OIL Trading Predictions

1 Day Prediction

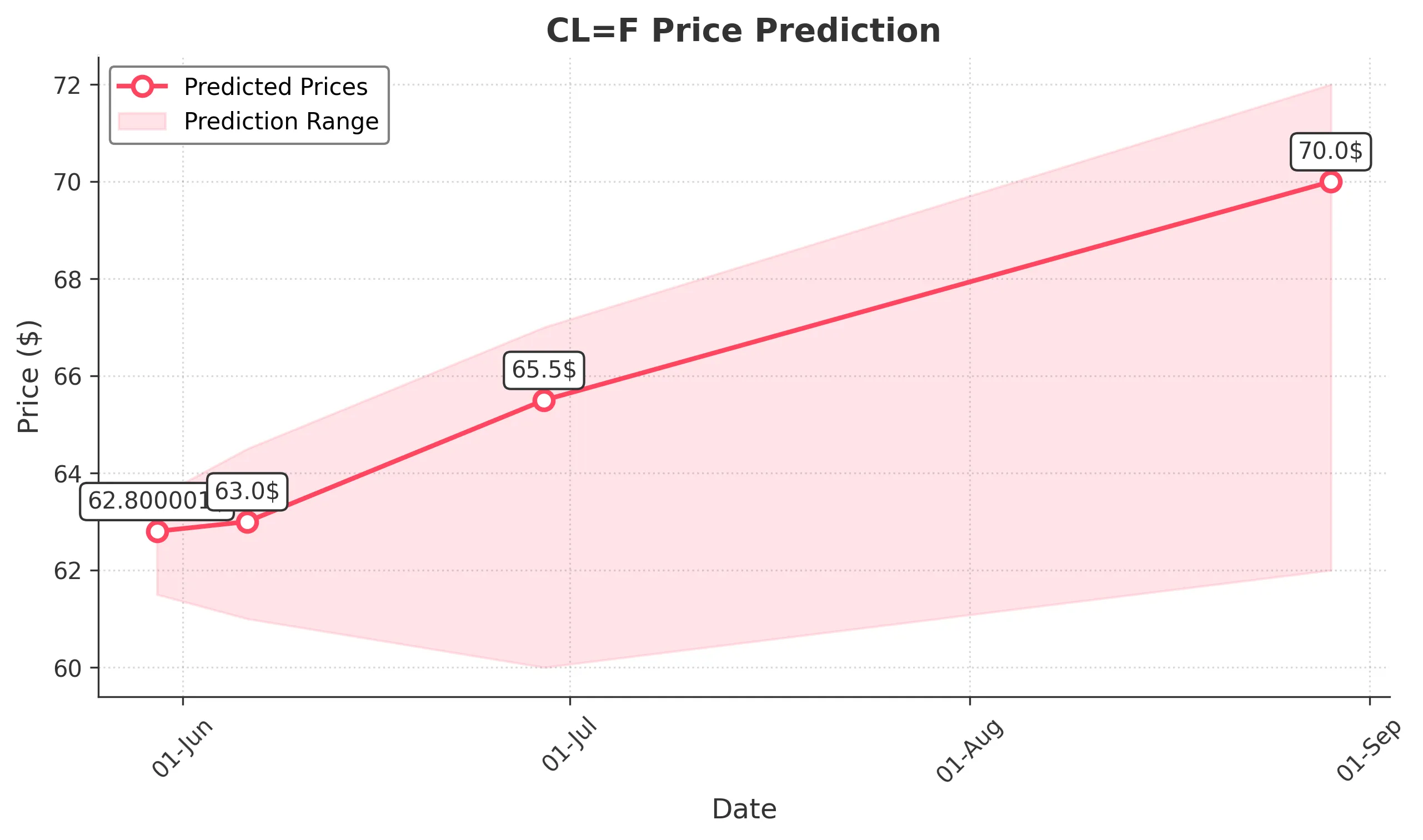

Target: May 30, 2025$62.800001

$62.5

$63.5

$61.5

Description

The stock shows a slight bullish trend with a recent upward movement. RSI indicates neutrality, while MACD is close to crossing above the signal line. However, recent volatility suggests caution.

Analysis

Over the past 3 months, CL=F has shown a bearish trend with significant fluctuations. Key support at 58.20 and resistance at 71.48. Volume spikes indicate investor uncertainty. Technical indicators suggest mixed signals, with MACD and RSI showing potential for upward movement but also caution due to volatility.

Confidence Level

Potential Risks

Potential for a reversal exists due to recent high volatility and external market factors.

1 Week Prediction

Target: June 6, 2025$63

$62.8

$64.5

$61

Description

The stock is expected to stabilize as it approaches resistance levels. The recent bullish momentum may continue, but caution is advised due to potential market corrections.

Analysis

The stock has been volatile, with a recent bearish phase followed by a slight recovery. Key resistance at 64.50 and support at 61.00. Technical indicators show mixed signals, with potential for upward movement but also risks of a downturn.

Confidence Level

Potential Risks

Market sentiment could shift rapidly, impacting the stock's performance.

1 Month Prediction

Target: June 29, 2025$65.5

$64

$67

$60

Description

Expect gradual recovery as the stock approaches key Fibonacci retracement levels. However, external economic factors may introduce volatility.

Analysis

The stock has shown a bearish trend with recent recovery attempts. Key support at 60.00 and resistance at 67.00. Technical indicators suggest potential for upward movement, but external factors may introduce volatility.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could significantly impact market sentiment.

3 Months Prediction

Target: August 29, 2025$70

$68

$72

$62

Description

Long-term outlook suggests recovery as market stabilizes. Key resistance levels may be tested, but economic conditions will play a crucial role.

Analysis

The stock has experienced significant volatility, with a bearish trend recently. Key support at 62.00 and resistance at 72.00. Technical indicators show potential for recovery, but external economic factors could impact performance.

Confidence Level

Potential Risks

Unforeseen economic events could derail recovery efforts.