NVDA Trading Predictions

1 Day Prediction

Target: May 28, 2025$134.5

$134

$136

$132

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, the MACD is positive, suggesting continued upward movement. Volume remains stable, supporting the bullish outlook.

Analysis

Over the past 3 months, NVDA has shown a bullish trend, recovering from lows around $94. The recent price action indicates strong support around $130, with resistance near $136. Technical indicators like the MACD and moving averages support further gains, but RSI suggests caution.

Confidence Level

Potential Risks

Potential market volatility and profit-taking could lead to a short-term pullback.

1 Week Prediction

Target: June 4, 2025$136

$135.5

$138

$133

Description

The stock is expected to continue its upward trajectory, supported by strong buying interest. The Bollinger Bands indicate potential for a breakout. However, the RSI nearing overbought levels suggests caution for short-term traders.

Analysis

NVDA has been on a bullish run, with significant support at $130. The recent price action shows a strong recovery from recent lows, and technical indicators suggest further upside potential. However, external factors could introduce volatility.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic factors or earnings reports, impacting price.

1 Month Prediction

Target: June 27, 2025$140

$138

$145

$135

Description

The stock is likely to reach new highs as bullish sentiment persists. The Fibonacci retracement levels indicate a target around $140. However, the RSI suggests potential overbought conditions, which could lead to corrections.

Analysis

In the last three months, NVDA has shown a strong recovery from lows, with key support at $130. The stock's upward momentum is supported by positive technical indicators, but caution is warranted as the RSI approaches overbought territory.

Confidence Level

Potential Risks

Market corrections or negative news could impact the bullish trend, leading to price declines.

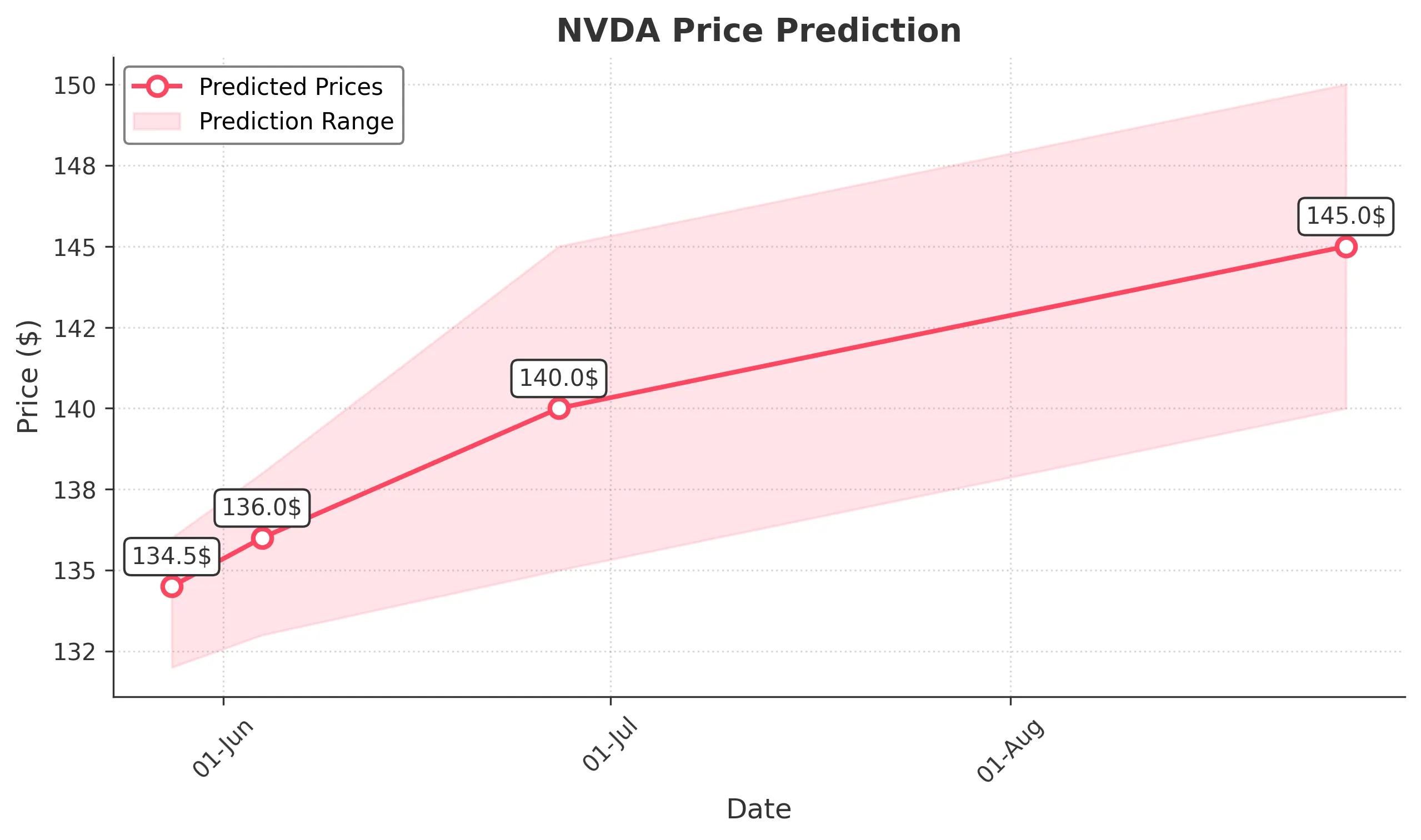

3 Months Prediction

Target: August 27, 2025$145

$143

$150

$140

Description

The stock is expected to continue its upward trend, potentially reaching $145. The MACD remains bullish, and the overall market sentiment is positive. However, external economic factors could introduce volatility.

Analysis

NVDA has demonstrated a strong bullish trend over the past three months, recovering from significant lows. Key support levels are established, but the potential for market volatility remains. Technical indicators suggest continued upward momentum, but caution is advised.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to significant price fluctuations.