NVDA Trading Predictions

1 Day Prediction

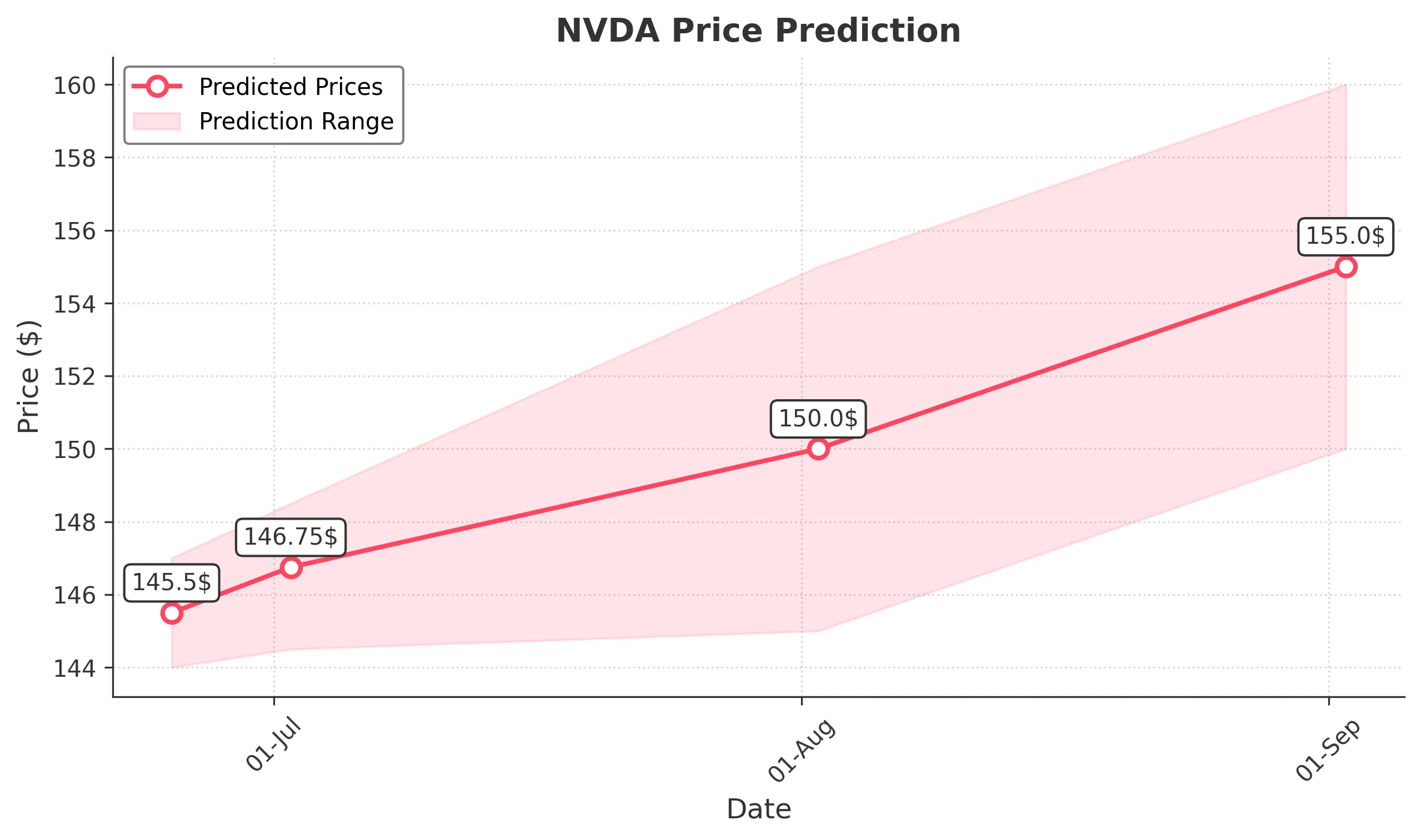

Target: June 25, 2025$145.5

$145

$147

$144

Description

The stock shows bullish momentum with a recent close above the 50-day moving average. RSI is neutral, indicating potential for upward movement. Volume has been stable, suggesting sustained interest. However, market sentiment remains cautious due to macroeconomic factors.

Analysis

Over the past 3 months, NVDA has shown a bullish trend with significant support at $140. Recent price action indicates a recovery from a dip, with the stock bouncing off the $140 level. The MACD is positive, and Bollinger Bands suggest a potential breakout.

Confidence Level

Potential Risks

Potential volatility due to external market news could impact the prediction.

1 Week Prediction

Target: July 2, 2025$146.75

$145.5

$148.5

$144.5

Description

The stock is expected to maintain its upward trajectory, supported by recent bullish candlestick patterns. The MACD remains positive, and the RSI indicates room for growth. However, external economic factors could introduce volatility.

Analysis

NVDA has been trending upward, with key resistance at $150. The stock has shown resilience, bouncing back from recent lows. Volume spikes during upward movements indicate strong buying interest, while the ATR suggests moderate volatility.

Confidence Level

Potential Risks

Market corrections or negative news could lead to unexpected price movements.

1 Month Prediction

Target: August 2, 2025$150

$146.5

$155

$145

Description

With continued bullish momentum and positive market sentiment, NVDA is likely to reach $150. The stock is supported by strong fundamentals and technical indicators. However, any macroeconomic shifts could impact this trajectory.

Analysis

The stock has shown a strong recovery, with significant support at $140. The recent price action indicates a bullish trend, with the MACD and RSI supporting further gains. However, external factors could introduce risks.

Confidence Level

Potential Risks

Economic downturns or sector-specific issues could hinder growth.

3 Months Prediction

Target: September 2, 2025$155

$152

$160

$150

Description

Assuming continued positive market conditions, NVDA could reach $155. The stock's upward trend is supported by strong technical indicators. However, potential market corrections and economic uncertainties could pose risks.

Analysis

Over the past three months, NVDA has shown a bullish trend with key resistance at $160. The stock's performance has been influenced by strong earnings and positive market sentiment. However, external economic factors could introduce volatility.

Confidence Level

Potential Risks

Unforeseen market events or economic downturns could significantly affect the stock's performance.