NSDQ Trading Predictions

1 Day Prediction

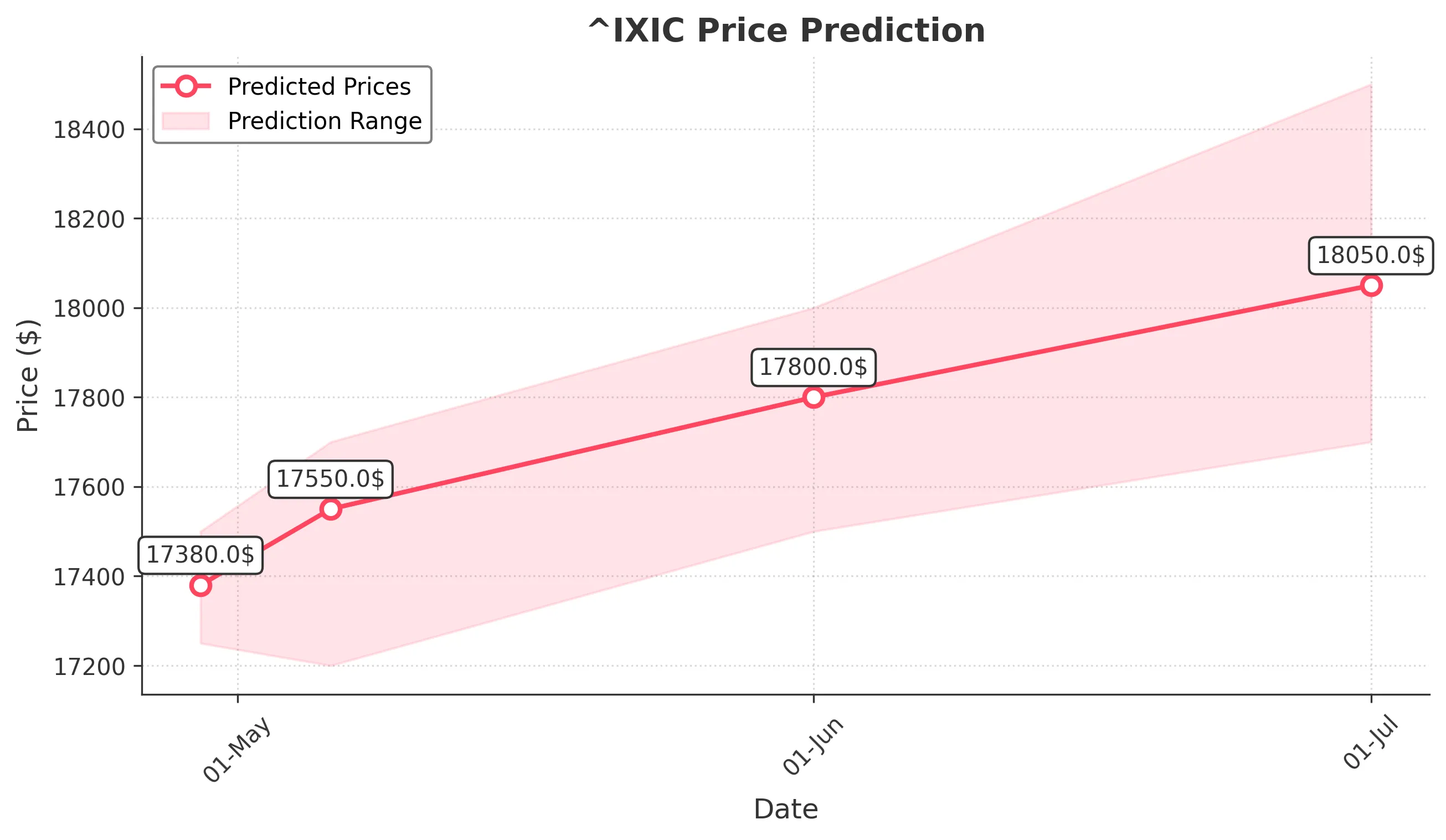

Target: April 29, 2025$17380

$17375

$17500

$17250

Description

The market shows signs of stabilization after recent volatility. The RSI is neutral, and MACD indicates a potential bullish crossover. However, the recent bearish trend may limit upward movement. Expect a close around 17380.

Analysis

The past three months have seen significant volatility, with a bearish trend dominating. Key support at 17250 and resistance at 17500. Volume spikes indicate uncertainty. Technical indicators suggest potential for a short-term bounce, but risks remain.

Confidence Level

Potential Risks

Market sentiment remains fragile, and any negative news could lead to a sharp decline.

1 Week Prediction

Target: May 6, 2025$17550

$17380

$17700

$17200

Description

A slight recovery is anticipated as the market digests recent losses. The MACD shows bullish momentum, and the RSI is approaching oversold territory. Expect a close around 17550, barring any major market disruptions.

Analysis

The market has been bearish, with significant sell-offs. Key support at 17200 and resistance at 17700. Technical indicators suggest a possible rebound, but external factors could hinder recovery.

Confidence Level

Potential Risks

Continued economic uncertainty and potential geopolitical tensions could impact market stability.

1 Month Prediction

Target: June 1, 2025$17800

$17550

$18000

$17500

Description

As the market stabilizes, a gradual upward trend is expected. The RSI may indicate a recovery, and MACD could confirm bullish momentum. Anticipate a close around 17800, assuming no major economic shocks.

Analysis

The market has shown signs of recovery, with key support at 17500 and resistance at 18000. Technical indicators suggest a potential upward trend, but external economic factors remain a concern.

Confidence Level

Potential Risks

Economic indicators and earnings reports could sway market sentiment significantly.

3 Months Prediction

Target: July 1, 2025$18050

$17800

$18500

$17700

Description

A continued recovery is expected as market sentiment improves. The MACD may indicate sustained bullish momentum, and the RSI could remain in a healthy range. Expect a close around 18050, barring unforeseen events.

Analysis

The market is showing signs of recovery, with key support at 17700 and resistance at 18500. Technical indicators suggest a bullish outlook, but external factors could introduce volatility.

Confidence Level

Potential Risks

Potential economic downturns or unexpected geopolitical events could derail the recovery.