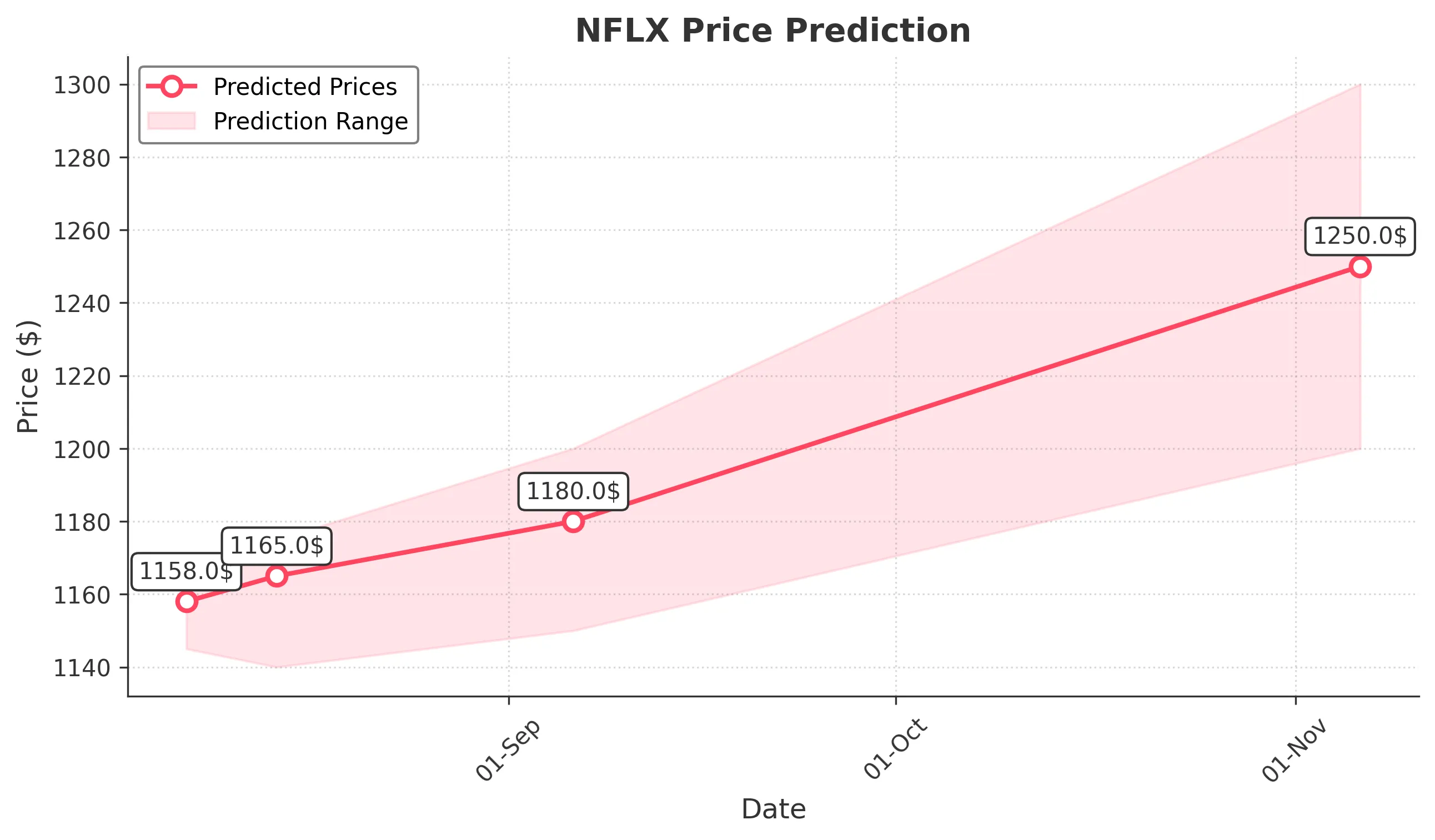

Target: August 7, 2025$1158

$1155

$1165

$1145

Description

The stock shows a slight bullish trend with a potential close around 1158. The RSI indicates neutrality, while the MACD is showing a bullish crossover. However, recent volatility suggests caution.

Analysis

Over the past 3 months, NFLX has shown a bearish trend recently, with significant support at 1150. The RSI is neutral, and MACD indicates potential bullish momentum. Volume has been inconsistent, suggesting uncertainty.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, which may impact the price.

1 Week Prediction

Target: August 14, 2025$1165

$1158

$1175

$1140

Description

Expect a slight recovery with a close around 1165. The Bollinger Bands suggest a potential breakout, while the MACD remains bullish. However, the recent bearish trend raises concerns.

Analysis

The stock has faced downward pressure recently, with resistance at 1180. The ATR indicates increased volatility, and the recent candlestick patterns show indecision. Overall, the outlook remains cautious.

Confidence Level

Potential Risks

Potential for further declines if market sentiment turns negative or if earnings disappoint.

1 Month Prediction

Target: September 6, 2025$1180

$1165

$1200

$1150

Description

A potential recovery to 1180 is expected as the stock stabilizes. The Fibonacci retracement levels suggest support at 1150, while the MACD indicates a bullish trend. Caution is advised due to market volatility.

Analysis

NFLX has shown a bearish trend recently, with key support at 1150. The RSI is approaching oversold levels, indicating a potential rebound. Volume patterns suggest cautious trading, and external factors may influence future performance.

Confidence Level

Potential Risks

Economic factors or earnings reports could lead to unexpected volatility.

3 Months Prediction

Target: November 6, 2025$1250

$1180

$1300

$1200

Description

A bullish outlook with a potential close of 1250 as the stock recovers. The MACD shows a strong bullish signal, and the RSI is improving. However, external market conditions could impact this prediction.

Analysis

The stock has been volatile, with a recent bearish trend. Key resistance is at 1300, while support is at 1200. The MACD and RSI suggest potential recovery, but market sentiment remains a concern.

Confidence Level

Potential Risks

Macroeconomic factors or competitive pressures could affect the stock's performance.