NSDQ Trading Predictions

1 Day Prediction

Target: May 24, 2025$18650

$18700

$18800

$18500

Description

The market shows bearish momentum with a recent downtrend. RSI indicates oversold conditions, but MACD suggests potential for a slight recovery. Volume spikes indicate selling pressure. Expect a close around 18650.

Analysis

The past 3 months show a bearish trend with significant resistance at 19000. Recent candlestick patterns indicate indecision, and volume analysis shows increased selling. The market sentiment is cautious, influenced by macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction significantly.

1 Week Prediction

Target: May 31, 2025$18500

$18600

$18700

$18300

Description

The bearish trend is expected to continue, with potential support at 18300. Technical indicators suggest a lack of bullish momentum. Volume remains high, indicating ongoing selling pressure.

Analysis

The stock has been in a downtrend, with key support at 18300. The RSI is approaching oversold levels, but MACD remains bearish. Volume patterns indicate strong selling, and market sentiment is cautious.

Confidence Level

Potential Risks

Unexpected market news or economic data releases could alter this outlook.

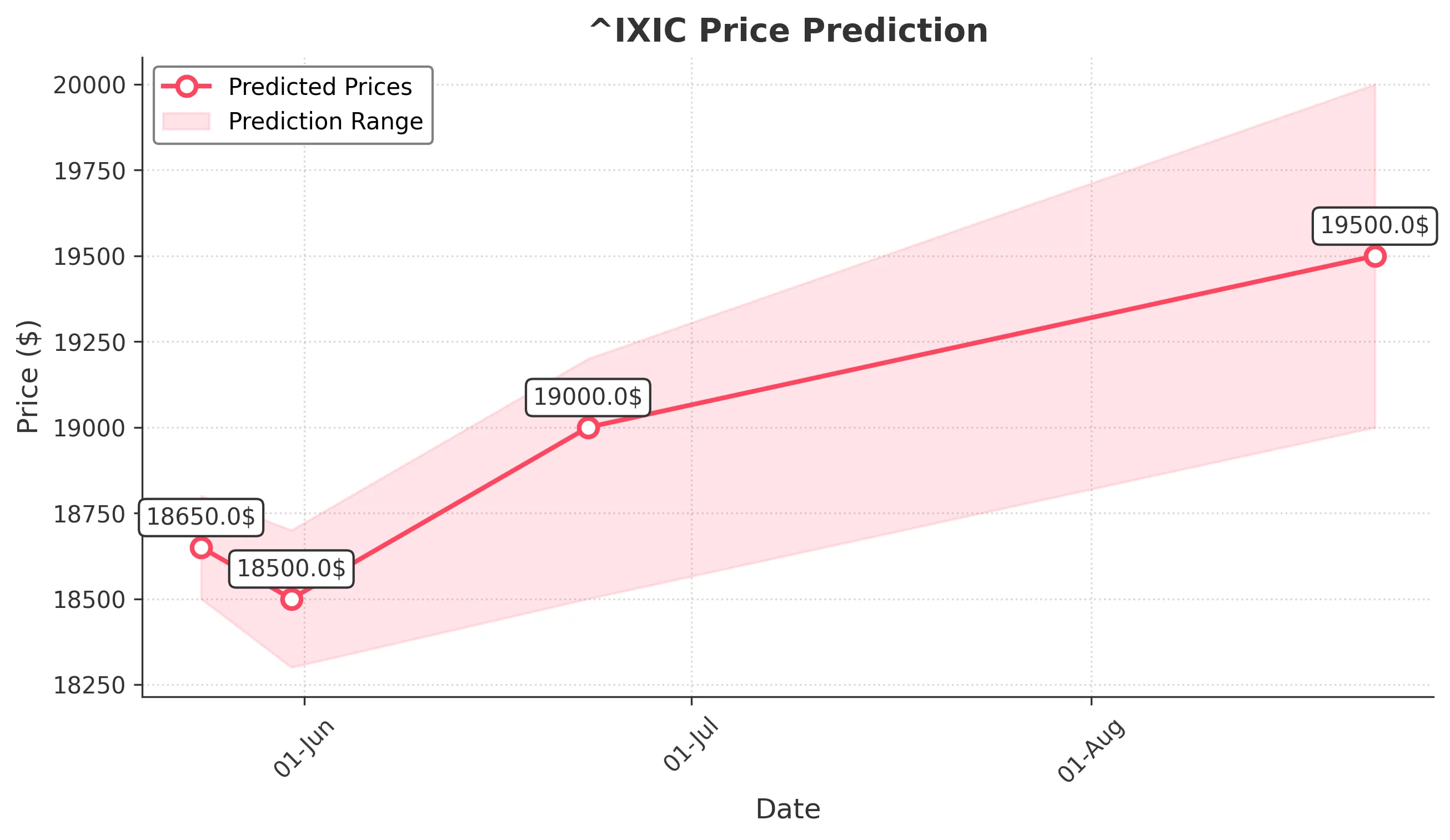

1 Month Prediction

Target: June 23, 2025$19000

$18800

$19200

$18500

Description

A potential recovery is anticipated as the market may find support at 18500. Technical indicators suggest a possible reversal, with bullish divergence in RSI. Volume may stabilize as sentiment improves.

Analysis

The stock has shown signs of stabilization after a prolonged downtrend. Key support at 18500 may hold, and if it does, a recovery towards 19000 is plausible. However, market sentiment remains fragile.

Confidence Level

Potential Risks

Market conditions are volatile, and external factors could hinder recovery.

3 Months Prediction

Target: August 23, 2025$19500

$19300

$20000

$19000

Description

If the market stabilizes, a gradual recovery towards 19500 is possible. Technical indicators may show bullish signals if support levels hold. However, macroeconomic factors could still pose risks.

Analysis

The stock's performance over the last three months has been bearish, with significant resistance at 20000. If the market sentiment shifts positively, a recovery could occur, but risks remain high due to external factors.

Confidence Level

Potential Risks

Economic uncertainties and potential market corrections could impact this forecast.