NSDQ Trading Predictions

1 Day Prediction

Target: April 17, 2025$16500

$16540

$16600

$16450

Description

The market shows signs of consolidation with a slight bearish trend. The RSI is approaching oversold levels, indicating potential for a bounce. However, recent volatility and high volume suggest caution. Expect a close around 16500.

Analysis

The past three months have seen significant volatility, with a bearish trend emerging recently. Key support at 16500 is being tested. The RSI indicates potential oversold conditions, but the MACD shows bearish momentum. Volume spikes suggest increased selling pressure.

Confidence Level

Potential Risks

Market sentiment is fragile, and any negative news could lead to further declines.

1 Week Prediction

Target: April 24, 2025$16200

$16400

$16500

$16000

Description

Expect continued bearish pressure as the market reacts to macroeconomic uncertainties. The Bollinger Bands indicate potential for further downside. A close around 16200 is likely as selling persists.

Analysis

The index has been in a downtrend, with significant resistance at 17000. Recent candlestick patterns show bearish engulfing formations. Volume analysis indicates increased selling, and the ATR suggests heightened volatility.

Confidence Level

Potential Risks

Economic data releases could impact market sentiment significantly, leading to unexpected volatility.

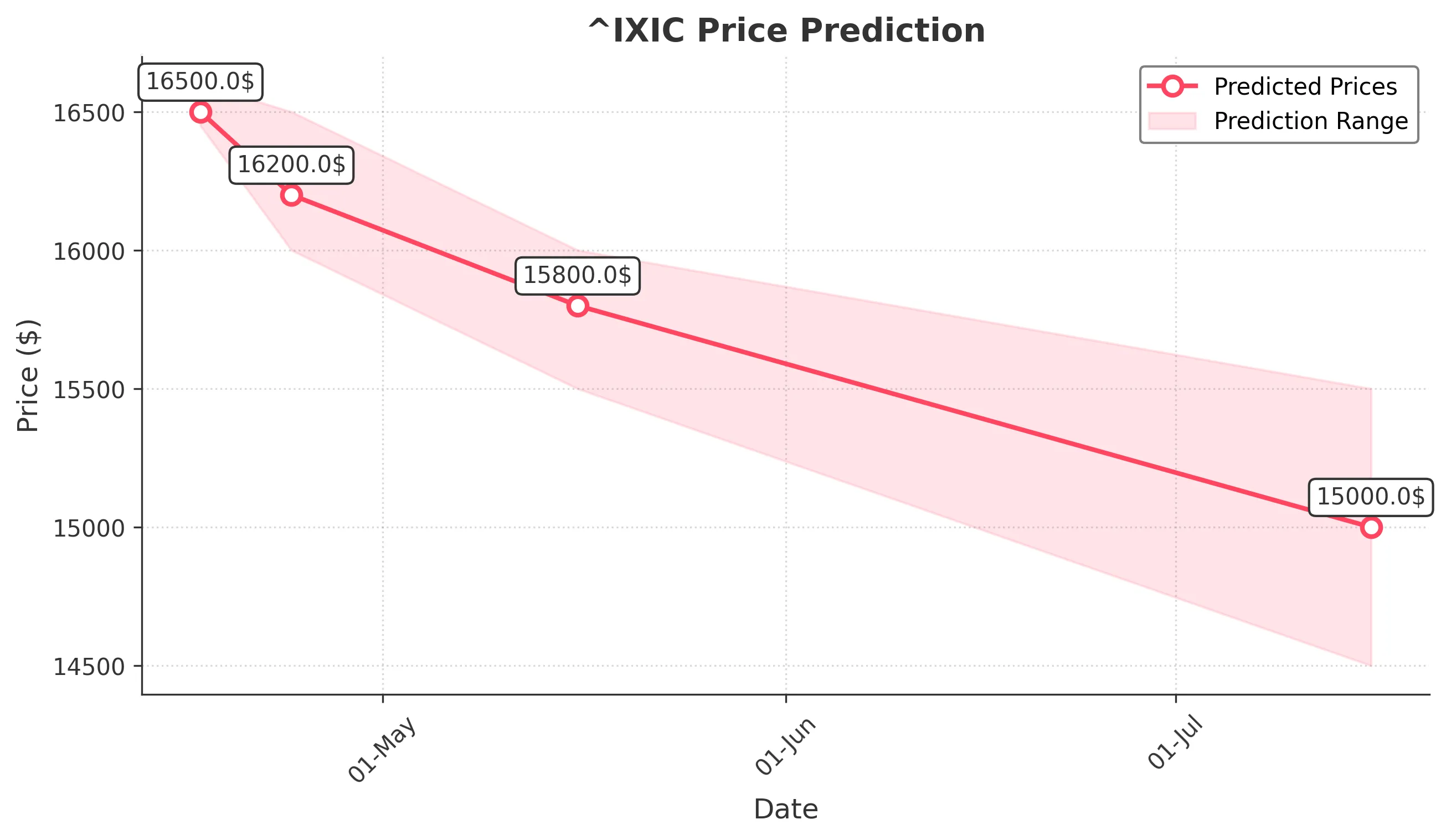

1 Month Prediction

Target: May 16, 2025$15800

$16100

$16000

$15500

Description

The bearish trend is expected to continue as macroeconomic factors weigh on investor sentiment. A close around 15800 is anticipated, with potential for further declines if support levels fail.

Analysis

The index has shown a clear downtrend, with significant resistance at 16500. The MACD is bearish, and the RSI indicates oversold conditions. Volume patterns suggest persistent selling pressure, and key support levels are at risk.

Confidence Level

Potential Risks

Unforeseen economic events or earnings reports could lead to sharp reversals.

3 Months Prediction

Target: July 16, 2025$15000

$15500

$15500

$14500

Description

Long-term bearish sentiment is expected to dominate as economic conditions remain uncertain. A close around 15000 is likely, with potential for further declines if key support levels are breached.

Analysis

The index has been in a prolonged downtrend, with significant resistance at 16000. The ATR indicates high volatility, and the RSI remains in oversold territory. Volume analysis shows persistent selling, and macroeconomic factors could further impact performance.

Confidence Level

Potential Risks

Market conditions are highly unpredictable, and any positive economic news could lead to a reversal.