OIL Trading Predictions

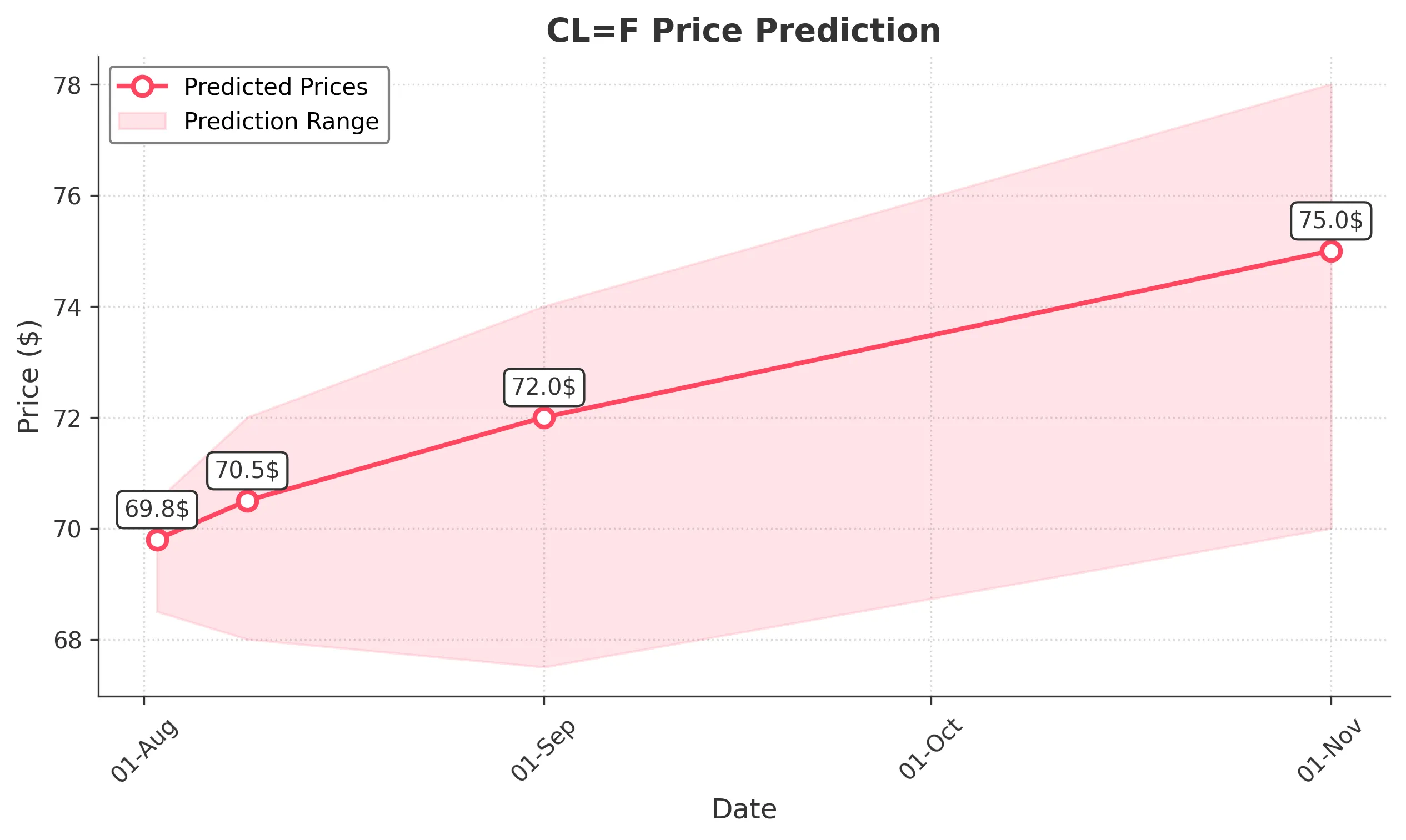

1 Day Prediction

Target: August 2, 2025$69.8

$69.5

$70.5

$68.5

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong buying pressure may push the price higher. Watch for volume spikes as confirmation.

Analysis

Over the past 3 months, CL=F has shown a bullish trend, with significant support at $66 and resistance around $70. The recent price action indicates strong buying interest, but the RSI suggests caution as it nears overbought territory.

Confidence Level

Potential Risks

Potential for a short-term pullback due to overbought RSI conditions.

1 Week Prediction

Target: August 9, 2025$70.5

$69.8

$72

$68

Description

The bullish trend is expected to continue, supported by recent price action and volume. However, the MACD shows signs of potential divergence, which could indicate a weakening momentum. Watch for any bearish reversal patterns.

Analysis

The stock has been trending upward, with key support at $66. The recent high of $70 indicates strong resistance. Volume has been consistent, but any signs of reversal patterns should be monitored closely.

Confidence Level

Potential Risks

Possible bearish divergence in MACD could signal a trend reversal.

1 Month Prediction

Target: September 1, 2025$72

$70.5

$74

$67.5

Description

Expect continued bullish momentum, with potential for a breakout above $72. The Fibonacci retracement levels suggest support at $68. However, market sentiment could shift due to macroeconomic factors.

Analysis

CL=F has shown a strong upward trend, with significant resistance at $74. The stock's performance has been buoyed by positive market sentiment, but external economic factors could introduce volatility.

Confidence Level

Potential Risks

Macroeconomic events could impact market sentiment and lead to volatility.

3 Months Prediction

Target: November 1, 2025$75

$72.5

$78

$70

Description

Long-term bullish outlook with potential for price to reach $75. The stock is likely to face resistance at $78. Watch for any bearish signals as the market adjusts to economic conditions.

Analysis

The stock has been on a bullish trajectory, but the potential for market corrections exists. Key support at $70 and resistance at $78 will be critical in determining future price movements. Overall, a balanced view is necessary.

Confidence Level

Potential Risks

Economic uncertainties and potential market corrections could affect the prediction.