OIL Trading Predictions

1 Day Prediction

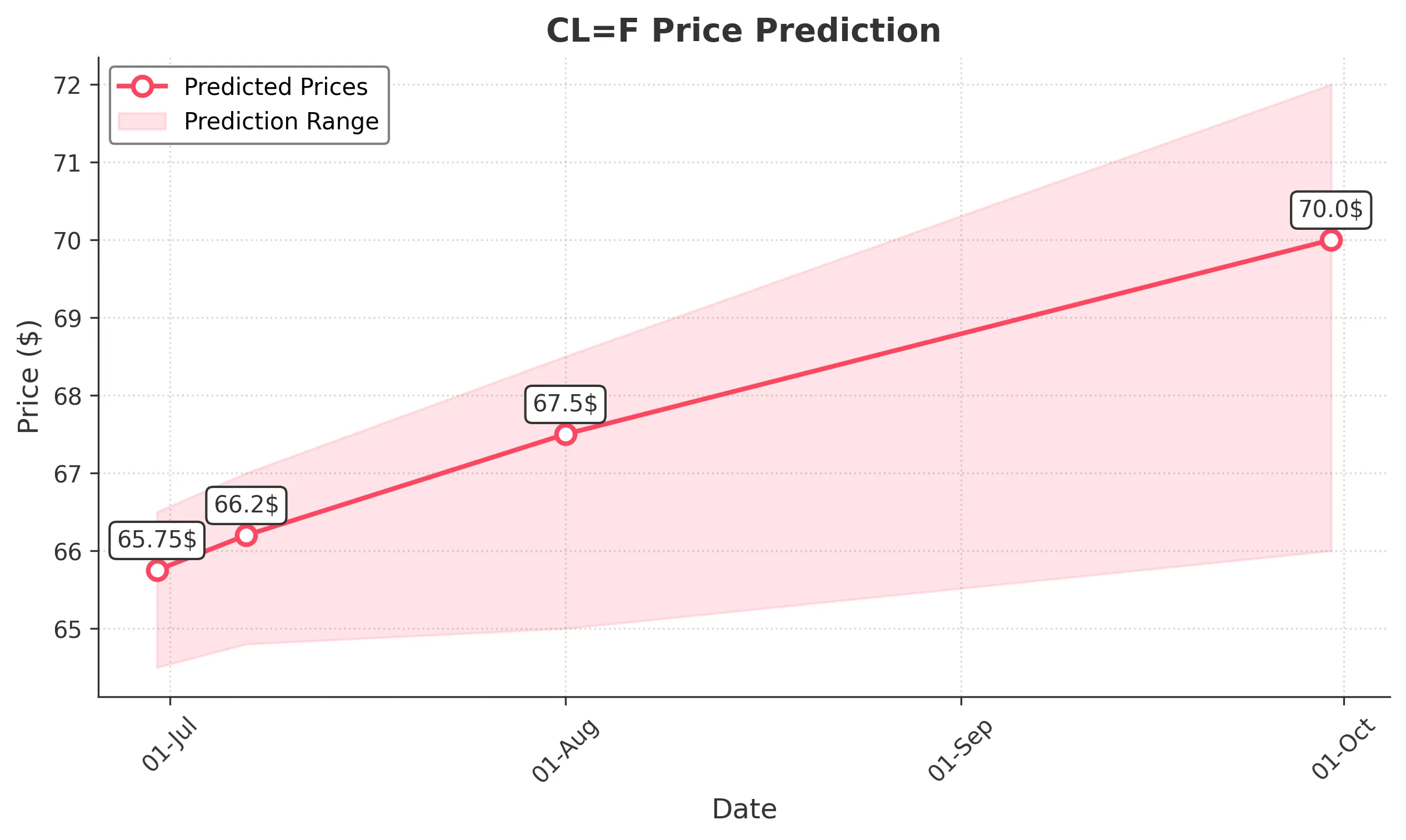

Target: June 30, 2025$65.75

$65.6

$66.5

$64.5

Description

The stock shows a slight bullish trend with a recent upward movement. RSI indicates neutrality, while MACD is close to crossing above the signal line. However, recent volatility suggests caution. Expect a close around 65.75.

Analysis

Over the past 3 months, CL=F has shown a bullish trend with significant highs around 72.98. Support is seen at 64.00, while resistance is at 77.62. Recent volume spikes indicate increased interest, but the stock has also faced pullbacks, suggesting potential volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: July 7, 2025$66.2

$65.9

$67

$64.8

Description

The stock is expected to maintain a bullish sentiment with a gradual increase. The MACD shows potential for upward momentum, while the RSI remains stable. Anticipate a close around 66.20 as market sentiment remains cautiously optimistic.

Analysis

The stock has been fluctuating between 64.00 and 72.98, with recent trading volumes indicating strong interest. The Bollinger Bands suggest a potential breakout, but caution is warranted due to recent volatility.

Confidence Level

Potential Risks

Any negative macroeconomic news could reverse the trend.

1 Month Prediction

Target: August 1, 2025$67.5

$66.8

$68.5

$65

Description

A continued bullish trend is expected as the stock approaches key resistance levels. The MACD is bullish, and the RSI indicates strength. However, watch for potential pullbacks as the stock approaches resistance at 68.50.

Analysis

CL=F has shown resilience with a bullish trend, but recent highs indicate potential resistance. The stock's performance has been supported by increasing volumes, but the market remains sensitive to external factors.

Confidence Level

Potential Risks

Market corrections or geopolitical events could impact the price.

3 Months Prediction

Target: September 30, 2025$70

$68.5

$72

$66

Description

Expect a bullish trend to continue as the stock approaches historical highs. The MACD and RSI suggest upward momentum, but potential resistance at 72.00 may cause fluctuations. Anticipate a close around 70.00.

Analysis

The stock has shown a strong upward trend, with significant support at 66.00. The recent price action indicates bullish sentiment, but external economic factors could lead to volatility. The stock's performance will depend on broader market conditions.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to market volatility and potential economic shifts.