NSDQ Trading Predictions

1 Day Prediction

Target: June 24, 2025$19450

$19400

$19550

$19350

Description

The market shows a slight bullish trend with a recent Doji candlestick indicating indecision. RSI is neutral, and MACD is showing a potential bullish crossover. Expect a close around 19450 with minor fluctuations.

Analysis

The past 3 months show a bullish trend with significant support at 19400. Recent volume spikes indicate strong buying interest. However, the market is sensitive to macroeconomic news, which could lead to volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden downturn is possible if bearish sentiment prevails.

1 Week Prediction

Target: July 1, 2025$19500

$19450

$19600

$19300

Description

With the current bullish momentum and a potential breakout above resistance at 19500, the market is likely to close around this level. Watch for volume trends to confirm strength.

Analysis

The stock has shown resilience with a bullish trend. Key resistance at 19600 and support at 19400. Technical indicators suggest continued upward momentum, but external factors could introduce risk.

Confidence Level

Potential Risks

Any negative economic data could reverse the trend. The market remains sensitive to geopolitical events.

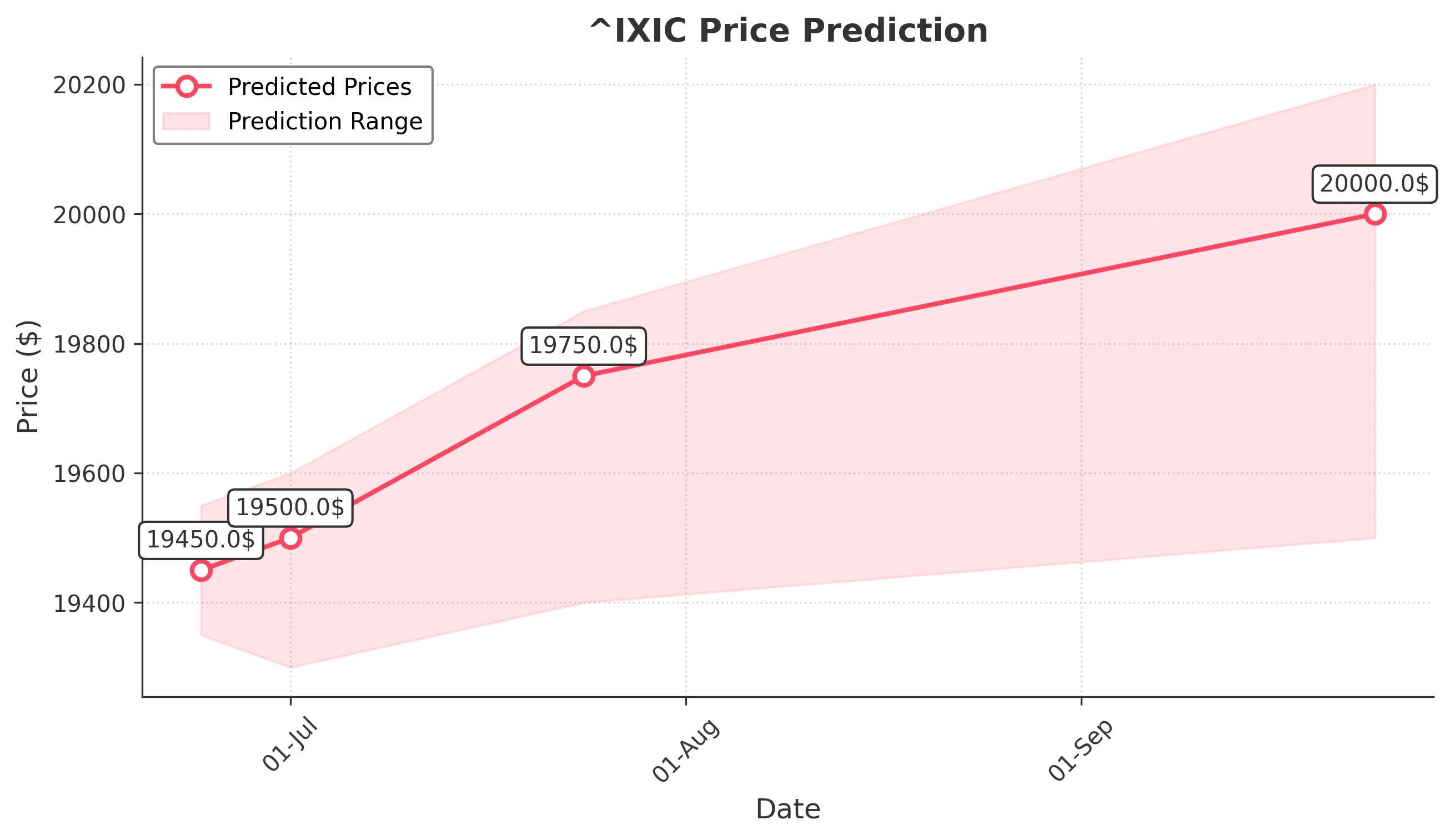

1 Month Prediction

Target: July 24, 2025$19750

$19600

$19850

$19400

Description

Expect a gradual increase as bullish sentiment persists. The MACD indicates a strong upward trend, and Fibonacci levels suggest potential resistance at 19850.

Analysis

The stock has been in a bullish phase, with strong support at 19400. Technical indicators are favorable, but external economic conditions could impact performance. Volume trends will be crucial.

Confidence Level

Potential Risks

Market corrections are possible, especially if economic indicators turn negative. Watch for signs of reversal.

3 Months Prediction

Target: September 24, 2025$20000

$19800

$20200

$19500

Description

Long-term bullish outlook as the market continues to recover. Key resistance at 20200 may be tested. Watch for volume confirmation of upward trends.

Analysis

The overall trend is bullish, with significant support at 19500. Technical indicators suggest continued upward momentum, but external factors could lead to volatility. A balanced view is necessary.

Confidence Level

Potential Risks

Potential for market corrections and economic downturns could affect predictions. Unforeseen events may introduce volatility.