NVDA Trading Predictions

1 Day Prediction

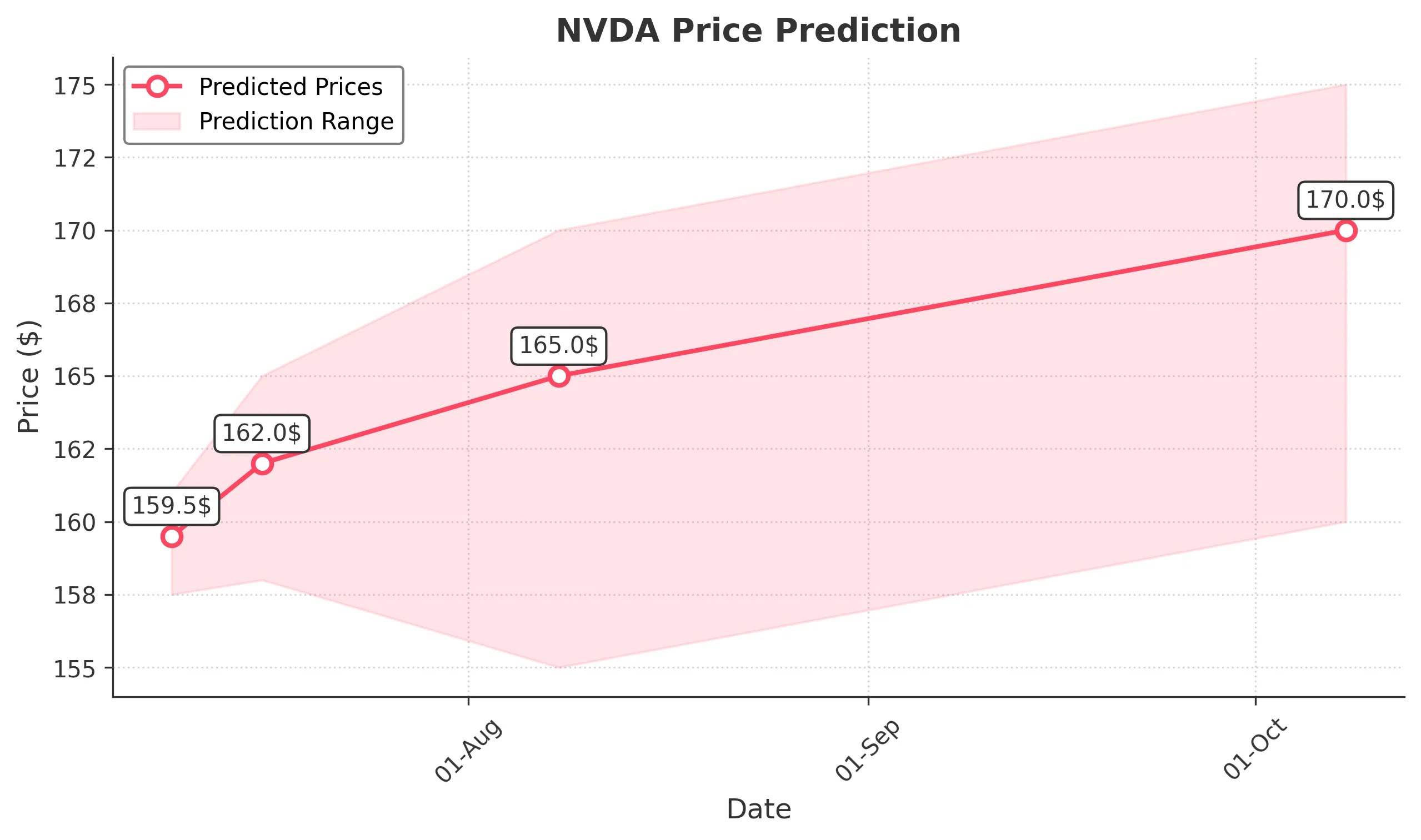

Target: July 9, 2025$159.5

$158.5

$161

$157.5

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, the MACD remains positive, suggesting continued upward movement. Volume is expected to be moderate.

Analysis

Over the past 3 months, NVDA has shown a bullish trend, with significant support at $150 and resistance around $160. The recent price action indicates strong buying interest, but the RSI nearing overbought levels suggests caution.

Confidence Level

Potential Risks

Potential market volatility and profit-taking could lead to a price pullback.

1 Week Prediction

Target: July 16, 2025$162

$159.5

$165

$158

Description

The upward trend is expected to continue, supported by strong buying volume. The MACD indicates bullish momentum, while the Bollinger Bands suggest potential for a breakout. However, the RSI indicates overbought conditions.

Analysis

NVDA has maintained a bullish trend with key support at $150. The stock has shown strong volume spikes, indicating investor interest. However, the RSI suggests caution as it approaches overbought territory, which could lead to a pullback.

Confidence Level

Potential Risks

Market corrections or negative news could impact the bullish trend.

1 Month Prediction

Target: August 8, 2025$165

$162

$170

$155

Description

The stock is expected to continue its upward trajectory, supported by strong fundamentals and market sentiment. The MACD remains bullish, and the price is above the 50-day moving average. However, the RSI indicates potential overbought conditions.

Analysis

In the last three months, NVDA has shown a strong bullish trend with significant resistance at $170. The stock's performance has been supported by positive market sentiment and strong volume, but caution is warranted due to overbought signals.

Confidence Level

Potential Risks

Economic factors or earnings reports could lead to volatility.

3 Months Prediction

Target: October 8, 2025$170

$165

$175

$160

Description

The stock is projected to maintain its bullish trend, driven by strong demand and positive market conditions. The MACD remains favorable, and the price is expected to test higher resistance levels. However, external economic factors could introduce volatility.

Analysis

NVDA has shown a consistent upward trend over the past three months, with key support at $160 and resistance at $175. The stock's performance has been bolstered by strong volume and positive sentiment, but potential market corrections should be monitored.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings surprises could impact the stock's performance.