OIL Trading Predictions

1 Day Prediction

Target: May 28, 2025$61.5

$61.3

$62

$60.8

Description

The stock shows a slight bullish trend with a recent Doji pattern indicating indecision. RSI is neutral, and MACD is close to crossing above the signal line. Expect a minor upward movement.

Analysis

The stock has been trading sideways with slight bullish tendencies. Key support at 60.00 and resistance at 62.00. Volume has been decreasing, indicating potential consolidation.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction.

1 Week Prediction

Target: June 4, 2025$62

$61.8

$63.5

$60.5

Description

Expect a gradual increase as the stock approaches resistance levels. The MACD shows bullish momentum, and the RSI is nearing overbought territory, suggesting caution.

Analysis

The stock has shown resilience but is facing resistance at 63.00. Recent volume spikes indicate interest, but the overall trend remains cautious.

Confidence Level

Potential Risks

Potential for a pullback if resistance holds or if negative news arises.

1 Month Prediction

Target: June 27, 2025$64.5

$62.5

$66

$61

Description

A bullish outlook as the stock breaks through resistance levels. The MACD is bullish, and the RSI is supportive of upward movement. Watch for potential profit-taking.

Analysis

The stock has shown a bullish trend with key support at 61.00. The recent upward momentum is supported by increasing volume, indicating strong buying interest.

Confidence Level

Potential Risks

Market sentiment and macroeconomic factors could lead to volatility.

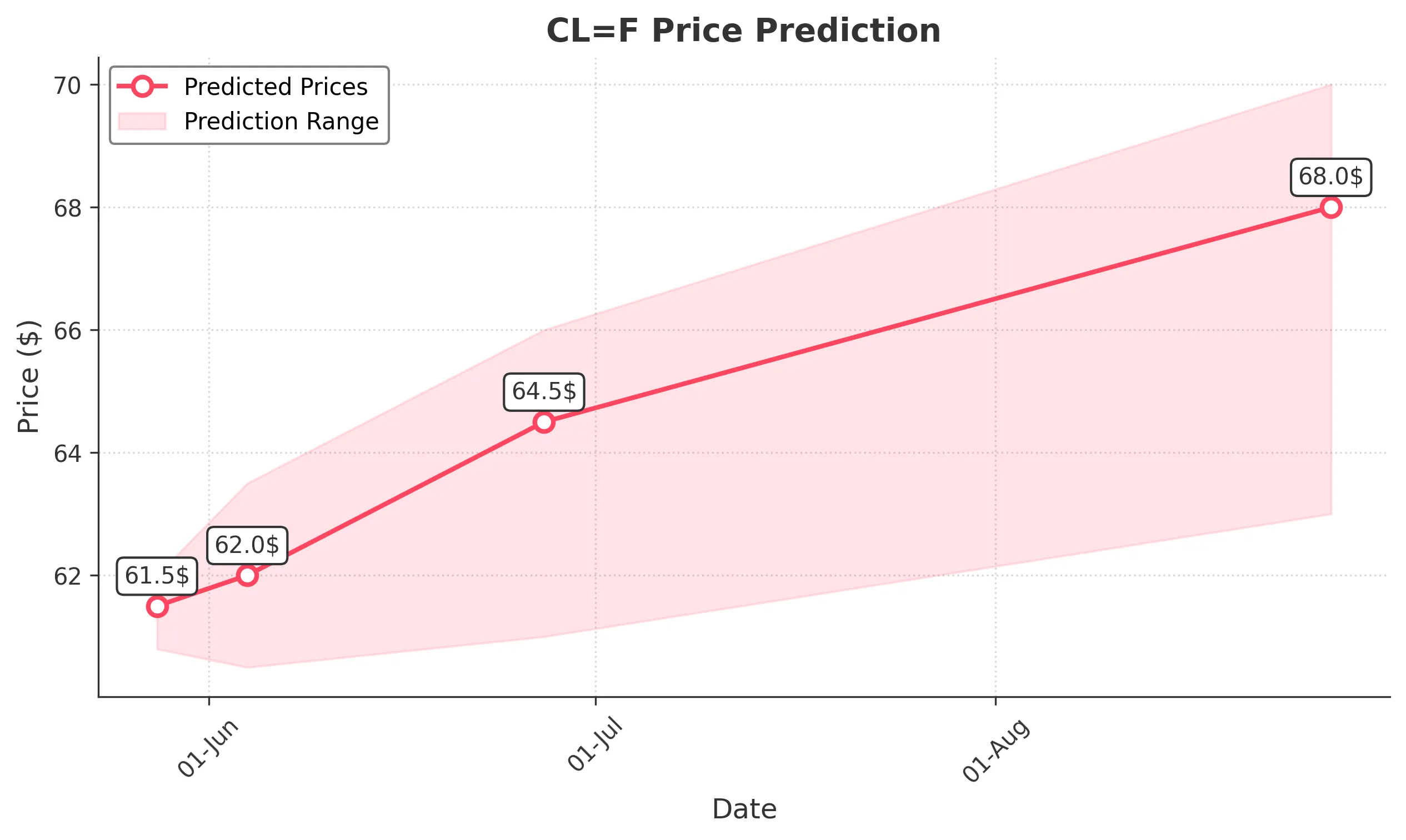

3 Months Prediction

Target: August 27, 2025$68

$65

$70

$63

Description

Long-term bullish trend expected as the stock breaks past previous highs. The MACD and RSI indicate strong momentum, but watch for potential corrections.

Analysis

The stock has been in a bullish phase with significant support at 63.00. The overall market sentiment is positive, but external factors could introduce volatility.

Confidence Level

Potential Risks

Economic conditions and geopolitical events could impact the market significantly.