OIL Trading Predictions

1 Day Prediction

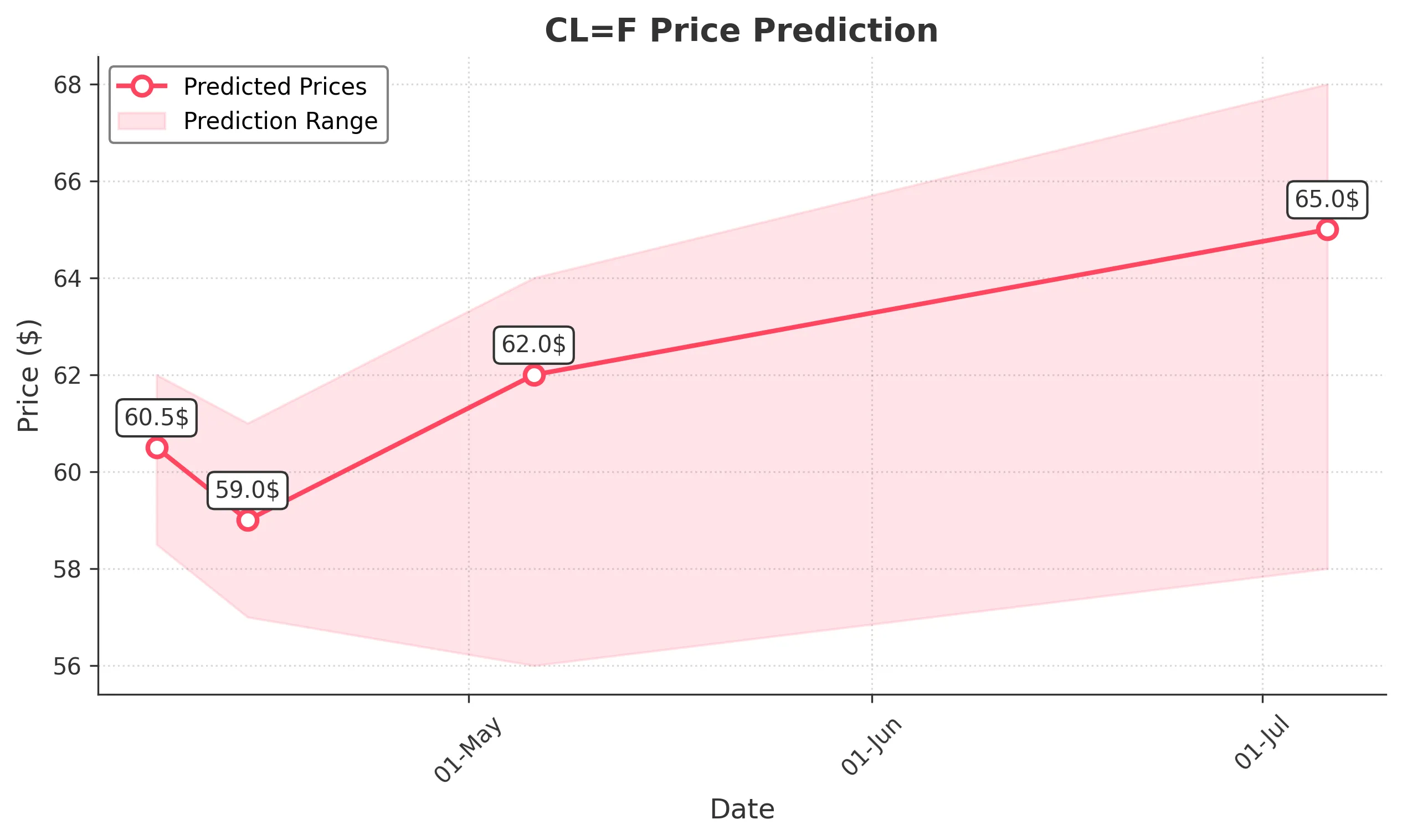

Target: April 7, 2025$60.5

$60

$62

$58.5

Description

The stock shows bearish momentum with a recent downtrend. The RSI indicates oversold conditions, but a potential bounce could occur. However, the MACD is bearish, suggesting continued weakness. Volume is low, indicating lack of conviction.

Analysis

Over the past 3 months, CL=F has shown a bearish trend, with significant resistance around 72. The recent drop below 66 indicates a potential continuation of this trend. The ATR suggests increased volatility, and the volume patterns show declining interest.

Confidence Level

Potential Risks

Market sentiment is weak, and any negative news could exacerbate the decline.

1 Week Prediction

Target: April 14, 2025$59

$59.5

$61

$57

Description

The bearish trend is expected to continue, with potential support at 57. The MACD remains negative, and the RSI is still low, indicating weak buying pressure. A lack of significant volume suggests limited interest in recovery.

Analysis

The stock has been in a downtrend, with key support at 57. The recent price action shows a lack of bullish reversal signals. The Bollinger Bands indicate a squeeze, suggesting potential volatility, but the overall sentiment remains bearish.

Confidence Level

Potential Risks

Any macroeconomic news could impact the stock's performance, leading to unexpected volatility.

1 Month Prediction

Target: May 6, 2025$62

$60

$64

$56

Description

A potential recovery could occur as the stock approaches key support levels. The RSI may begin to show bullish divergence, indicating a possible reversal. However, the MACD remains bearish, suggesting caution.

Analysis

The stock has been under pressure, but a potential bounce off support levels could lead to a short-term recovery. The volume patterns indicate a lack of strong buying interest, and the overall market sentiment remains cautious.

Confidence Level

Potential Risks

The market remains volatile, and any negative news could hinder recovery efforts.

3 Months Prediction

Target: July 6, 2025$65

$64

$68

$58

Description

If the stock can stabilize above 60, a gradual recovery may occur. The potential for bullish patterns to emerge exists, but the MACD and RSI need to confirm a trend reversal. Volume should increase to support any upward movement.

Analysis

The stock has faced significant downward pressure, with key resistance at 68. The overall trend remains bearish, but a recovery could be possible if market conditions improve. The ATR indicates potential volatility, and external economic factors could play a crucial role.

Confidence Level

Potential Risks

Long-term trends are uncertain, and external factors could significantly impact performance.