OIL Trading Predictions

1 Day Prediction

Target: June 10, 2025$64.75

$64.6

$65.5

$64

Description

The stock shows a slight bullish trend with a recent upward movement. The RSI is neutral, and MACD indicates potential upward momentum. However, recent volatility suggests caution.

Analysis

Over the past 3 months, CL=F has shown a bullish trend with significant resistance around 70. Recent price action indicates a pullback, but support at 60 remains strong. Volume has been inconsistent, indicating potential volatility.

Confidence Level

Potential Risks

Market sentiment could shift due to external factors, and a reversal is possible if selling pressure increases.

1 Week Prediction

Target: June 17, 2025$65.2

$64.8

$66

$63.5

Description

The stock is expected to consolidate around current levels. The Bollinger Bands are tightening, indicating potential for a breakout. However, the recent bearish candlestick patterns suggest caution.

Analysis

The stock has been trading sideways recently, with key support at 60 and resistance at 70. Technical indicators show mixed signals, with RSI nearing overbought levels. Volume spikes indicate potential interest but also risk.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could impact market sentiment, leading to increased volatility.

1 Month Prediction

Target: July 10, 2025$66.5

$65

$68

$64

Description

A gradual upward trend is anticipated as the stock finds support. The MACD is bullish, and the RSI is improving. However, market volatility remains a concern.

Analysis

The stock has shown resilience with a bullish trend over the past months. Key support at 60 has held, while resistance at 70 remains a challenge. Volume patterns suggest accumulation, but caution is warranted due to market fluctuations.

Confidence Level

Potential Risks

Potential economic data releases could lead to unexpected market reactions.

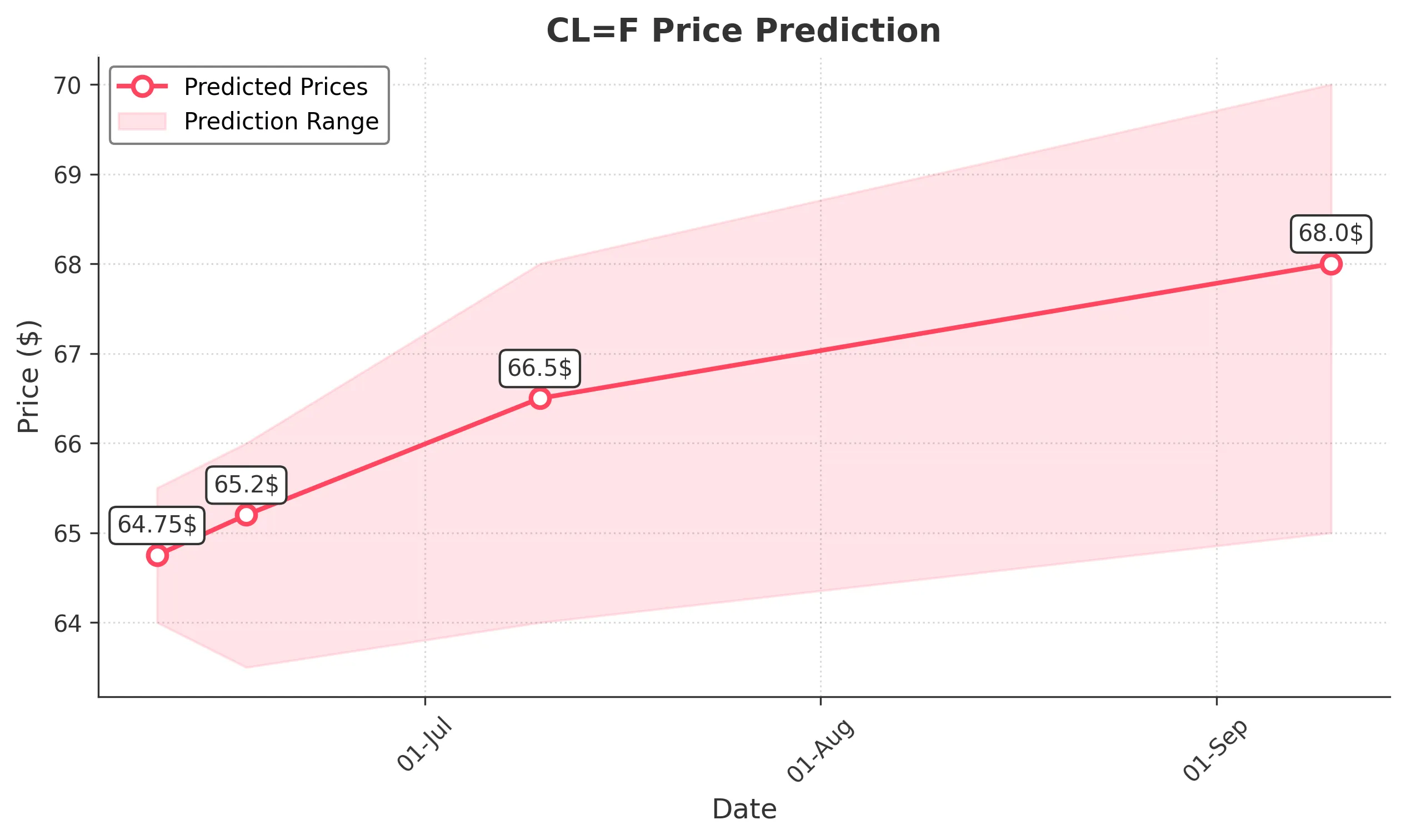

3 Months Prediction

Target: September 10, 2025$68

$66.5

$70

$65

Description

The stock is expected to trend upwards as it breaks through resistance levels. Positive macroeconomic indicators could support this move, but caution is advised due to potential market corrections.

Analysis

The overall trend has been bullish, with significant support at 60 and resistance at 70. Technical indicators suggest a potential breakout, but recent volatility and external factors could lead to price corrections.

Confidence Level

Potential Risks

Economic uncertainties and geopolitical events could impact the stock's performance.