OIL Trading Predictions

1 Day Prediction

Target: May 1, 2025$59.5

$59.8

$60.2

$58.8

Description

The stock shows bearish momentum with a recent downtrend. RSI indicates oversold conditions, but MACD is negative. A potential bounce could occur, but overall sentiment remains weak.

Analysis

Over the past 3 months, CL=F has shown a bearish trend, with significant resistance around $64. Recent price action indicates a downward movement, with volume spikes during sell-offs. Technical indicators suggest potential for a short-term bounce, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden positive catalyst may reverse the trend.

1 Week Prediction

Target: May 8, 2025$58

$58.5

$59.5

$57.5

Description

Continued bearish pressure is expected as the stock struggles to maintain upward momentum. The recent downtrend and negative MACD signal further declines.

Analysis

The stock has been in a downtrend, with key support around $58. Technical indicators like the ATR suggest increasing volatility. Volume analysis shows selling pressure, indicating a bearish outlook for the coming week.

Confidence Level

Potential Risks

Unforeseen market events or changes in oil prices could lead to volatility. A reversal pattern could emerge if bullish sentiment returns.

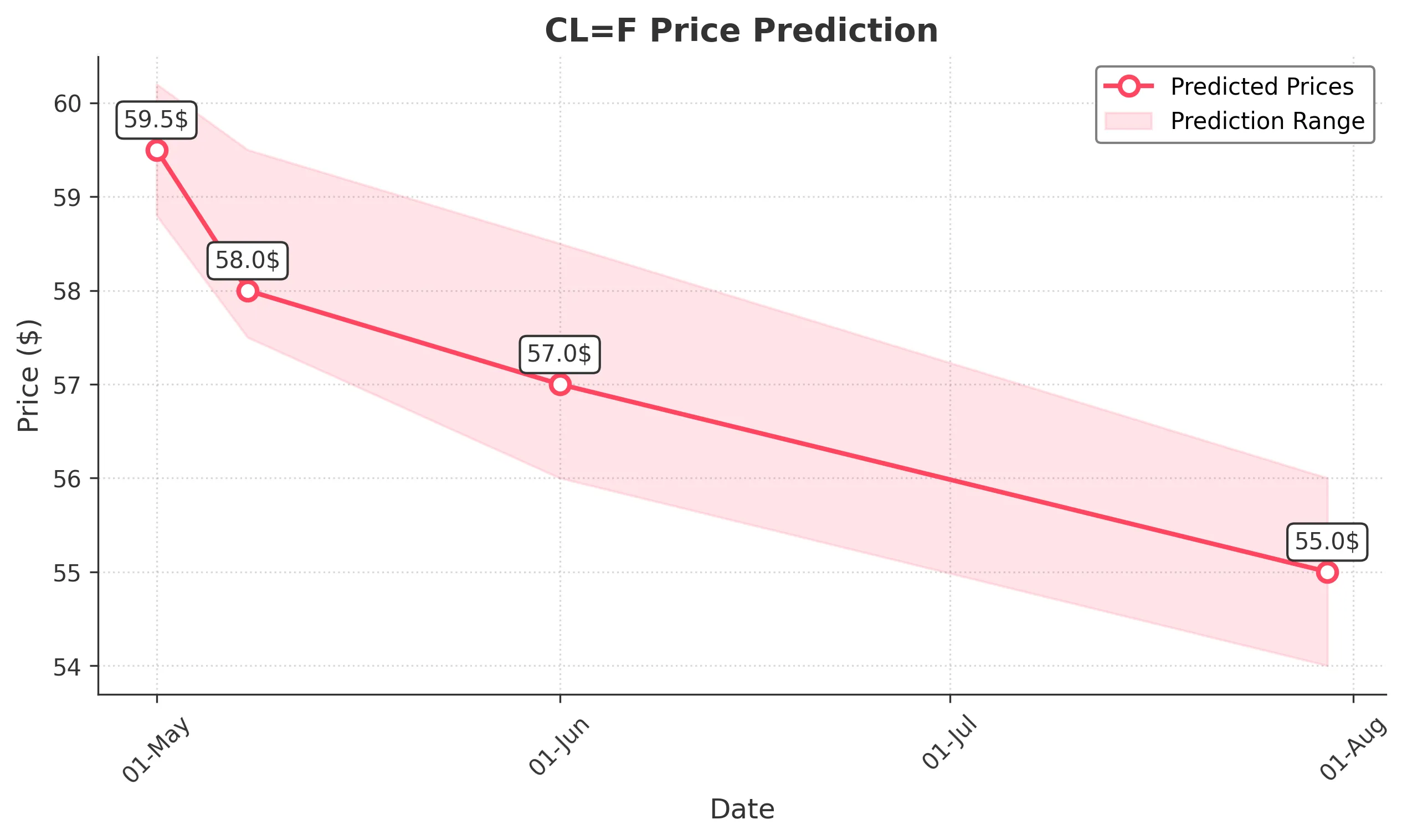

1 Month Prediction

Target: June 1, 2025$57

$57.5

$58.5

$56

Description

The bearish trend is likely to continue, with potential for further declines as market sentiment remains weak. Key support levels will be tested.

Analysis

The stock has faced significant resistance and is trading below key moving averages. Volume patterns indicate a lack of buying interest, and technical indicators suggest further downside potential.

Confidence Level

Potential Risks

Market conditions could change rapidly, and any positive news could lead to a reversal. Watch for signs of bullish patterns.

3 Months Prediction

Target: July 30, 2025$55

$55.5

$56

$54

Description

Long-term bearish outlook as the stock continues to face selling pressure. Key support levels are likely to be tested, with potential for further declines.

Analysis

The stock has been in a prolonged downtrend, with significant resistance levels. Technical indicators suggest a bearish outlook, and volume analysis shows a lack of buying interest. External factors may influence future performance.

Confidence Level

Potential Risks

Macroeconomic factors and oil price fluctuations could significantly impact the stock's performance. A reversal pattern could emerge if bullish sentiment returns.