OIL Trading Predictions

1 Day Prediction

Target: July 24, 2025$65.8

$65.5

$66.5

$65.2

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 65.80.

Analysis

Over the past 3 months, CL=F has shown a bullish trend with significant highs around 72.98. However, recent price action indicates a potential reversal with lower highs and increased selling pressure. Key support at 65.00 and resistance at 68.00.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish reversal is possible.

1 Week Prediction

Target: July 31, 2025$66.5

$66

$67.5

$65

Description

Expect a slight recovery as the stock may find support near 65.00. The MACD shows a potential bullish crossover, indicating a possible upward move. However, caution is advised due to recent bearish sentiment.

Analysis

The stock has been in a consolidation phase with key support at 65.00. Recent candlestick patterns suggest indecision, and the RSI is approaching neutral territory. Volume has been inconsistent, indicating uncertainty among traders.

Confidence Level

Potential Risks

Uncertainty in market sentiment and potential macroeconomic events could lead to unexpected price movements.

1 Month Prediction

Target: August 31, 2025$68

$67

$70

$66

Description

A gradual recovery is anticipated as the stock may bounce back from recent lows. The Bollinger Bands suggest potential upward movement, while the MACD indicates bullish momentum. Watch for resistance at 70.00.

Analysis

The stock has shown resilience with a recent bounce off support levels. The overall trend remains bullish, but recent price action indicates potential resistance at 70.00. Volume patterns suggest cautious optimism among investors.

Confidence Level

Potential Risks

Market conditions and external factors could hinder recovery. A failure to break resistance may lead to further declines.

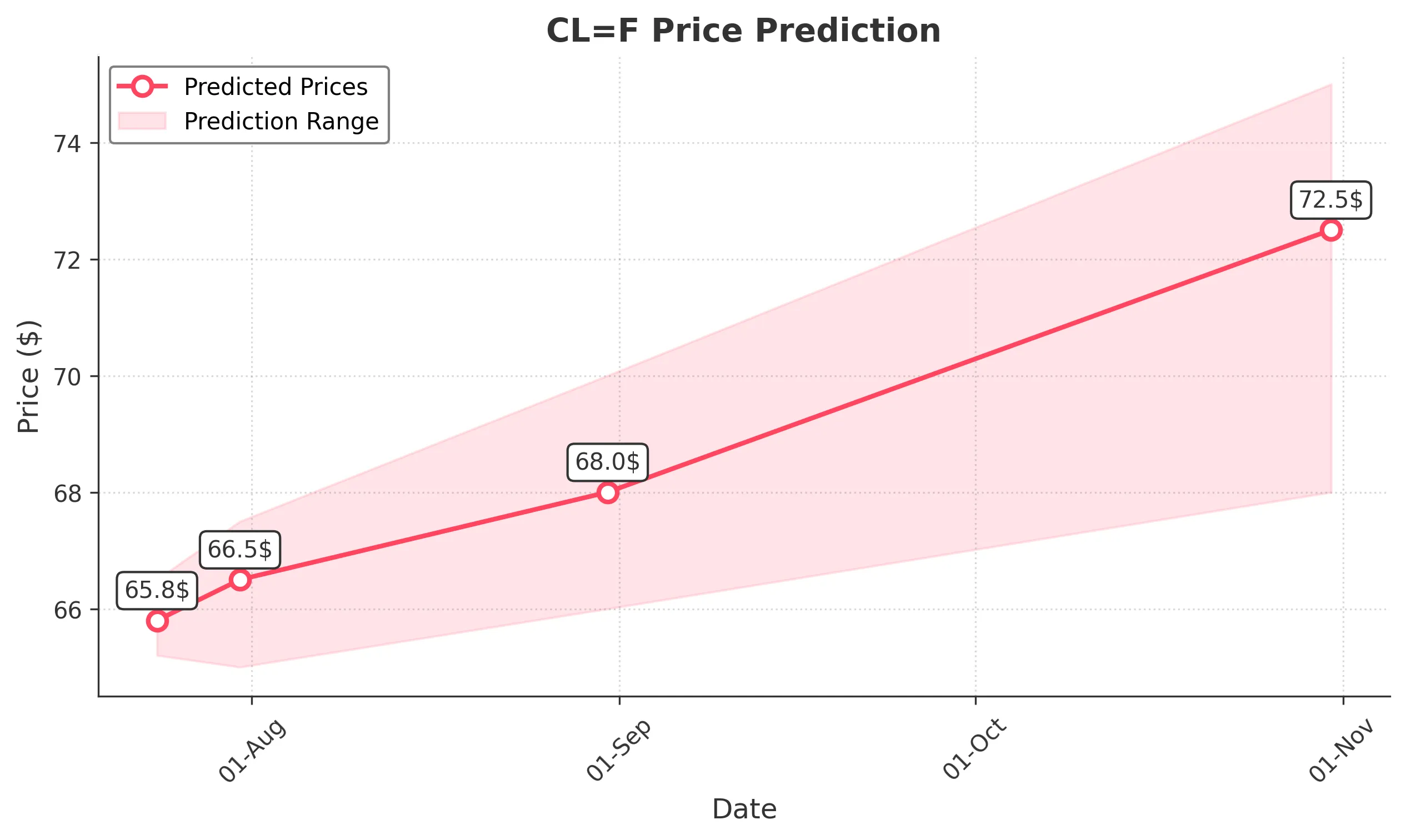

3 Months Prediction

Target: October 31, 2025$72.5

$71

$75

$68

Description

Long-term bullish sentiment is expected as the stock may break through resistance levels. Positive macroeconomic indicators and improving market sentiment could drive prices higher. Watch for volatility.

Analysis

The stock has shown strong upward momentum over the past months, with significant highs. Key resistance levels are being tested, and if broken, could lead to further gains. However, external factors must be monitored closely.

Confidence Level

Potential Risks

Potential geopolitical events and economic downturns could impact the stock's performance. A failure to maintain upward momentum could lead to corrections.