OIL Trading Predictions

1 Day Prediction

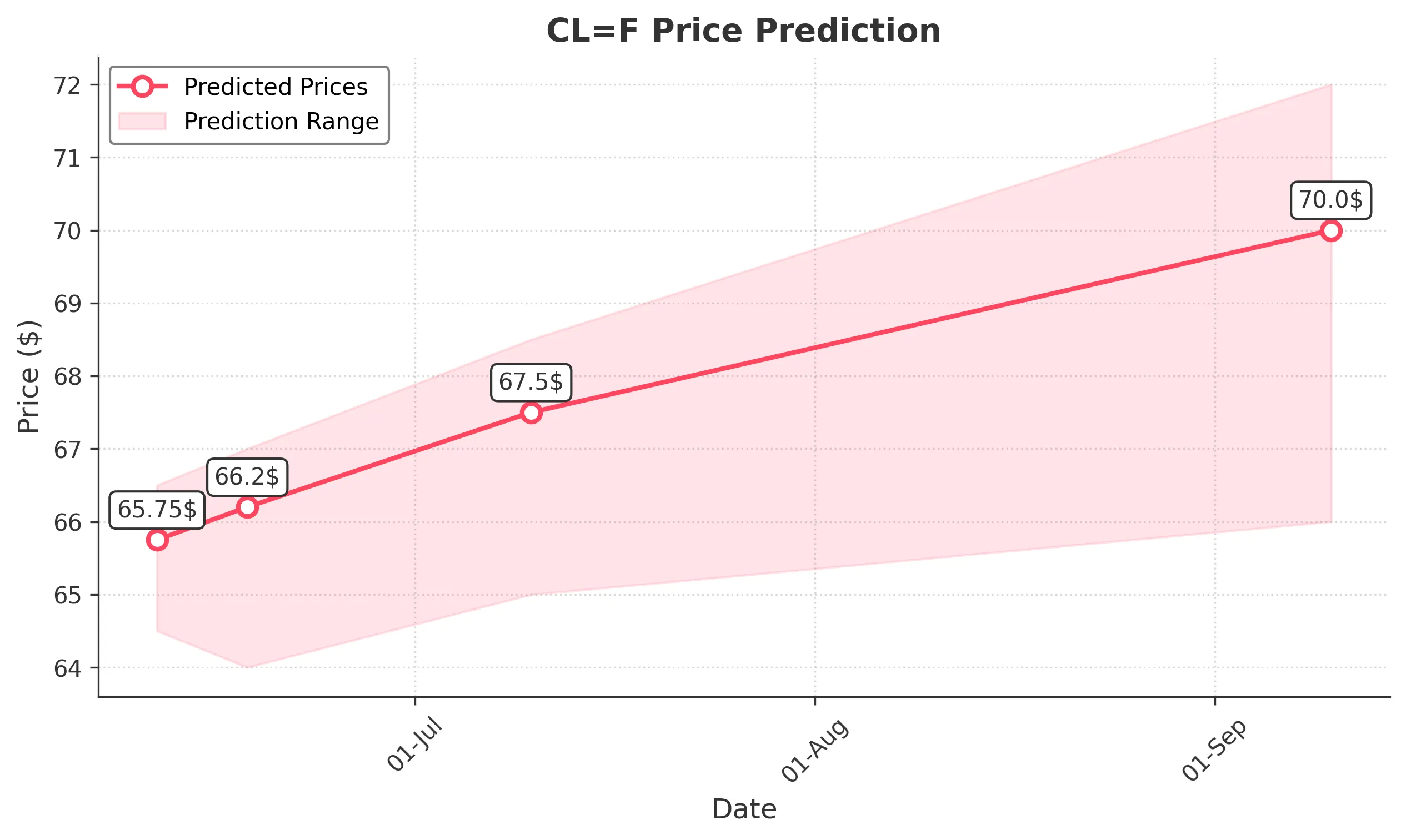

Target: June 11, 2025$65.75

$65.3

$66.5

$64.5

Description

The stock shows a slight bullish trend with a recent upward movement. RSI indicates overbought conditions, suggesting a potential pullback. MACD is positive but flattening, indicating weakening momentum. Expect a close around 65.75.

Analysis

Over the past 3 months, CL=F has shown a bullish trend with significant resistance at 66.50. Recent candlestick patterns indicate indecision, and volume has been inconsistent. External factors like oil prices and geopolitical events may impact future performance.

Confidence Level

Potential Risks

Potential for a reversal due to overbought RSI and recent volatility.

1 Week Prediction

Target: June 18, 2025$66.2

$65.8

$67

$64

Description

Expect a slight upward movement as the stock stabilizes. The 50-day moving average supports this trend, but RSI remains high, indicating potential resistance. Watch for volume spikes that could signal a breakout or reversal.

Analysis

The stock has been in a bullish phase, but recent volatility and high RSI levels suggest caution. Key support at 64.00 and resistance at 67.00 are critical. Volume patterns indicate potential for increased trading activity next week.

Confidence Level

Potential Risks

High RSI could lead to a pullback, and market sentiment may shift due to external news.

1 Month Prediction

Target: July 10, 2025$67.5

$66

$68.5

$65

Description

A bullish outlook for the month as the stock may break through resistance levels. The MACD shows potential for upward momentum, and Fibonacci retracement levels suggest support at 65.00. Watch for external market influences.

Analysis

CL=F has shown resilience with a bullish trend. Key support at 65.00 and resistance at 68.50 are pivotal. Technical indicators suggest upward momentum, but external factors like oil supply and demand could introduce volatility.

Confidence Level

Potential Risks

Market volatility and geopolitical events could impact the price trajectory.

3 Months Prediction

Target: September 10, 2025$70

$68

$72

$66

Description

Long-term bullish sentiment as the stock may continue to rise, supported by strong fundamentals and technical indicators. The 200-day moving average suggests a positive trend, but watch for potential corrections.

Analysis

The stock has been on a bullish trajectory, with key support at 66.00 and resistance at 72.00. Technical indicators show strong momentum, but external economic factors could introduce risks. A balanced view is necessary as market conditions evolve.

Confidence Level

Potential Risks

Economic conditions and oil market fluctuations could lead to unexpected price movements.