NSDQ Trading Predictions

1 Day Prediction

Target: April 12, 2025$16350

$16300

$16500

$16200

Description

The market shows signs of consolidation after recent volatility. A slight bullish sentiment is indicated by the recent candlestick patterns, but resistance at 16500 may limit upward movement. Volume remains high, suggesting active trading.

Analysis

The past three months have seen significant volatility, with a bearish trend recently. Key support at 15500 and resistance at 16500 are critical. The RSI indicates oversold conditions, but MACD shows bearish momentum. Volume spikes suggest uncertainty.

Confidence Level

Potential Risks

Potential for further declines exists if bearish sentiment prevails or if macroeconomic news impacts market confidence.

1 Week Prediction

Target: April 19, 2025$16200

$16250

$16400

$16000

Description

Expect continued pressure on prices as the market digests recent losses. The RSI remains low, indicating potential for a rebound, but resistance levels may hold. Volume trends suggest cautious trading.

Analysis

The index has been in a bearish phase, with significant drops in price. Support at 16000 is critical, while resistance at 16500 remains a barrier. Technical indicators show mixed signals, with volatility high and volume fluctuating.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to external economic factors or earnings reports, impacting predictions.

1 Month Prediction

Target: May 12, 2025$16500

$16400

$17000

$16000

Description

A potential recovery could occur as the market stabilizes. If bullish momentum builds, prices may test resistance at 17000. However, macroeconomic factors could hinder growth.

Analysis

The index has shown a bearish trend recently, with significant support at 16000. Technical indicators suggest a potential reversal, but uncertainty remains high. Volume patterns indicate mixed sentiment, and external factors could influence market direction.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could lead to unexpected volatility, affecting the accuracy of this prediction.

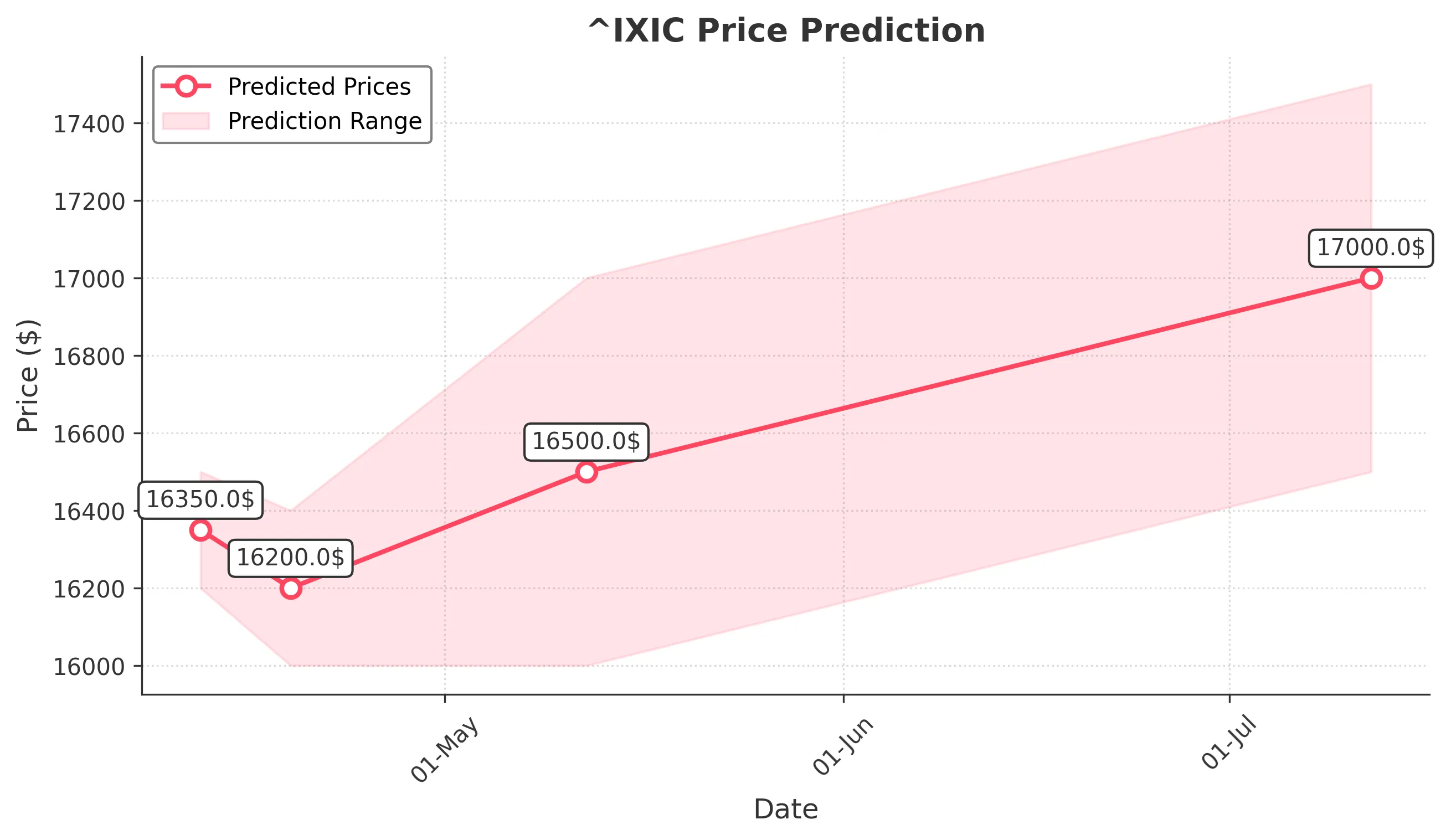

3 Months Prediction

Target: July 12, 2025$17000

$16800

$17500

$16500

Description

If the market stabilizes and economic conditions improve, a gradual recovery towards 17000 is possible. However, resistance levels will need to be overcome for sustained growth.

Analysis

The index has faced significant challenges, with a bearish trend dominating. Key support at 16000 and resistance at 17000 are crucial. Technical indicators show potential for recovery, but external factors could lead to further declines.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential economic downturns or changes in market sentiment.