OIL Trading Predictions

1 Day Prediction

Target: April 28, 2025$63.5

$63.2

$64.2

$62.8

Description

The stock shows a slight bullish trend with a recent close above the 20-day moving average. RSI indicates neutral momentum, while MACD is close to crossing above the signal line. Expect minor fluctuations due to recent volatility.

Analysis

Over the past 3 months, CL=F has shown a bearish trend with significant volatility. Key support at $60 and resistance at $65. Recent volume spikes indicate increased interest, but overall sentiment remains cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Potential for reversal exists if market sentiment shifts or if external news impacts oil prices.

1 Week Prediction

Target: May 5, 2025$64

$63.8

$65.5

$62.5

Description

A potential upward movement is indicated as the stock approaches resistance levels. The Bollinger Bands suggest a squeeze, indicating a breakout may occur. However, RSI is nearing overbought territory, suggesting caution.

Analysis

The stock has been trading sideways with recent attempts to break above resistance. Technical indicators show mixed signals, with MACD indicating potential bullish momentum but RSI suggesting overbought conditions. Volume patterns are inconsistent.

Confidence Level

Potential Risks

Market volatility and external economic news could lead to unexpected price movements.

1 Month Prediction

Target: June 5, 2025$65.5

$64.5

$67

$63

Description

Expect a gradual increase as the stock may break through resistance levels. The Fibonacci retracement levels suggest a target around $66. However, watch for potential pullbacks as market sentiment can shift quickly.

Analysis

The stock has shown resilience with a recent bounce off support levels. Technical indicators suggest a bullish outlook, but caution is warranted due to potential market corrections. Volume analysis indicates growing interest.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could impact oil prices and market sentiment.

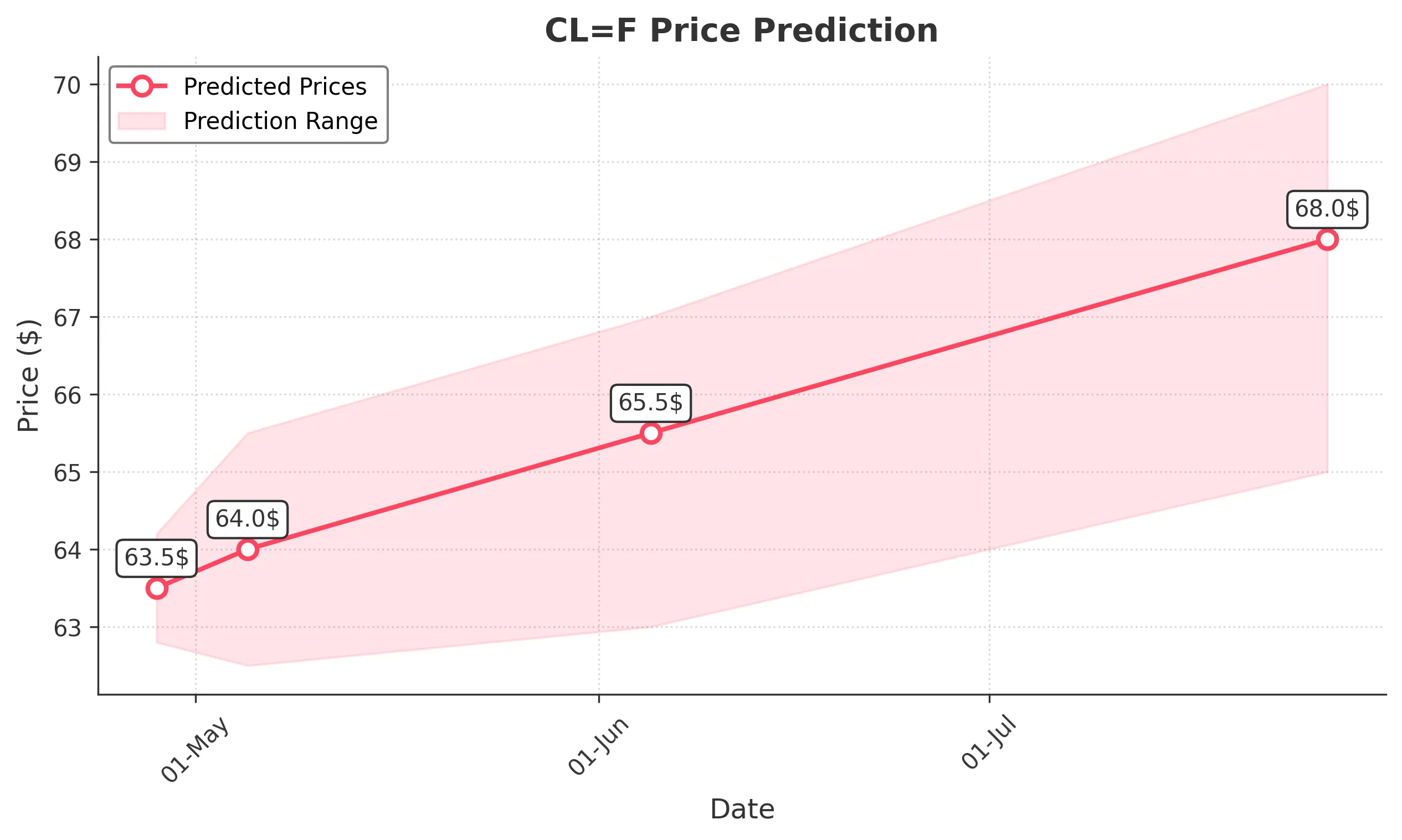

3 Months Prediction

Target: July 27, 2025$68

$67.5

$70

$65

Description

Long-term outlook appears bullish as the stock may continue to trend upwards. The 50-day moving average is likely to cross above the 200-day, indicating a golden cross. However, external factors could introduce volatility.

Analysis

The stock has shown a recovery from recent lows, with key support at $60 and resistance at $70. Technical indicators suggest a bullish trend, but market sentiment remains fragile. Volume patterns indicate cautious optimism.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic downturns could negatively impact oil prices.