NVDA Trading Predictions

1 Day Prediction

Target: August 9, 2025$182.5

$181.8

$184

$180

Description

The stock shows bullish momentum with a recent upward trend. The RSI is nearing overbought levels, indicating potential for a pullback. However, strong buying volume suggests continued interest. Expect a close around 182.50.

Analysis

Over the past 3 months, NVDA has shown a bullish trend, with significant support at $170 and resistance around $185. The recent price action indicates strong buying interest, but the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI; market sentiment could shift quickly.

1 Week Prediction

Target: August 16, 2025$185

$182.5

$188

$180

Description

The bullish trend is expected to continue, with strong support at $180. The MACD shows a bullish crossover, and volume remains robust. Anticipate a close around $185 as momentum builds.

Analysis

NVDA has maintained a bullish trend, with key support at $180 and resistance at $188. The MACD indicates bullish momentum, but the market's overall sentiment and potential macroeconomic events could introduce volatility.

Confidence Level

Potential Risks

Market volatility and external factors could impact momentum; watch for any bearish signals.

1 Month Prediction

Target: September 8, 2025$190

$185

$195

$180

Description

Expect continued bullish momentum as NVDA approaches key Fibonacci retracement levels. The market sentiment remains positive, but watch for potential resistance at $195.

Analysis

The stock has shown a strong upward trajectory, with significant support at $180. The Fibonacci levels suggest potential resistance around $195. While the trend is bullish, external economic factors could introduce volatility.

Confidence Level

Potential Risks

Potential market corrections and external economic factors could affect the upward trend.

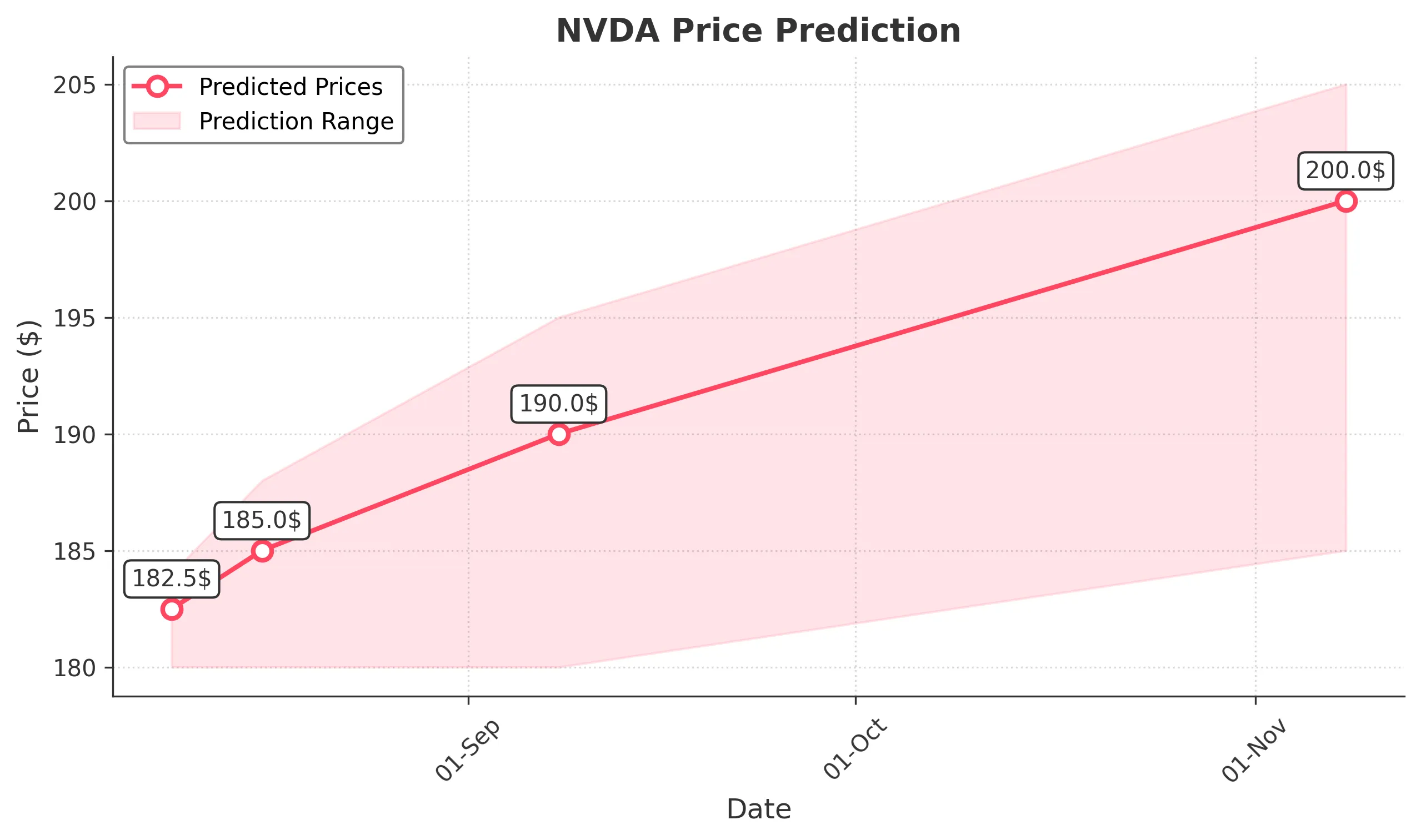

3 Months Prediction

Target: November 8, 2025$200

$190

$205

$185

Description

Long-term bullish outlook as NVDA continues to capitalize on market trends. However, watch for potential corrections as the stock approaches $205 resistance.

Analysis

Over the past three months, NVDA has shown a strong bullish trend, with key support at $180 and resistance at $205. The overall market sentiment is positive, but potential economic shifts could introduce volatility and corrections.

Confidence Level

Potential Risks

Market corrections and economic shifts could impact the stock's performance; remain cautious.