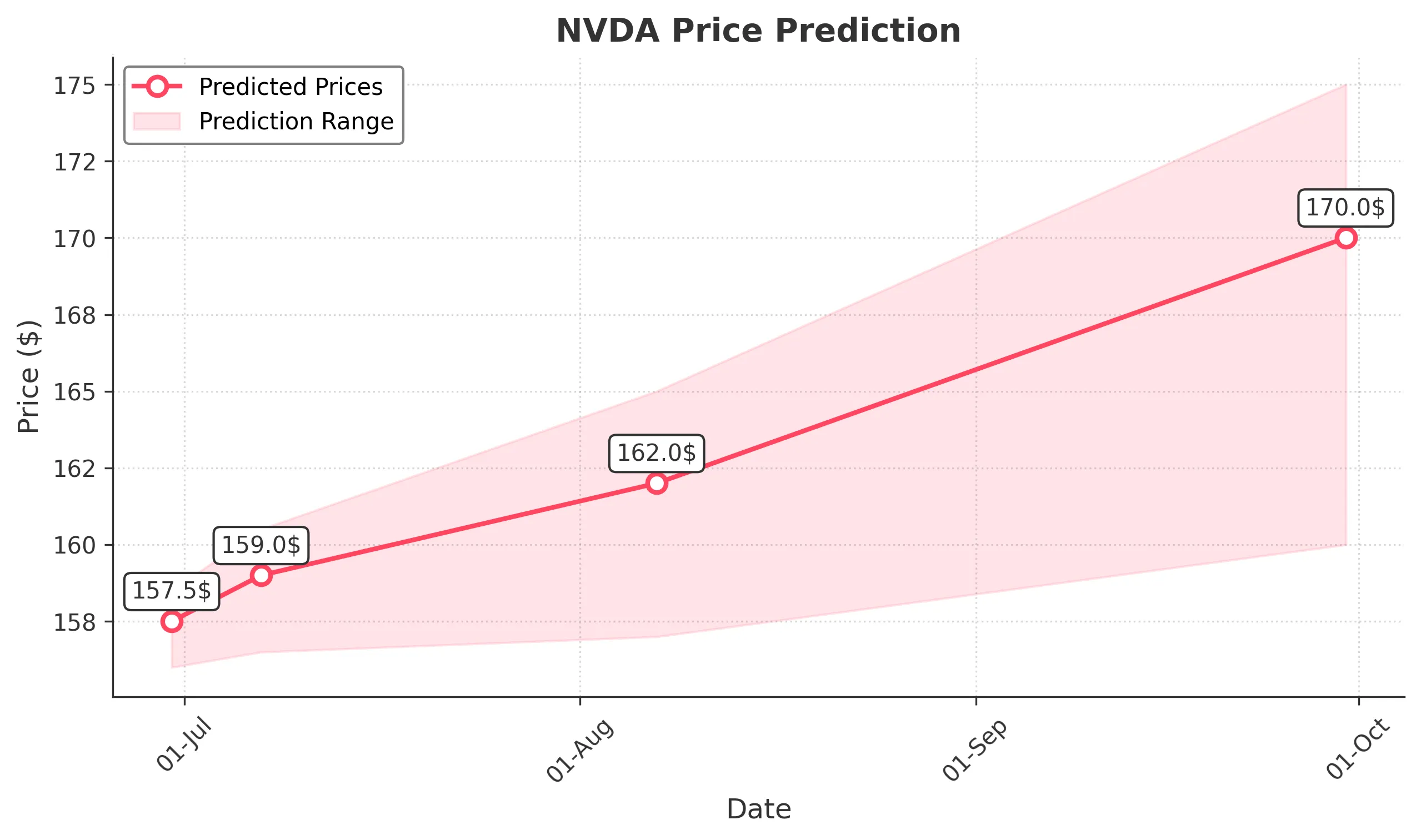

NVDA Trading Predictions

1 Day Prediction

Target: June 30, 2025$157.5

$157

$158.5

$156

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong volume and positive market sentiment suggest a close around 157.500.

Analysis

Over the past 3 months, NVDA has shown a bullish trend, recovering from lows in April. Key resistance at 158.500 and support around 145. The MACD indicates upward momentum, while volume spikes suggest strong buying interest.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI and market volatility.

1 Week Prediction

Target: July 7, 2025$159

$158

$160.5

$156.5

Description

The upward trend is expected to continue, supported by strong buying volume. The MACD remains bullish, and the stock is likely to test resistance at 160.500. However, watch for potential profit-taking.

Analysis

NVDA has been on a bullish run, with significant support at 145. The recent price action shows strong buying interest, but the RSI indicates potential overbought conditions. A balanced view suggests caution for short-term traders.

Confidence Level

Potential Risks

Market sentiment could shift, leading to profit-taking and volatility.

1 Month Prediction

Target: August 7, 2025$162

$160

$165

$157

Description

The stock is expected to continue its upward trajectory, with strong fundamentals supporting growth. The Fibonacci retracement levels suggest a target of 162.000, but watch for potential resistance at 165.000.

Analysis

In the last three months, NVDA has shown resilience, bouncing back from lows. The MACD and moving averages indicate bullish momentum, but the market remains sensitive to macroeconomic news and earnings results.

Confidence Level

Potential Risks

External market factors and earnings reports could impact performance.

3 Months Prediction

Target: September 30, 2025$170

$165

$175

$160

Description

Long-term bullish sentiment is supported by strong fundamentals and market trends. The stock may face resistance at 175.000, but overall growth is expected as the tech sector remains strong.

Analysis

NVDA's performance has been strong, with key support at 145 and resistance at 175. The stock's upward trend is supported by positive market sentiment, but external factors such as interest rates and tech sector performance could introduce risks.

Confidence Level

Potential Risks

Market volatility and economic conditions could lead to unexpected downturns.