NVDA Trading Predictions

1 Day Prediction

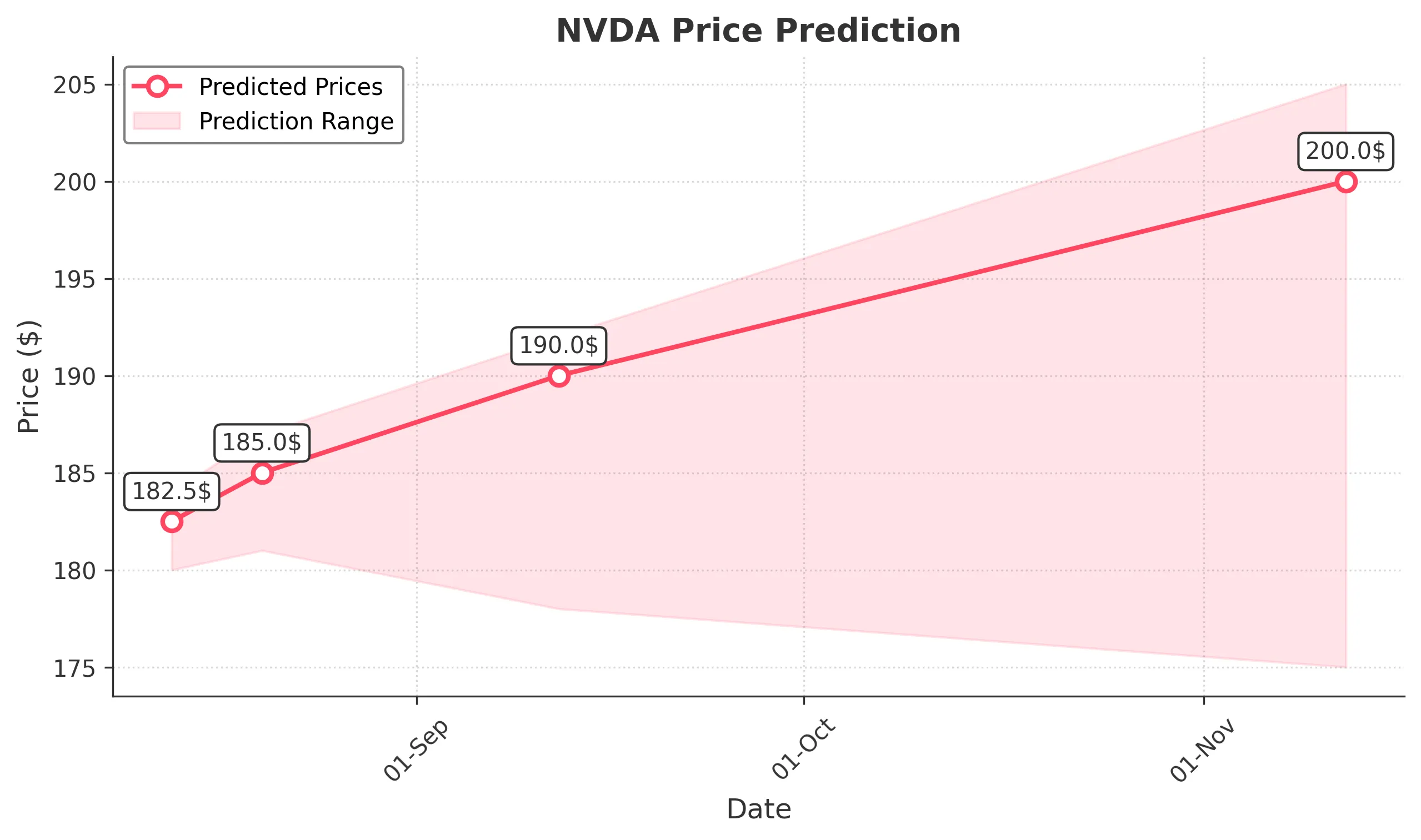

Target: August 13, 2025$182.5

$182

$184

$180

Description

The stock shows a bullish trend with a recent upward movement. The RSI is nearing overbought levels, indicating potential for a pullback. However, strong support at 180.00 suggests limited downside risk. Volume remains stable, supporting the upward momentum.

Analysis

Over the past 3 months, NVDA has shown a bullish trend with significant upward movements. Key support is at 180.00, while resistance is around 184.00. The MACD indicates bullish momentum, but the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Potential market volatility and external news could impact the prediction.

1 Week Prediction

Target: August 20, 2025$185

$182.5

$187

$181

Description

The stock is expected to continue its upward trajectory, supported by strong buying interest. The MACD remains bullish, and the recent candlestick patterns indicate a continuation of the trend. However, watch for potential resistance at 187.00.

Analysis

NVDA has maintained a bullish trend with increasing volume. The recent price action shows higher highs and higher lows, indicating strong momentum. Key resistance at 187.00 may pose a challenge, while support remains at 180.00.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and any negative news could reverse the trend.

1 Month Prediction

Target: September 12, 2025$190

$185

$192

$178

Description

The bullish trend is expected to persist as NVDA approaches key Fibonacci retracement levels. The overall market sentiment remains positive, but caution is advised as the stock approaches overbought conditions.

Analysis

In the last three months, NVDA has shown strong performance with significant price increases. The stock is approaching key Fibonacci levels, which may act as resistance. The RSI indicates potential overbought conditions, suggesting a possible pullback.

Confidence Level

Potential Risks

Economic indicators and earnings reports could introduce volatility.

3 Months Prediction

Target: November 12, 2025$200

$190

$205

$175

Description

Long-term bullish sentiment is supported by strong fundamentals and market trends. However, potential economic headwinds could impact growth. The stock may face resistance at 205.00, but strong support at 175.00 should provide a safety net.

Analysis

NVDA has shown a robust upward trend over the past three months, with significant price gains. Key support is at 175.00, while resistance is at 205.00. The overall market sentiment is positive, but external economic factors could introduce risks.

Confidence Level

Potential Risks

Macroeconomic factors and market corrections could lead to unexpected volatility.