OIL Trading Predictions

1 Day Prediction

Target: July 28, 2025$66.5

$66.3

$67.2

$65.8

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near 50, suggesting a neutral momentum. Expect a close around 66.50, with potential volatility due to market sentiment.

Analysis

Over the past 3 months, CL=F has shown a bullish trend with significant resistance around 68.00. The recent price action indicates consolidation, with support at 65.00. Volume has been decreasing, suggesting a potential reversal.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: August 4, 2025$67

$66.8

$68.5

$66

Description

The stock is expected to rise slightly as bullish momentum builds. The MACD is showing a bullish crossover, and the RSI is improving. However, resistance at 68.00 may limit gains.

Analysis

The stock has been in a bullish phase, with key support at 65.00 and resistance at 68.00. The recent increase in volume indicates growing interest, but caution is warranted as the market sentiment remains mixed.

Confidence Level

Potential Risks

Any negative macroeconomic news could reverse the upward trend.

1 Month Prediction

Target: September 4, 2025$68.5

$67

$70

$66.5

Description

A continued bullish trend is anticipated, supported by positive technical indicators. The stock may test the 70.00 resistance level, but profit-taking could lead to volatility.

Analysis

CL=F has shown strong upward momentum, with a recent breakout above 67.00. The RSI is approaching overbought territory, indicating a possible pullback. Volume patterns suggest sustained interest, but caution is advised.

Confidence Level

Potential Risks

Potential market corrections and geopolitical events could impact the price.

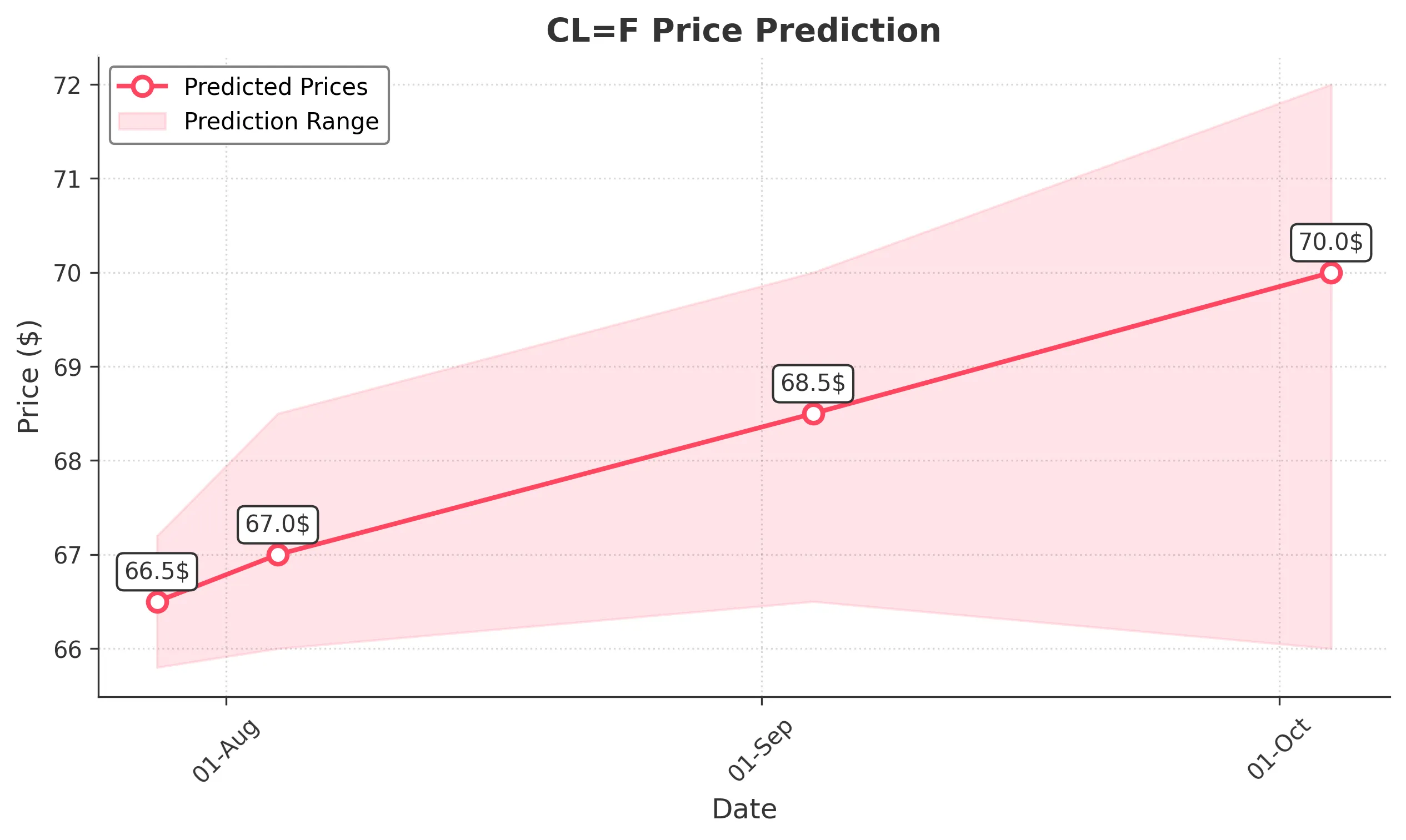

3 Months Prediction

Target: October 4, 2025$70

$68

$72

$66

Description

The stock is projected to reach 70.00 as bullish sentiment persists. However, the market may face resistance at higher levels, and profit-taking could lead to corrections.

Analysis

The overall trend for CL=F remains bullish, with significant support at 66.00 and resistance at 72.00. The stock has shown resilience, but external factors could introduce volatility. Monitoring macroeconomic conditions is crucial.

Confidence Level

Potential Risks

Economic indicators and market sentiment shifts could lead to unexpected volatility.