OIL Trading Predictions

1 Day Prediction

Target: August 15, 2025$62.5

$62.9

$63.2

$61.8

Description

The stock shows a bearish trend with a recent decline in price and volume. RSI indicates oversold conditions, suggesting a potential bounce. However, resistance at 63.00 may limit upward movement.

Analysis

Over the past 3 months, CL=F has shown a bearish trend with significant resistance at 64.00. Recent candlestick patterns indicate indecision, and volume has been declining. The MACD is bearish, and ATR suggests increased volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish sentiment could lead to a price increase.

1 Week Prediction

Target: August 22, 2025$63

$62.5

$64.5

$61.5

Description

A potential recovery is expected as the stock approaches key support levels. The RSI may recover from oversold conditions, and a bullish divergence could form if the price holds above 62.00.

Analysis

The stock has been in a downtrend, but recent support at 61.50 may provide a base for a rebound. The MACD is showing signs of convergence, indicating a possible reversal. Volume patterns suggest cautious trading.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to unexpected price movements.

1 Month Prediction

Target: September 14, 2025$65.5

$63

$67

$62

Description

If the stock can break above 64.00, a bullish trend may develop. The Fibonacci retracement levels suggest potential resistance at 66.00, but a sustained rally could push prices higher.

Analysis

The stock has shown mixed signals with recent bearish momentum. Key resistance at 64.00 and support at 61.50 are critical. The ATR indicates potential for volatility, and the market sentiment remains cautious.

Confidence Level

Potential Risks

Market sentiment and external factors could lead to volatility. A failure to break resistance may result in further declines.

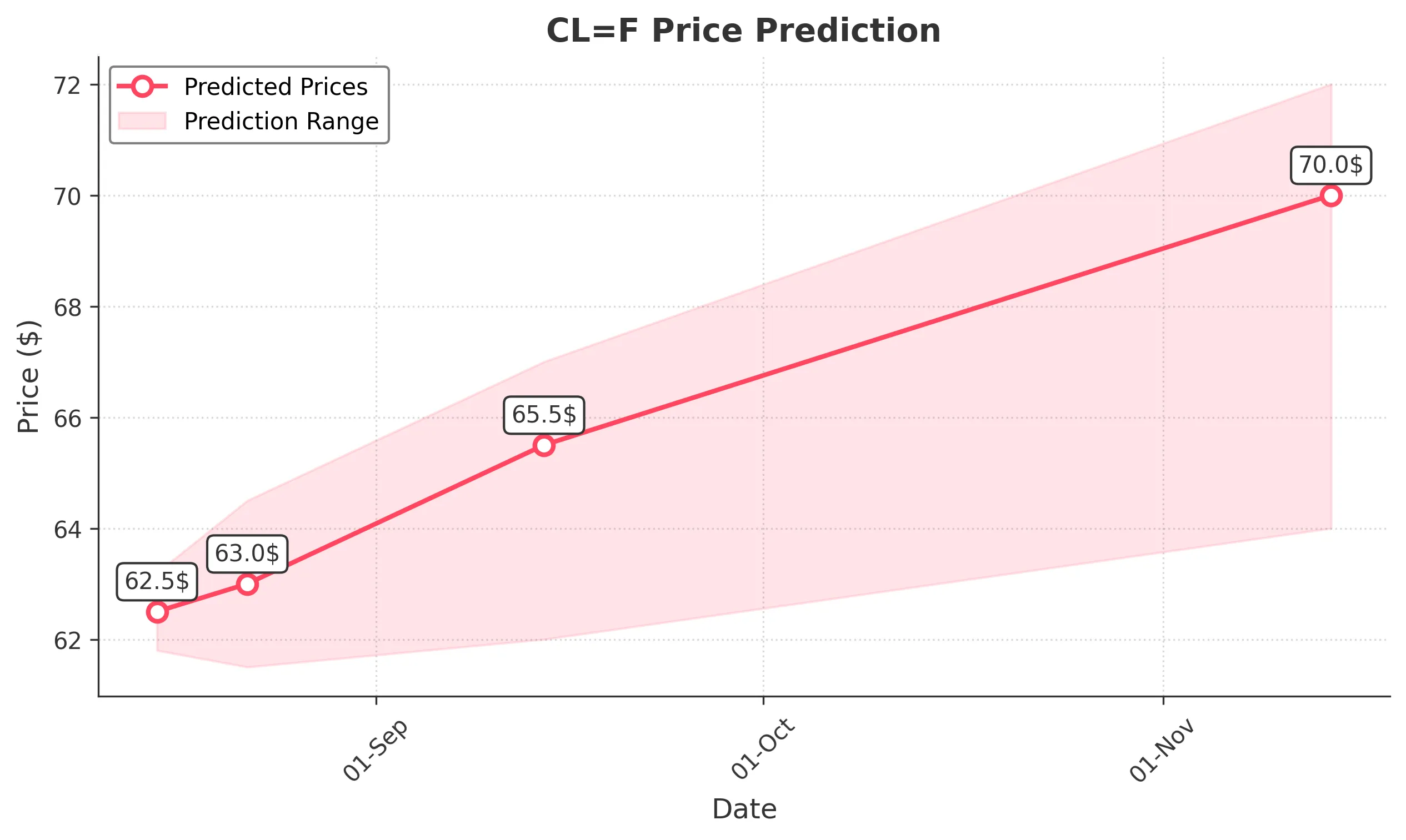

3 Months Prediction

Target: November 14, 2025$70

$66.5

$72

$64

Description

If the bullish trend continues, the stock could reach 70.00, supported by positive market sentiment and potential recovery in oil prices. However, resistance at 72.00 may pose challenges.

Analysis

The stock has experienced significant fluctuations, with a recent bearish trend. Key resistance levels at 72.00 and support at 64.00 are crucial. The overall market sentiment is mixed, and external factors could influence future performance.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market shifts and economic conditions. A downturn in oil prices could negatively impact the stock.