OIL Trading Predictions

1 Day Prediction

Target: June 27, 2025$65.5

$65

$66.5

$64

Description

The stock shows a slight bullish trend with a potential close around 65.50. Recent candlestick patterns indicate indecision, while RSI is neutral. Volume is expected to be moderate, reflecting cautious sentiment.

Analysis

Over the past 3 months, CL=F has shown a bearish trend recently after a peak in mid-June. Key support is around 64.00, while resistance is at 66.50. RSI indicates neutral momentum, and volume has been inconsistent, suggesting uncertainty.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 4, 2025$66

$65.5

$67

$64.5

Description

A slight recovery is anticipated as the stock may close at 66.00. The MACD shows a potential bullish crossover, and the Bollinger Bands indicate a tightening range, suggesting a breakout could occur.

Analysis

The stock has been volatile, with significant fluctuations. The recent downtrend has created a bearish sentiment, but technical indicators suggest a possible reversal. Key resistance at 67.00 and support at 64.50 are critical levels to watch.

Confidence Level

Potential Risks

Potential for a reversal exists if market sentiment shifts negatively.

1 Month Prediction

Target: August 4, 2025$68

$66.5

$70

$65

Description

Expect a gradual increase to 68.00 as bullish momentum builds. The Fibonacci retracement levels suggest a recovery towards previous highs, supported by improving market sentiment and potential positive news.

Analysis

The stock has shown resilience despite recent declines. The 50-day moving average is trending upwards, indicating potential bullish momentum. Volume patterns suggest accumulation, and key resistance at 70.00 could be tested if the bullish trend continues.

Confidence Level

Potential Risks

Economic indicators or geopolitical events could disrupt this upward trend.

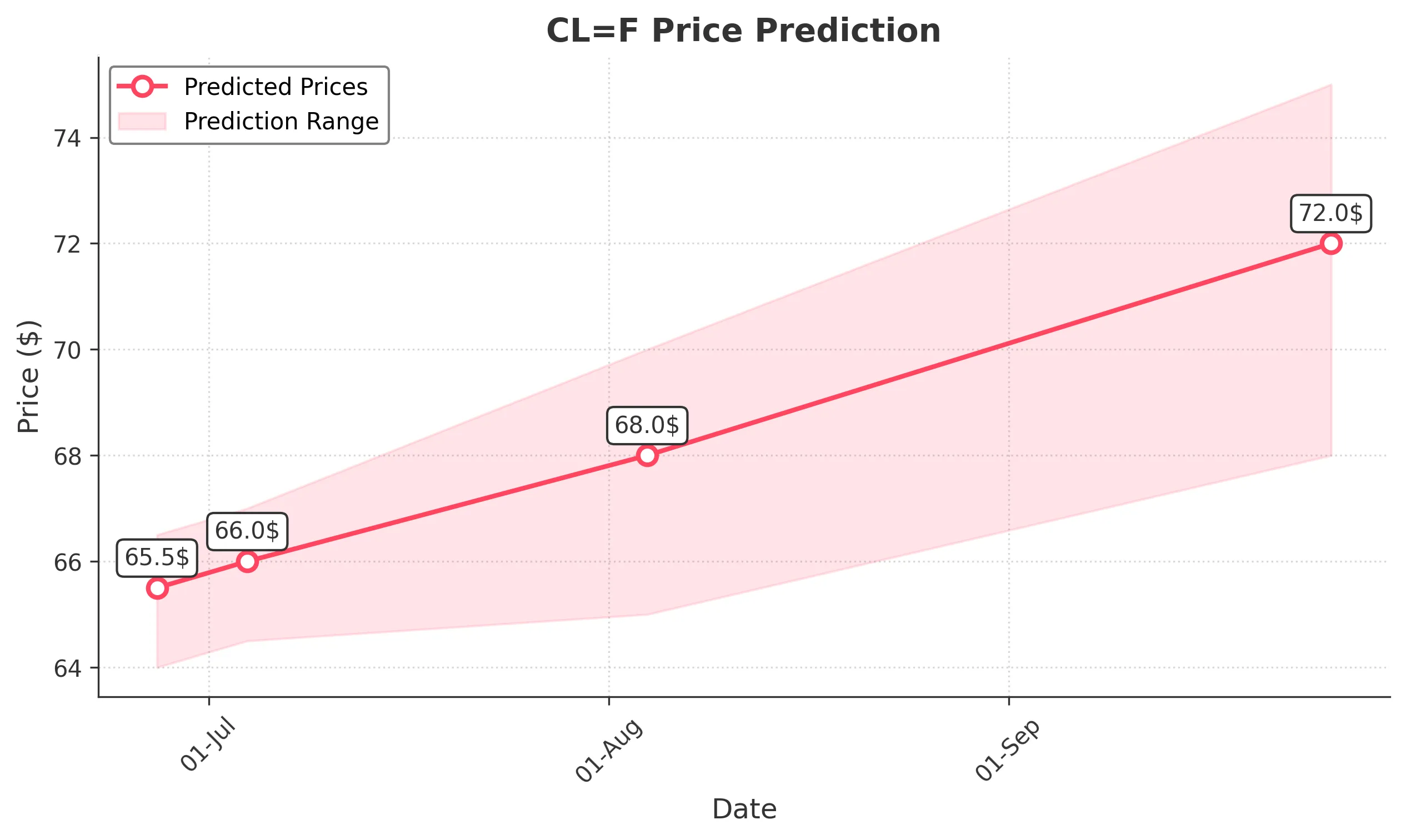

3 Months Prediction

Target: September 26, 2025$72

$70

$75

$68

Description

A bullish outlook with a target close of 72.00, driven by positive earnings reports and macroeconomic stability. The stock is expected to break through resistance levels, supported by strong volume and favorable technical indicators.

Analysis

The stock has shown a recovery pattern with increasing volume and positive sentiment. Key support at 68.00 and resistance at 75.00 are critical. The overall trend appears bullish, with technical indicators supporting upward momentum.

Confidence Level

Potential Risks

Unexpected market corrections or negative news could impact the forecast.