NSDQ Trading Predictions

1 Day Prediction

Target: July 24, 2025$20950

$20900

$21050

$20850

Description

The market shows bullish momentum with a recent upward trend. The RSI is nearing overbought levels, suggesting a potential pullback. However, strong support at 20850 may hold. Volume remains robust, indicating continued interest.

Analysis

The past 3 months show a bullish trend with significant upward movement. Key support at 20850 and resistance at 21050. The MACD indicates upward momentum, while the ATR suggests moderate volatility. Volume spikes on up days indicate strong buying interest.

Confidence Level

Potential Risks

Potential for a reversal if market sentiment shifts or if macroeconomic news impacts investor confidence.

1 Week Prediction

Target: July 31, 2025$21000

$20950

$21200

$20700

Description

The bullish trend is expected to continue, with the market likely to test resistance at 21200. However, the RSI indicates overbought conditions, which could lead to a pullback. Volume trends suggest sustained interest.

Analysis

The stock has shown consistent upward movement, with key support at 20700. The MACD remains positive, indicating bullish momentum. Recent volume patterns suggest strong buying, but caution is warranted due to potential overbought conditions.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.

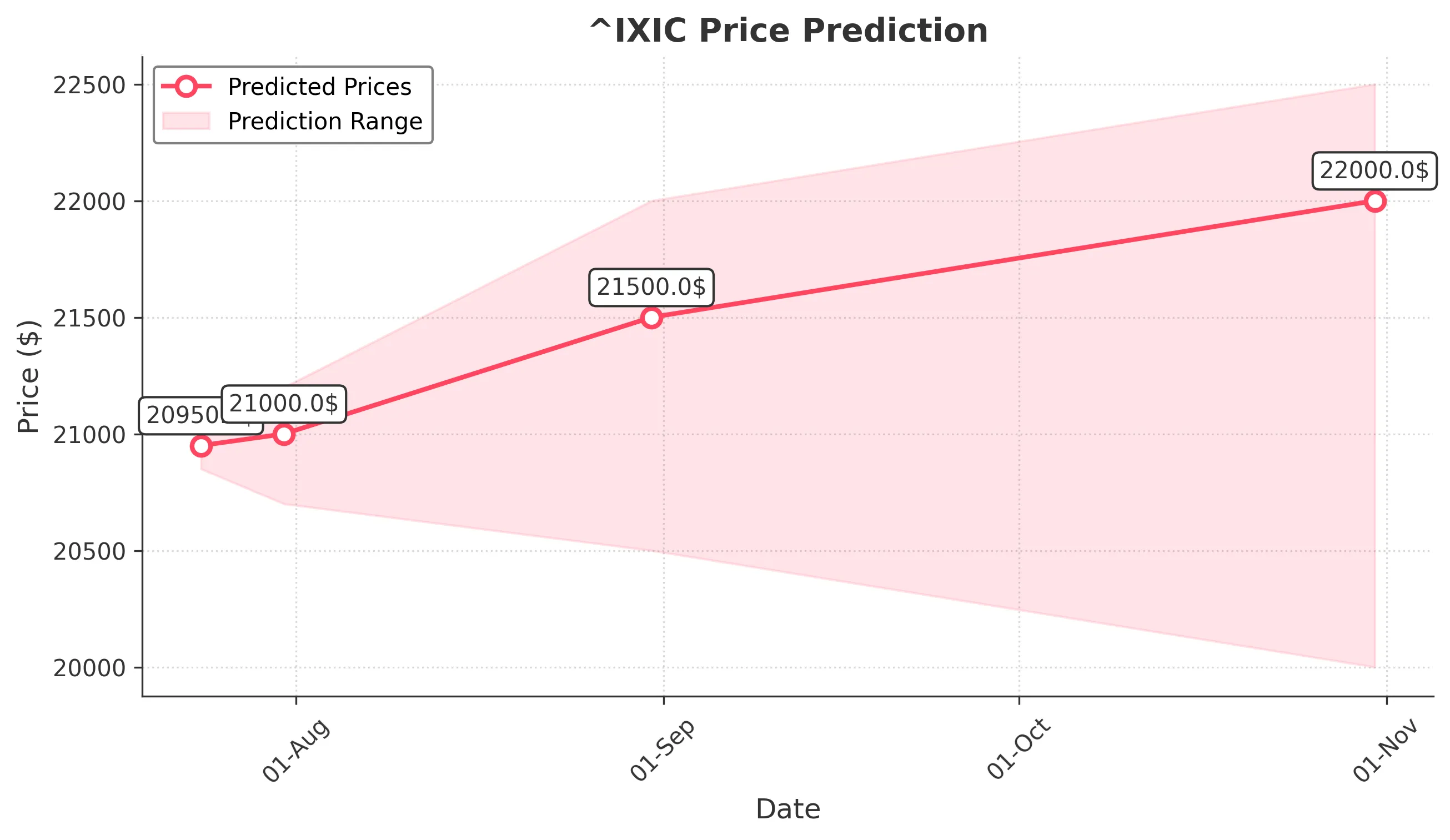

1 Month Prediction

Target: August 31, 2025$21500

$21000

$22000

$20500

Description

Expect continued bullish momentum, with potential to reach 21500. However, the market may face resistance at 22000. The RSI suggests a correction could occur, and volume trends indicate a possible slowdown in buying pressure.

Analysis

The stock has been in a strong uptrend, with significant support at 20500. The MACD is bullish, but the RSI indicates potential overbought conditions. Volume analysis shows strong interest, but caution is advised as the market may face resistance.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could impact market sentiment and lead to volatility.

3 Months Prediction

Target: October 31, 2025$22000

$21500

$22500

$20000

Description

Long-term bullish outlook with potential to reach 22000, but significant resistance at 22500 may limit gains. The market could experience corrections, especially if economic indicators turn negative.

Analysis

The overall trend remains bullish, but the stock may face challenges at key resistance levels. The ATR indicates increasing volatility, and the RSI suggests potential overbought conditions. Volume patterns show strong interest, but caution is warranted.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant volatility and price corrections.