OIL Trading Predictions

1 Day Prediction

Target: June 9, 2025$64.800001

$64.75

$65

$64.5

Description

The stock shows a bullish trend with a recent upward movement. The RSI is approaching overbought levels, indicating potential consolidation. A Doji candlestick suggests indecision, but overall momentum remains positive.

Analysis

Over the past 3 months, CL=F has shown a bullish trend with significant support at $60. The recent price action indicates a recovery from a dip, with moving averages indicating upward momentum. However, volatility remains a concern.

Confidence Level

Potential Risks

Potential reversal if market sentiment shifts or if external news impacts oil prices.

1 Week Prediction

Target: June 16, 2025$65.5

$64.800001

$66.5

$64

Description

The stock is expected to continue its upward trajectory, supported by recent bullish patterns. However, the RSI indicates potential overbought conditions, which may lead to a pullback. Watch for volume spikes as a signal.

Analysis

The stock has been trending upward, with key resistance at $66. Recent volume patterns suggest increased interest, but the RSI indicates caution. A potential pullback could occur if momentum wanes.

Confidence Level

Potential Risks

Market volatility and external factors could lead to unexpected price movements.

1 Month Prediction

Target: July 9, 2025$66

$65.5

$67.5

$63.5

Description

Expect a slight upward trend as the stock consolidates around current levels. The MACD shows bullish momentum, but the RSI suggests caution. A breakout above $67 could signal further gains.

Analysis

The stock has shown resilience, with a bullish trend supported by moving averages. However, the market remains sensitive to external factors, and a sideways movement may occur as traders assess the situation.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could impact oil prices significantly.

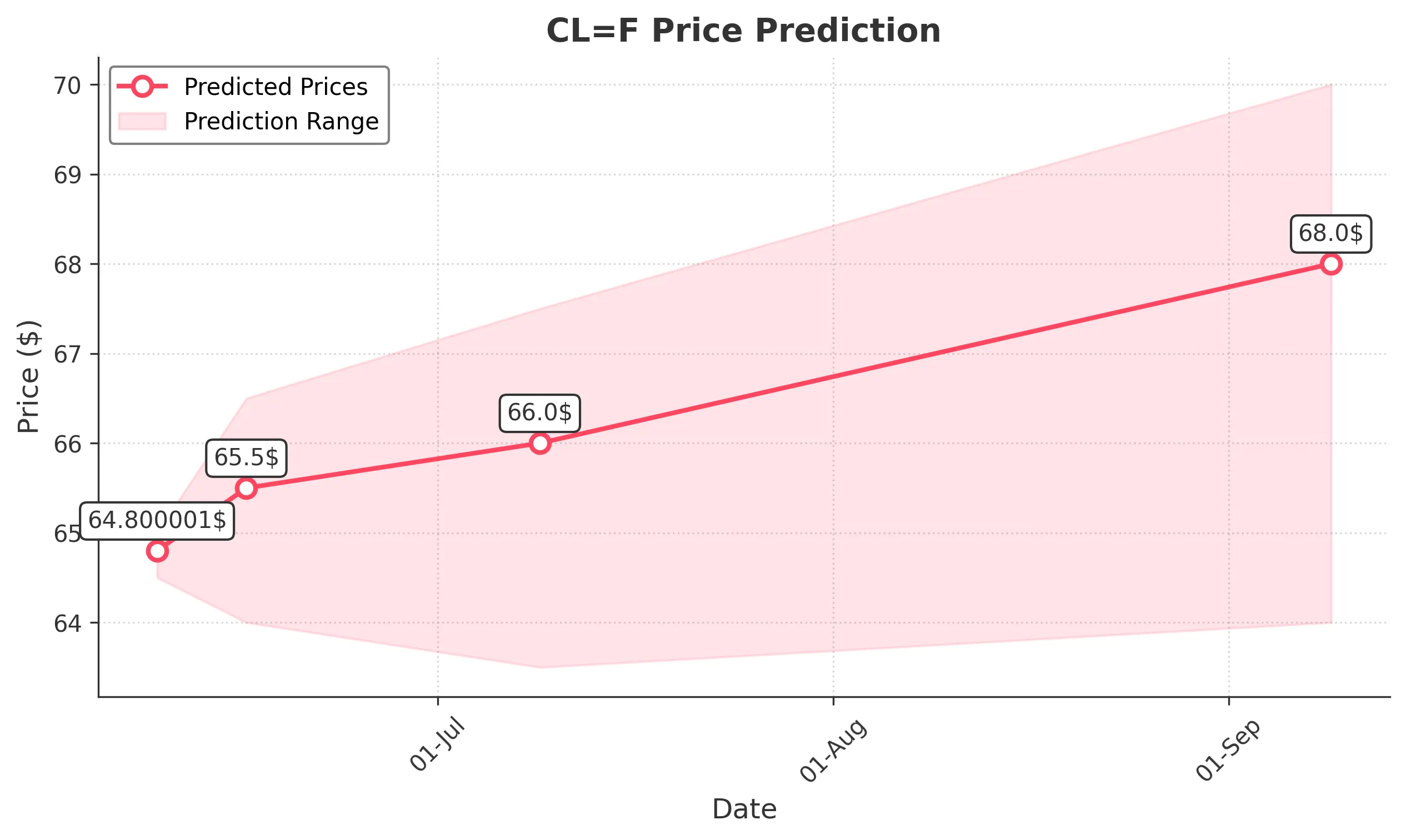

3 Months Prediction

Target: September 9, 2025$68

$66

$70

$64

Description

Long-term outlook remains bullish, with potential for further gains if the market stabilizes. Key resistance at $70 may be tested. Watch for macroeconomic indicators that could influence oil demand.

Analysis

The stock has shown a strong recovery, but the market is volatile. Key support at $64 and resistance at $70 are critical levels to watch. Overall sentiment is cautiously optimistic, but risks remain.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic downturns could lead to significant price corrections.