OIL Trading Predictions

1 Day Prediction

Target: April 24, 2025$64.8

$64.5

$65.5

$63.5

Description

The stock shows a slight bullish trend with a recent close above the 20-day moving average. RSI indicates neutral momentum, while MACD is showing a potential bullish crossover. However, recent volatility suggests caution.

Analysis

Over the past 3 months, CL=F has experienced significant volatility, with a bearish trend in early April followed by a recovery. Key support is around $60, while resistance is near $66. Volume spikes indicate potential interest, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market sentiment could shift due to external factors, and a reversal is possible if selling pressure increases.

1 Week Prediction

Target: May 1, 2025$65.5

$64.8

$66

$63

Description

The stock is expected to continue its upward momentum, supported by recent bullish candlestick patterns. The MACD remains positive, and the RSI is approaching overbought territory, indicating potential for a pullback.

Analysis

The stock has shown a recovery from recent lows, with a bullish trend emerging. Key resistance at $66 may limit upside potential, while support at $63 remains critical. Volume trends suggest increased interest, but caution is warranted.

Confidence Level

Potential Risks

Potential market corrections and external economic news could impact the stock's performance.

1 Month Prediction

Target: May 23, 2025$67.5

$66

$68.5

$64

Description

A continued bullish trend is anticipated as the stock breaks above key resistance levels. The RSI may indicate overbought conditions, suggesting a potential pullback. However, strong volume supports upward movement.

Analysis

The stock has shown resilience with a bullish trend, breaking through previous resistance levels. Key support is at $64, while resistance is at $68. Volume patterns indicate strong buying interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market volatility and economic indicators could lead to unexpected price movements.

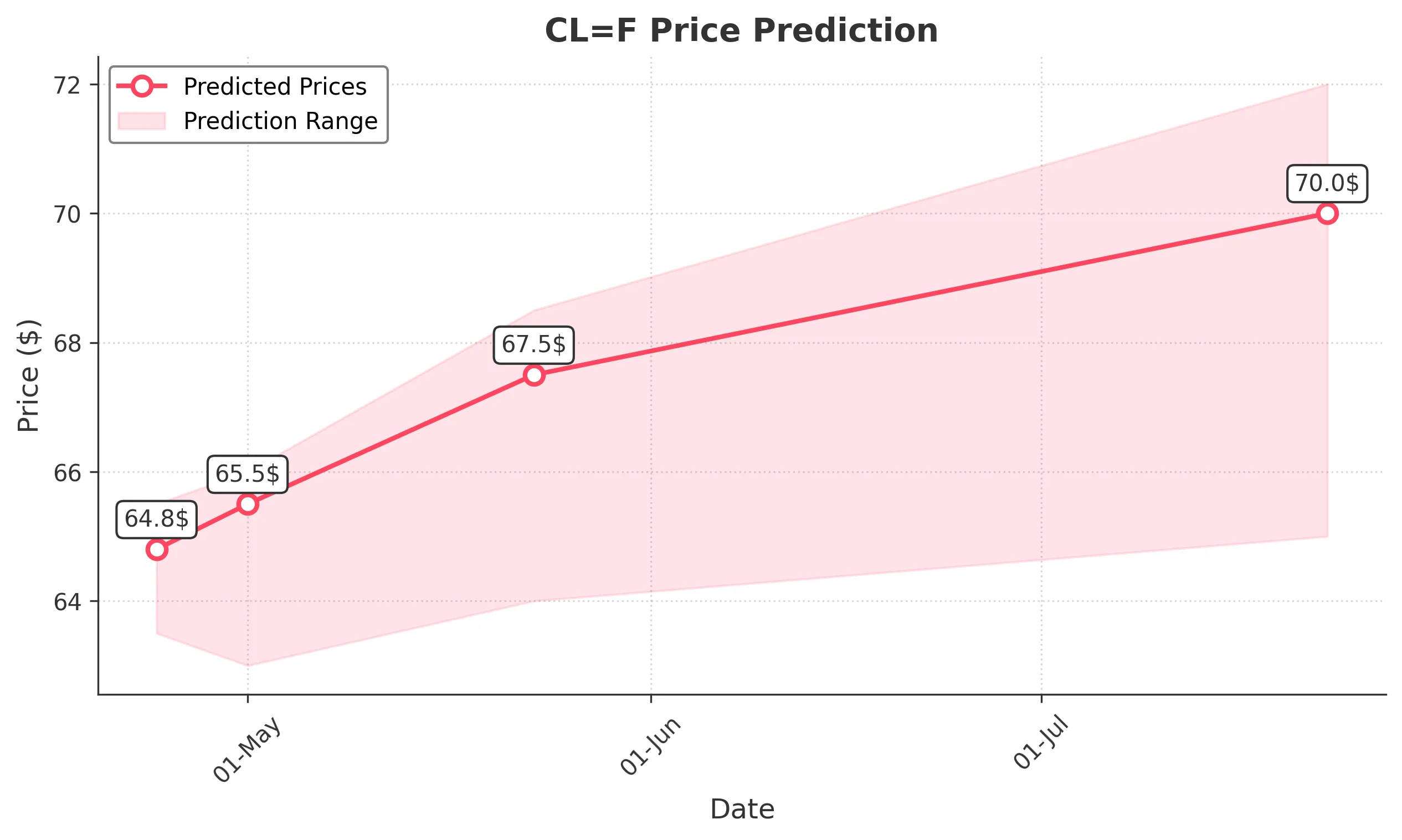

3 Months Prediction

Target: July 23, 2025$70

$68.5

$72

$65

Description

The stock is projected to maintain a bullish trajectory, supported by positive market sentiment and technical indicators. However, potential resistance at $72 may limit gains, and profit-taking could occur.

Analysis

Over the past three months, CL=F has shown a recovery from lows, with a bullish trend emerging. Key resistance at $72 may pose challenges, while support at $65 is critical. Volume trends suggest sustained interest, but external factors could introduce uncertainty.

Confidence Level

Potential Risks

Economic conditions and geopolitical events could impact market sentiment and stock performance.