OIL Trading Predictions

1 Day Prediction

Target: April 30, 2025$61.800001

$61.700001

$62.5

$61.200001

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates oversold conditions, but MACD is bearish. Expect a minor recovery, but overall sentiment remains cautious due to recent volatility.

Analysis

Over the past 3 months, CL=F has shown a bearish trend with significant volatility. Key support at 61.00 and resistance at 64.00. Volume spikes indicate potential reversals, but overall sentiment is cautious.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to external news or economic data releases, impacting the prediction.

1 Week Prediction

Target: May 7, 2025$62.5

$61.800001

$63.5

$61

Description

A potential rebound is expected as the stock approaches key support levels. The RSI may recover from oversold conditions, and MACD could show signs of bullish divergence, suggesting a short-term upward move.

Analysis

The stock has been in a bearish phase, with significant fluctuations. Support at 61.00 is critical, while resistance at 64.00 looms. Volume analysis shows potential for recovery, but caution is warranted.

Confidence Level

Potential Risks

Uncertainty remains due to macroeconomic factors and potential market corrections that could affect the upward momentum.

1 Month Prediction

Target: May 29, 2025$64

$62.5

$66

$61.5

Description

Expect a gradual recovery as the stock stabilizes. Technical indicators suggest a potential bullish reversal, with MACD crossing above the signal line. Market sentiment may improve if economic indicators are favorable.

Analysis

The stock has shown signs of recovery potential, with key support at 61.00 and resistance at 66.00. Technical indicators suggest a bullish reversal, but external factors could influence performance.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could impact market sentiment and lead to unexpected volatility.

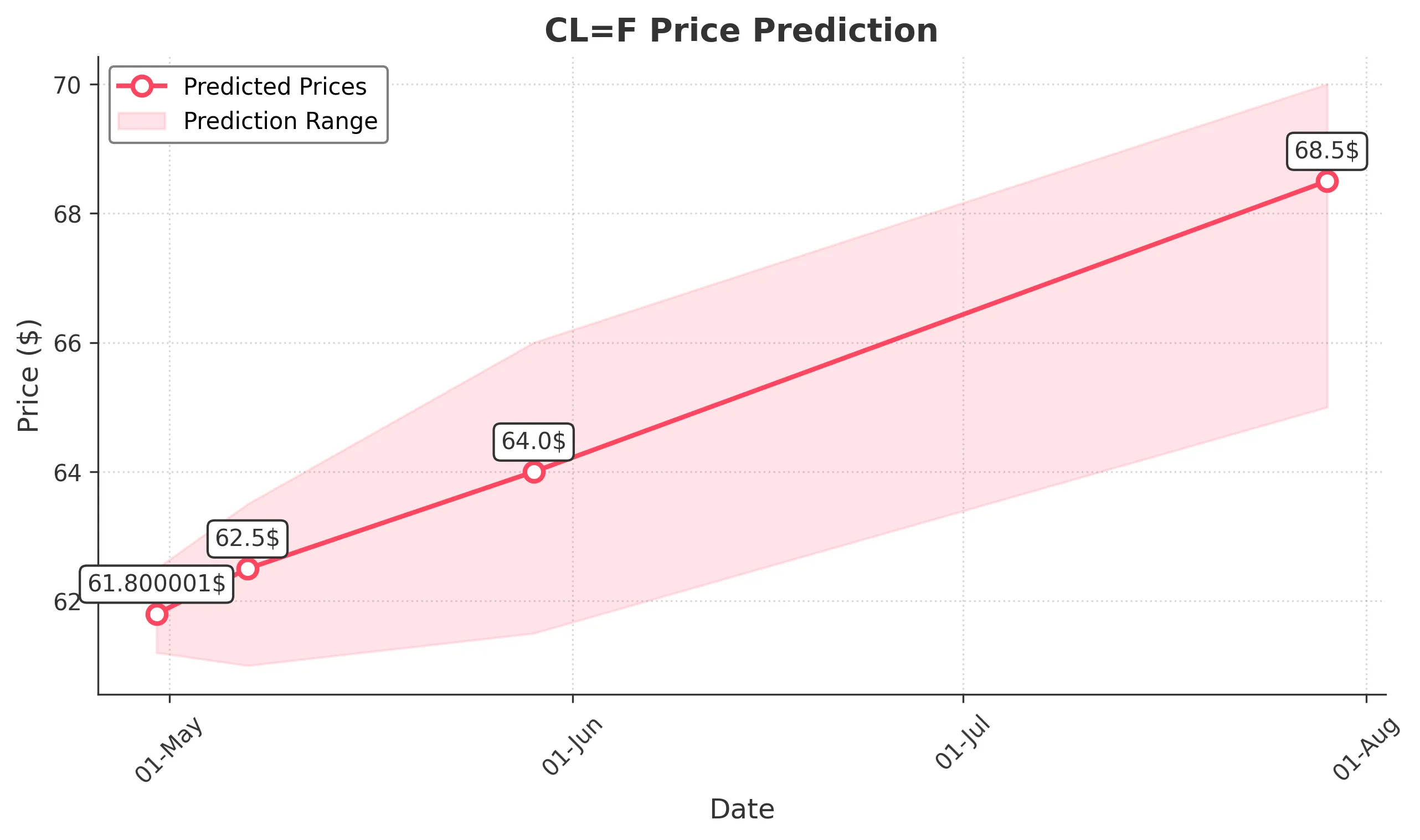

3 Months Prediction

Target: July 29, 2025$68.5

$66

$70

$65

Description

Long-term outlook appears bullish as the stock may break through resistance levels. Positive macroeconomic trends and improved market sentiment could drive prices higher, supported by bullish technical indicators.

Analysis

The stock has been in a bearish trend but shows signs of potential recovery. Key resistance at 70.00 and support at 61.00. Technical indicators suggest a bullish outlook, but external factors could impact performance.

Confidence Level

Potential Risks

Long-term predictions are subject to market volatility and unforeseen economic changes that could alter the trajectory.