OIL Trading Predictions

1 Day Prediction

Target: April 3, 2025$71.5

$71.2

$72

$70.8

Description

The stock shows a slight bullish trend with a recent close of 71.129997. The RSI is neutral, and MACD indicates potential upward momentum. However, recent volatility suggests caution. Expect a close around 71.50.

Analysis

Over the past 3 months, CL=F has shown a bearish trend with significant support around 68.00. Recent price action indicates a potential reversal, but volatility remains high. The MACD is showing signs of bullish divergence, while the RSI is neutral.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: April 10, 2025$72

$71.8

$73

$71

Description

With a potential upward trend indicated by recent price action and a bullish MACD crossover, the stock may close around 72.00. However, resistance at 73.00 could limit gains.

Analysis

The stock has been trading sideways with a slight bullish bias. Key resistance at 73.00 and support at 68.00 are critical. Volume has been stable, but any significant news could alter the trend.

Confidence Level

Potential Risks

Resistance levels and external market factors could lead to price fluctuations, impacting the accuracy of this prediction.

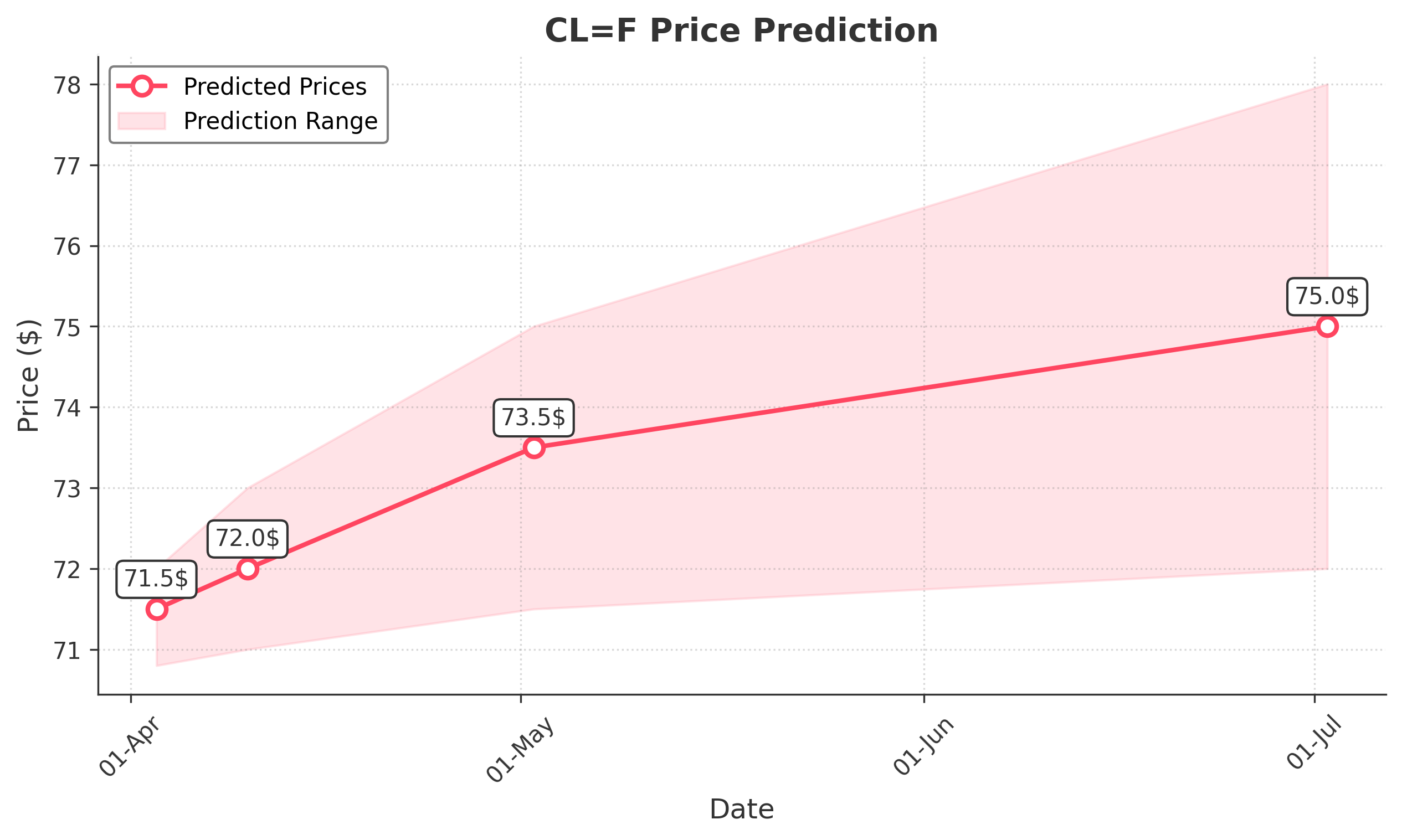

1 Month Prediction

Target: May 2, 2025$73.5

$72.5

$75

$71.5

Description

Expect a gradual increase towards 73.50 as bullish sentiment builds. The stock may face resistance at 75.00, but overall market conditions appear favorable.

Analysis

The stock has shown resilience with a recent upward trend. The MACD is bullish, and the RSI is approaching overbought territory. Key support at 71.50 and resistance at 75.00 will be crucial in the coming month.

Confidence Level

Potential Risks

Unexpected market events or earnings surprises could lead to volatility, affecting the prediction.

3 Months Prediction

Target: July 2, 2025$75

$74

$78

$72

Description

Long-term outlook suggests a bullish trend with a target close of 75.00. Market sentiment and technical indicators support this, but watch for potential pullbacks.

Analysis

The stock has been in a recovery phase, with key support at 72.00 and resistance at 78.00. The overall trend is bullish, but external factors such as economic data releases could introduce uncertainty.

Confidence Level

Potential Risks

Market volatility and economic conditions could impact the stock's performance, leading to potential corrections.