NSDQ Trading Predictions

1 Day Prediction

Target: May 1, 2025$17150

$17100

$17250

$17000

Description

The market shows signs of stabilization after recent volatility. The RSI is neutral, and MACD indicates a potential bullish crossover. However, recent bearish candlestick patterns suggest caution. Volume is expected to remain high as traders react to macroeconomic news.

Analysis

Over the past 3 months, ^IXIC has experienced significant fluctuations, with a bearish trend recently. Key support at 17000 and resistance at 17500. The RSI indicates potential oversold conditions, while MACD shows mixed signals. Volume spikes during sell-offs suggest heightened trader activity.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to external news or earnings reports, which may lead to unexpected volatility.

1 Week Prediction

Target: May 8, 2025$17200

$17150

$17400

$16950

Description

A slight upward trend is anticipated as the market digests recent economic data. The Bollinger Bands indicate potential for a breakout, while the MACD remains bullish. However, caution is warranted due to recent bearish patterns.

Analysis

The index has shown a bearish trend recently, with significant resistance at 17500. Volume analysis indicates increased selling pressure, but recent price action suggests a possible reversal. Technical indicators are mixed, with the RSI approaching oversold levels.

Confidence Level

Potential Risks

Potential for market corrections exists, especially if economic indicators disappoint or geopolitical tensions escalate.

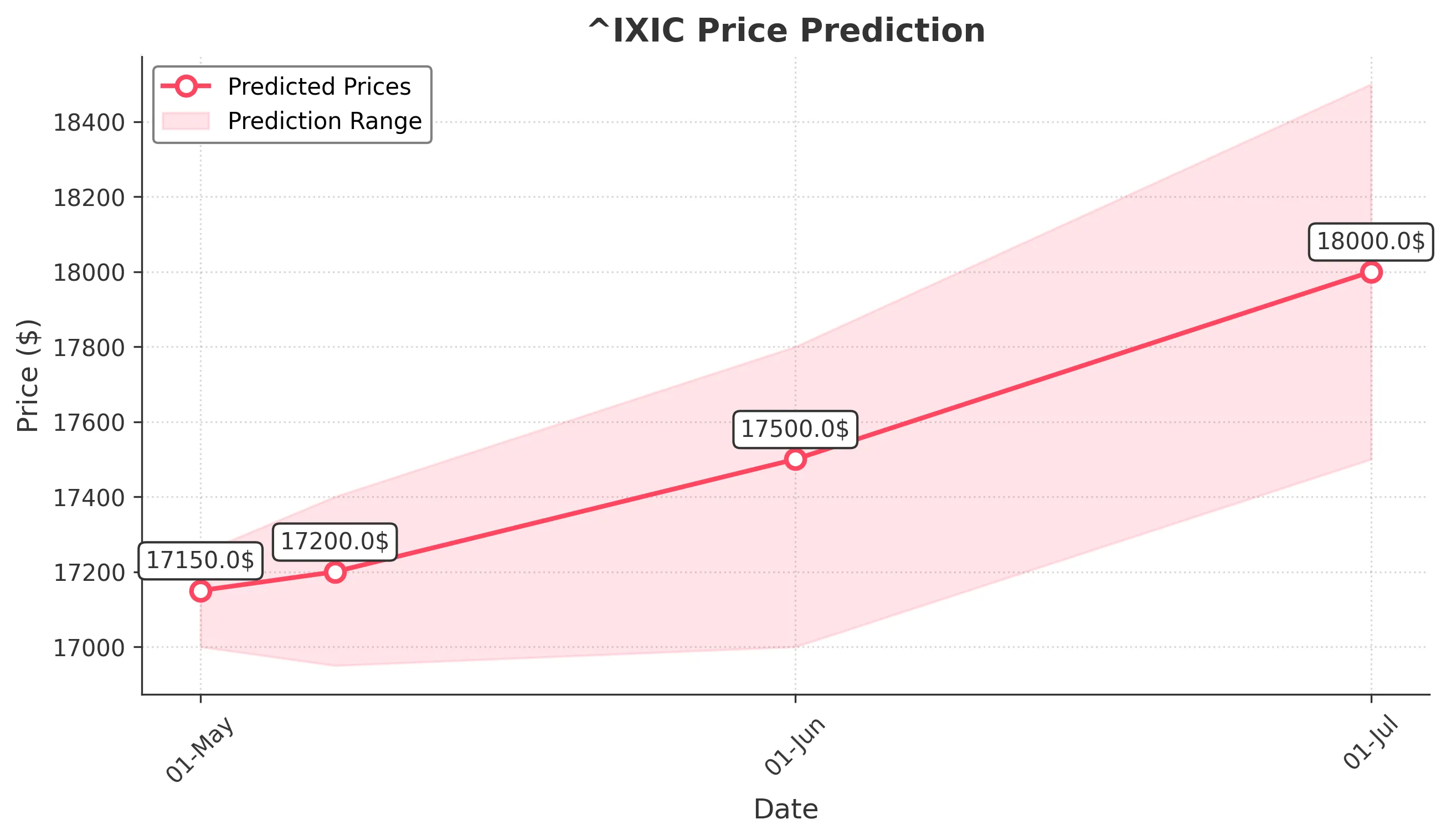

1 Month Prediction

Target: June 1, 2025$17500

$17250

$17800

$17000

Description

Expect a gradual recovery as market sentiment improves. The Fibonacci retracement levels suggest support around 17000, with potential resistance at 17800. The MACD indicates a bullish trend, but caution is advised due to potential volatility.

Analysis

The past three months have seen significant volatility, with a bearish trend recently. Key support at 17000 and resistance at 17800. The RSI is recovering, indicating potential for upward movement. Volume patterns suggest traders are positioning for a rebound.

Confidence Level

Potential Risks

Economic data releases and earnings reports could impact market direction, leading to unexpected volatility.

3 Months Prediction

Target: July 1, 2025$18000

$17750

$18500

$17500

Description

A bullish outlook is anticipated as economic conditions stabilize. The MACD shows a strong bullish signal, and the RSI indicates upward momentum. However, external factors could introduce volatility.

Analysis

The index has faced significant challenges over the past three months, with a bearish trend recently. Key support at 17500 and resistance at 18500. Technical indicators suggest a potential recovery, but market sentiment remains fragile, influenced by macroeconomic factors.

Confidence Level

Potential Risks

Unforeseen economic events or geopolitical tensions could disrupt the anticipated upward trend.