NVDA Trading Predictions

1 Day Prediction

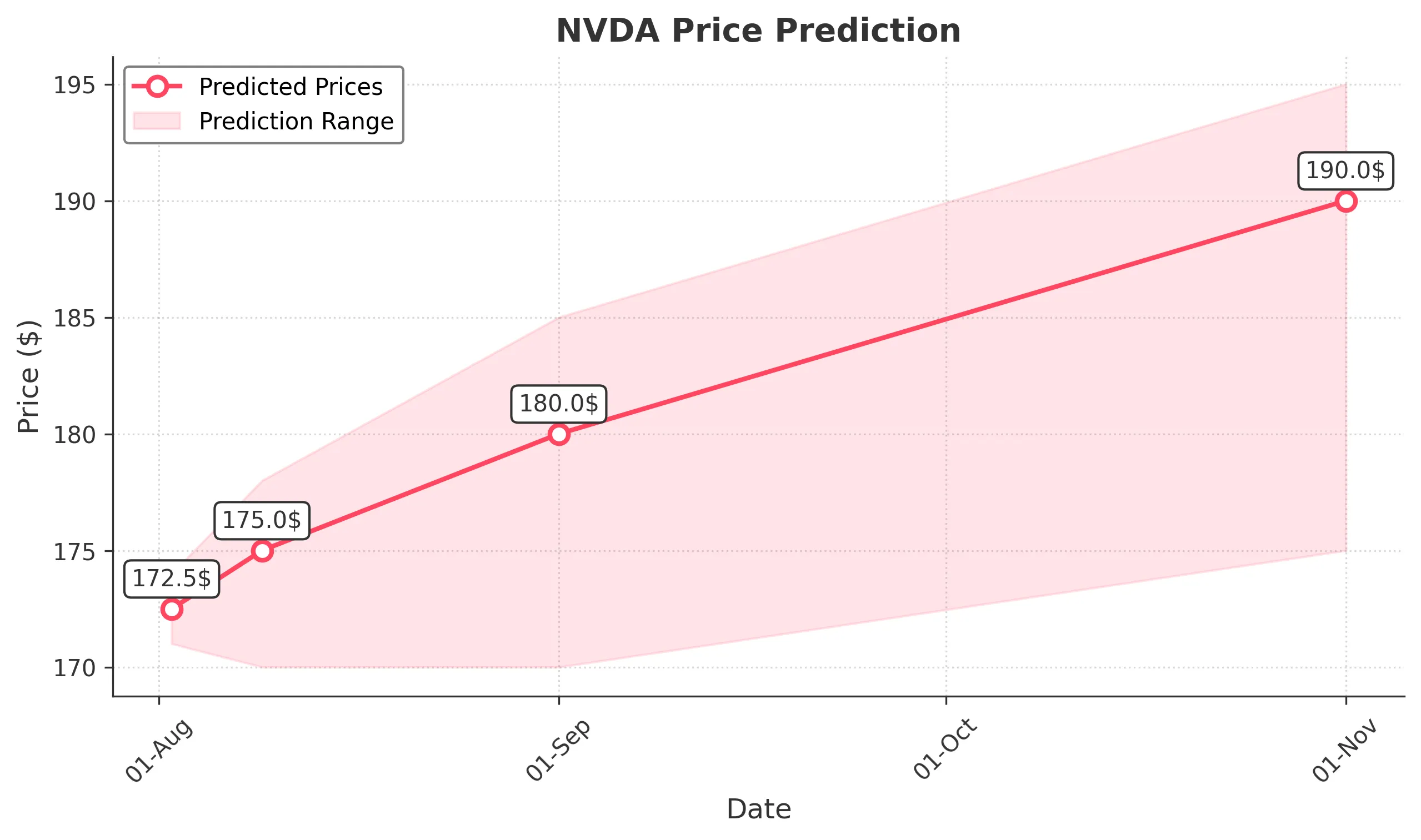

Target: August 2, 2025$172.5

$173

$174

$171

Description

The stock shows a slight bearish trend with a potential close around 172.50. Recent candlestick patterns indicate indecision, and the RSI is approaching overbought levels, suggesting a pullback may occur.

Analysis

Over the past 3 months, NVDA has shown a bullish trend with significant upward movements. Key support is around 170, while resistance is near 180. The RSI indicates potential overbought conditions, and recent volume spikes suggest increased interest.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: August 9, 2025$175

$172.5

$178

$170

Description

Expect a slight recovery to 175.00 as the stock may bounce off support levels. The MACD shows a bullish crossover, indicating potential upward momentum, but caution is advised due to recent volatility.

Analysis

The stock has been volatile, with significant price swings. The recent high of 179 suggests strong resistance, while support at 170 is critical. The ATR indicates increased volatility, and the market sentiment remains mixed.

Confidence Level

Potential Risks

Unforeseen market events could lead to a reversal in trend.

1 Month Prediction

Target: September 1, 2025$180

$175

$185

$170

Description

A bullish outlook with a target of 180.00 as the stock may break through resistance levels. The Fibonacci retracement levels suggest a potential upward trend, supported by positive market sentiment.

Analysis

The stock has shown strong bullish momentum, with key support at 170 and resistance at 180. The RSI is approaching neutral, indicating potential for further gains. Volume trends suggest sustained interest from investors.

Confidence Level

Potential Risks

Economic indicators and earnings reports could impact performance.

3 Months Prediction

Target: November 1, 2025$190

$180

$195

$175

Description

Long-term bullish trend expected, with a target of 190.00. The stock is likely to benefit from positive earnings and market sentiment, but caution is warranted due to potential market corrections.

Analysis

Over the last three months, NVDA has shown a strong upward trend, with significant price increases. Key support is at 175, while resistance is at 195. The overall market sentiment is positive, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market corrections and economic downturns could affect the stock's performance.