OIL Trading Predictions

1 Day Prediction

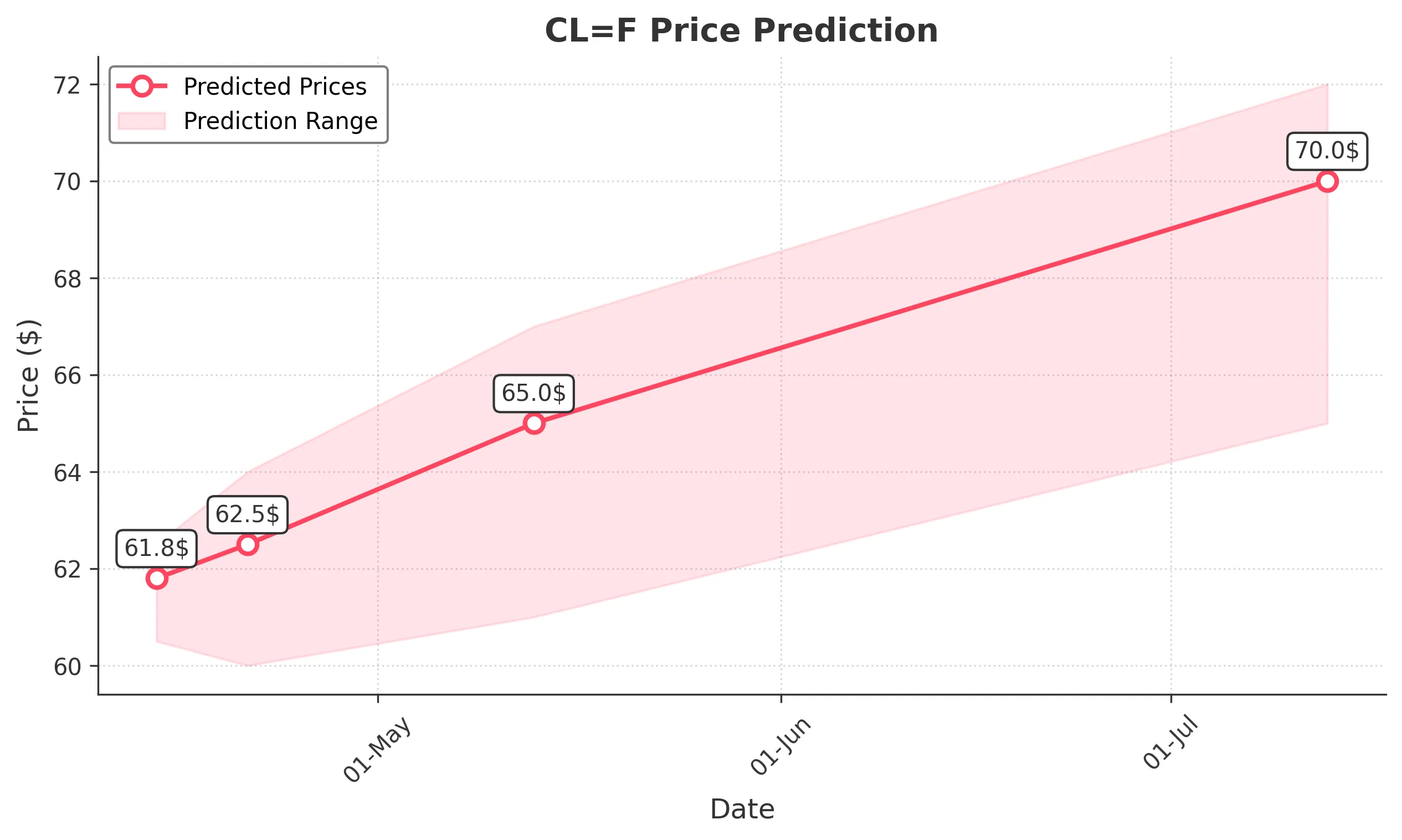

Target: April 14, 2025$61.8

$61.75

$62.5

$60.5

Description

The stock shows a slight bullish trend with a potential bounce from recent lows. RSI indicates oversold conditions, while MACD is showing a bullish crossover. However, volatility remains high, suggesting caution.

Analysis

Over the past 3 months, CL=F has experienced a bearish trend with significant volatility. Key support at 60.00 and resistance around 70.00. Recent candlestick patterns indicate indecision, and volume spikes suggest potential reversals.

Confidence Level

Potential Risks

Market sentiment is fragile, and external factors could lead to sudden price drops.

1 Week Prediction

Target: April 21, 2025$62.5

$61.8

$64

$60

Description

Expect a gradual recovery as the stock may find support at 60.00. The RSI is improving, and MACD shows potential bullish momentum. However, external economic factors could impact performance.

Analysis

The stock has been in a downtrend, with recent attempts to stabilize. Key resistance at 64.00 and support at 60.00. Volume analysis shows increased activity, indicating potential interest from buyers.

Confidence Level

Potential Risks

Economic data releases or geopolitical events could create volatility, affecting the prediction.

1 Month Prediction

Target: May 13, 2025$65

$62.5

$67

$61

Description

A recovery trend is anticipated as the stock stabilizes. The MACD may confirm bullish momentum, and RSI is expected to rise. However, market sentiment remains cautious due to macroeconomic uncertainties.

Analysis

The stock has shown signs of recovery, with key support at 60.00 and resistance at 67.00. Technical indicators suggest a potential bullish reversal, but external factors could introduce volatility.

Confidence Level

Potential Risks

Potential market corrections or negative news could derail the upward momentum.

3 Months Prediction

Target: July 13, 2025$70

$66.5

$72

$65

Description

If the recovery continues, the stock could reach 70.00, supported by improving fundamentals and market sentiment. However, macroeconomic conditions and potential resistance levels must be monitored.

Analysis

The stock is expected to recover gradually, with key resistance at 72.00 and support at 65.00. Recent volume trends indicate increased interest, but external factors could impact the overall market sentiment.

Confidence Level

Potential Risks

Economic downturns or unexpected news could lead to a reversal in the bullish trend.